Fed Unexpectedly Deviates From POMO Schedule, Buys Only 70% Of Scheduled Treasurys

Tyler Durden

Wed, 06/03/2020 – 12:45

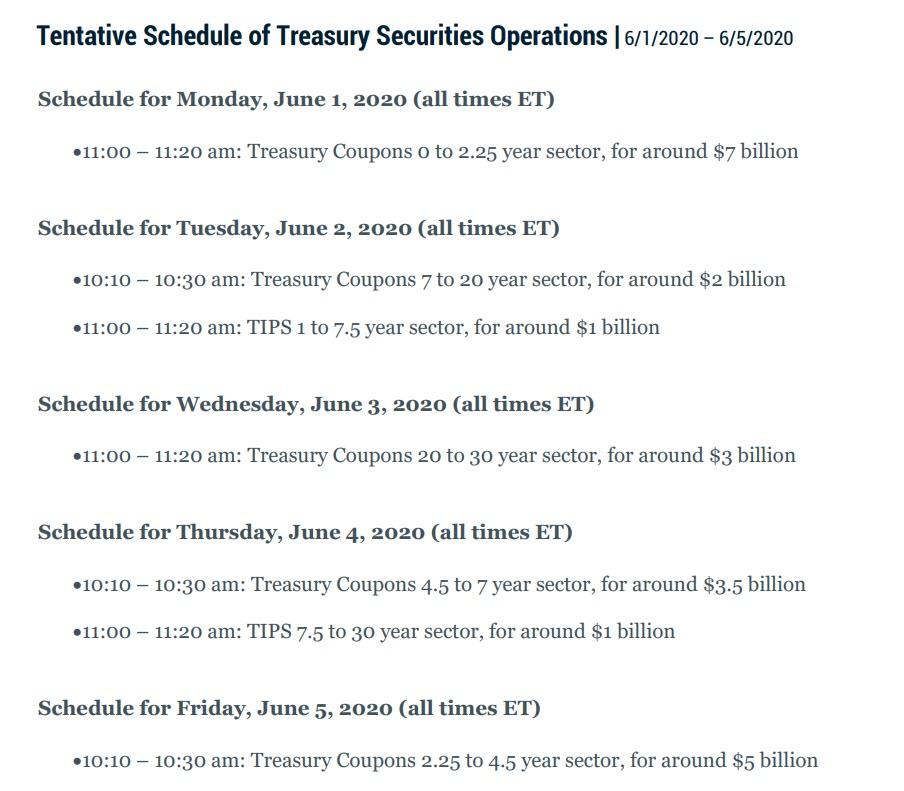

For nearly three months, ever since the Fed launched Unlimited QE on March 23, the New York Fed had published a weekly schedule every Friday of how many Treasurys it would purchase the coming week. In fact, just last Friday the Fed announced that this week it would purchase $22.5BN for the full week, on average $4.5BN per day (down from $5BN last week), as per the following daily breakdown.

And while the daily POMO amount has varied day by day, one thing was immutable: whatever the Fed said it would buy in any given POMO block is precisely how much it would accept from the open market.

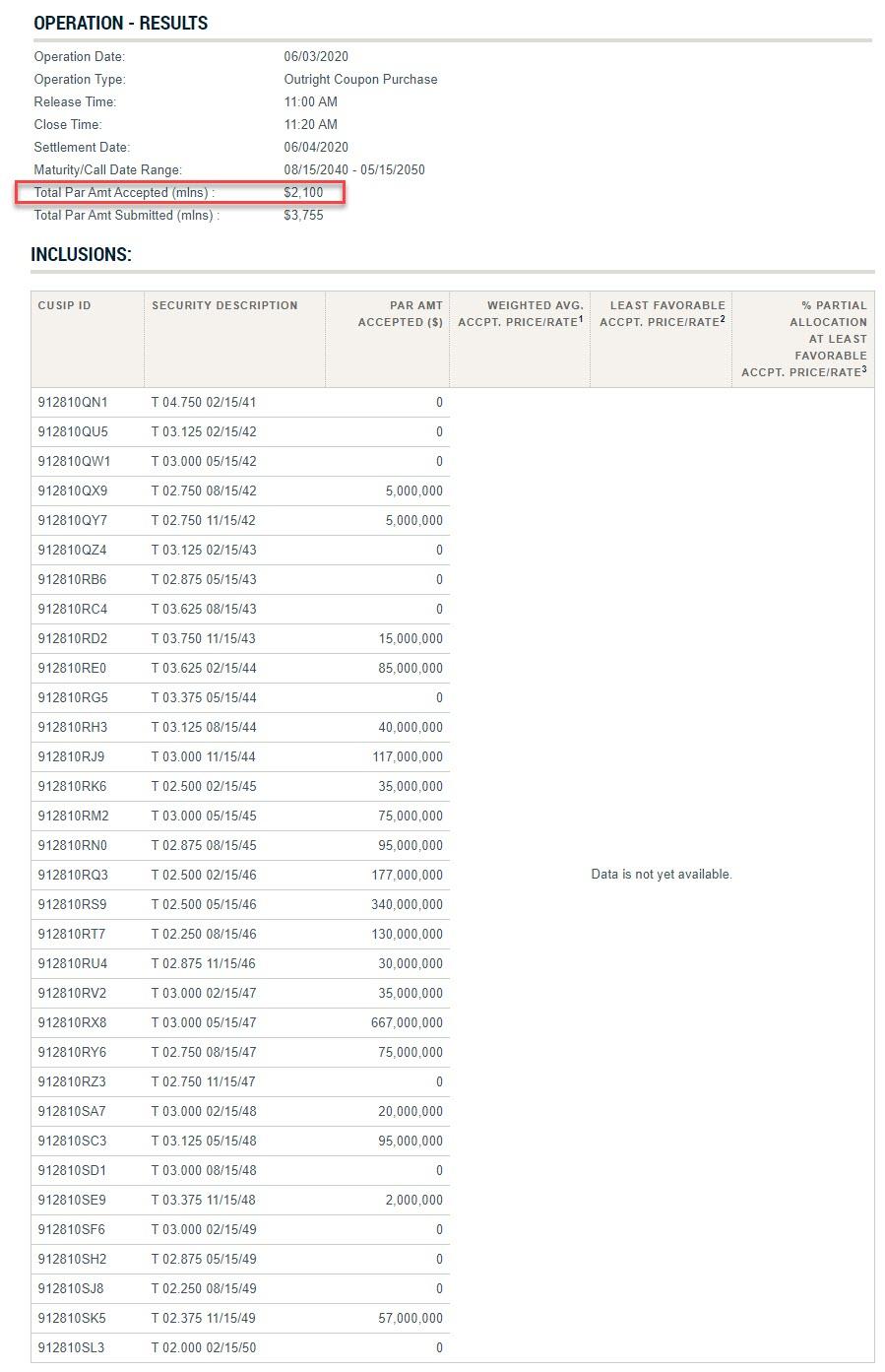

Until today, because whereas the Fed had previously said it would purchase $3 billion in 20-30 year bonds in Wednesday’s 11am POMO operation (see table above), the Fed today surprised Fed frontrunners and general market watchers, when it announced that out of the $3.755BN in bonds submitted, it accepted just $2.1BN, or 70% of the full amount.

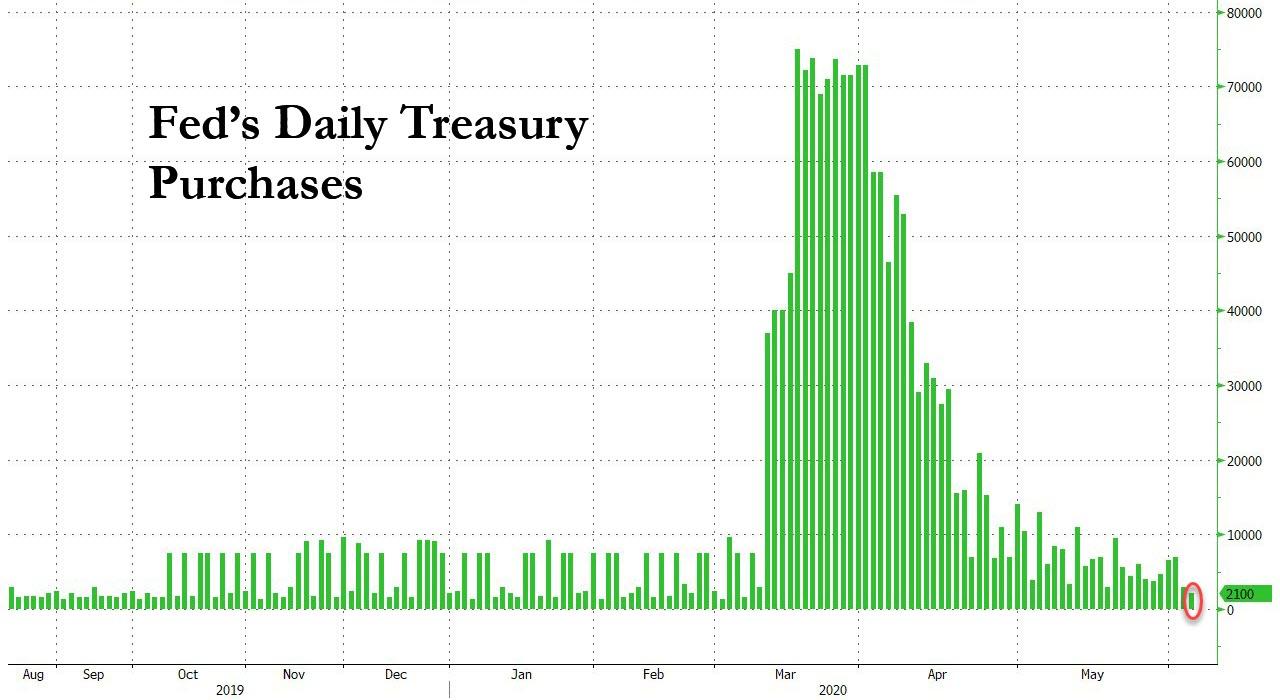

Today’s shrunk POMO, which was the only one on the day, also meant that Wednesday’s total TSY purchases by the Fed were the lowest since the start of the Fed’s emergency operations in late March.

So far there has been no explanation for the unexpected deviation from the schedule, although a possible reason is the collapse in the Submitted to Accepted (or Offer to cover) as a result of the sharp increase in long-end bonds being purchased by the Fed, which after several weeks in the $1.5BN range ($1.450BN on May 21, $1.75BN on May 27), was nearly doubled to $3 billion, and yet there was just not enough supply, as traders balked at selling their highest yielding Treasury paper. Indeed, the offer to cover was 1.788x (and would have been 1.25x had the Fed not shrank the size of the amount of debt accepted), down from 2.13x and 2.64x in the last two 2040-2050 POMOs respectively.

Of course, this would run counter to the latent concern in the market that the Fed isn’t monetizing enough debt across the curve, especially with trillions more in issuance coming on deck to find the massive fiscal stimulus.

In any event, the surprising deviation from the POMO schedule has failed to impact the market so far, with both 10Y and 30Y yields trading near session highs, with the latter last week at 1.550%.