“They Sent The World A Buy Signal”: Minerd Says Fed Faces “Day Of Reckoning” For Unleashing The Final Bubble

Tyler Durden

Wed, 06/03/2020 – 20:00

Just hours after Former NY Fed president Bill Dudley made the stunning admission that “the Fed is basically creating a little bit of moral hazard“, stunning not because he said what everyone already knew, but because as a former member of the Fed he himself admitted that the Fed has now terminally corrupted capitalism (it should go without saying that there is no such thing as “a little bit” of moral hazard – it’s either there, or it isn’t, Guggenheim CIO Scott Minerd, who in recent months has emerged as one of the most outspoken financial establishment anti-Fed talking heads (read “We Will Never Return To Free Market Capitalism”: Guggenheim’s Minerd Warns Fed Is Pushing US Toward A Populist Revolt” for the answer why), appeared on Bloomberg TV and in a tour de force interview explained why the Fed’s efforts to stabilize the economy will encourage companies to take on too much risk, inflate a corporate-bond bubble, and ultimately result in a “day of reckoning” for the Fed which will be forced to decide if the US can ever return to its capitalist roots, or will bail out insolvent enterprises in perpetuity, in the process destroying capital markets, price discovery, and laying the foundations for a regime that is anything but capitalist (we leave it up to readers to insert their most hated ideology here).

“It’s going to allow the excessive leverage – which had already been building up into the system coming into this – to continue, and to levels that are completely unprecedented in our history,” Minerd said at a virtual insurance conference Wednesday discussing the Fed’s most recent decision to purchase corporate bonds. As a result of the Fed’s visible hand, intervention, the risk a bubble in corporate bond markets “will just be extended and become more extreme.”

Below are the key excerpts from Minerd’s interview which we hope everyone in the Fed and Washington listens to, but we know nobody will:

“We already were at record levels of debt when we got into January of this year. One of my concerns was that when we have a downturn, this highly levered economy of ours was going to lead to more severe pressures on the economy. But now the Federal Reserve has basically eliminated the downside in corporate debt, they’ve sent the world a ‘Buy signal’ and we’re now putting on record amounts of corporate debt. The leverage is getting even more exacerbated. So the Fed is ultimately going to find itself in a position where it tries to fade out these problems of support for corporate debt it will be a lot like what happened in 2013 when Ben Bernanke first talked about ending QE: there was a tantrum. It’s quite likely that the Fed will face that day of reckoning when it tries to slow down asset purchases of corporate debt. And the market will then challenge the Fed where the put is, and I think this is now a permanent feature of the market.“

After quoting Milton Friedman who once said that “nothing is so permanent as a temporary government program”, Minerd warned that “corporate America is going to become addicted to the Fed providing support. Corporations will take greater risk, that if you don’t have a highly levered balance sheet relative to your competitors your equity returns will be punished during business expansions, and so pressures will be on CEOs to continue to increase the amount of leverage especially when the Fed has got a policy of maintaining low rates for extended period of time. So I think that ultimately the Fed will be faced the challenge of whether they allow a day of reckoning, or whether they decide that they just have to continue to provide liquidity to the system until inflation rates pick up to levels that probably will be viewed as unacceptable by most participants in the Fed today.”

The Guggenheim CIO then said he expects $1 trillion in bond “fallen angel” downgrades, but pointed out that since the Fed is effectively forcing liquidity, “it removes one of the major causes of default which is the inability to roll debt maturities over. So you have to think that at some point the rating agencies are going to start factoring the implicit support of the Federal Reserve and it will in the longer-run reduce downgrades.”

Minerd then addressed the proliferation of zombie companies that the Fed’s actions will create, saying that “ultimately it will reduce productivity.” And while there may be a side benefit, as the Fed’s actions expand the number of jobs “in the short run” but the long-run implication is that it should also cause a period of stagflation, “which we probably won’t see the consequences of for another decade or so.”

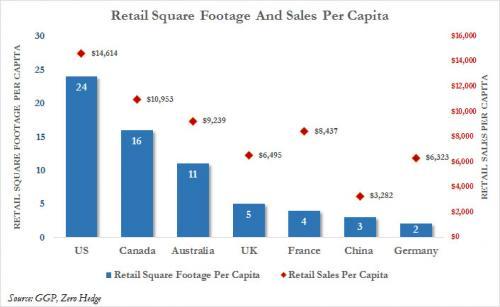

The interview then shifted gears and the Guggenheim CIO address the protests and rioting we are seeing in the streets, a direct byproduct of the unprecedented divide observed in America over the past decade across wealth, income, racial, religious and ideological lines, which just happens to coincide with the Fed’s takeover of capital markets as it adopted a “stock markets above all” vision, a perpetuation of the status quo which has led to even greater gains for the 0.1% and which has resulted in catastrophic consequences for everyone else. As Minerd admits, “most of the Fed support is going to major corporations. But the majority of people in our country work for small business and we’re going to have a large amount of business failures so as the economy recovery these businesses are not going to be there to create jobs, which will put more pressure more pressure on Congress and policymakers to come up with ways to encourage people to get back to work, to encourage businesses to reopen. Some of these businesses will never come back. In retail for instance, the amount of square footage in the US is about 5 times that of the UK..

… and so the fact that we’ve had such a glut in some categories like retailing, a lot of that is never coming back and the jobs that are attached to that are not coming back, and we’re going to have to retool workers and that is going to be a major policy issues.”

When asked at “what point do debt levels matter”, or “how far the US can push the US debt capacity”, Minerd responded that the “dirty little secret of central banking ultimately the role of the central bank is to finance the government. And so this open-ended financing from the Fed will continue and is going to give a lot of flexibility to Congress to pass additional support programs and some of them may end up being highly disruptive to the capitalist system. I believe we are in the process of altering capitalism in the United States and the free enterprise system has a number of threats on a number of fronts.”

Asked to explain what he means by “different capitalism”, Minerd said that inequality of all types – racial, income, wealth – all of these are the result of poor planning and programs out of Washington.” At this point the Guggenheim CIO struck on the true answer, one which we have been pounding the table on for over a decade, saying that in addition to Washington, inequality has been exacerbated by quantitative easing:

“if you came out of the financial crisis and you had money or assets, the returns you got over the next ten years even exacerbated further the inequality among people who didn’t have assets coming out of that crisis. These policies have been fundamentally flawed – they have failed to address the broader issues that Americans face and this is going to result in changes to policies coming out of Washington.”

The real question, according to Minerd, is “will the policy changes that are coming out be done in a way that encourages increases in productivity, output and living standards for all Americans, or will it just become a fight for the pie. That is, we need to cut up the pie again and we need to transfer wealth in some mechanism, whether through income or taxation or expropriation. Those sorts of policies have proven not to be very productive and to actually lower living standards over long periods of time.”

One look at the streets of America today should give us the answer which of these two futures the country is facing.

As for Minerd, one year ago he admitted that he “had discussions about joining the Fed.” Alas, after such blistering – and accurate – insight into why the Fed is at the very root of most of society’s problems, we can guarantee the Guggenheim CIO that he will never be allowed into the Marriner Eccles building for as long as the Fed exists.

His full interview is below.