The Simple Case For “Buying Everything” Right Now

Tyler Durden

Thu, 06/04/2020 – 14:26

Authored by Adam Button via ForexLive.com,

Suspend your disbelief and embrace the free-money future…

The enthusiasm in markets at the moment is bordering on euphoria. Retail money is pouring into the flavour-of-the-day and now FOMO is taking over more broadly.

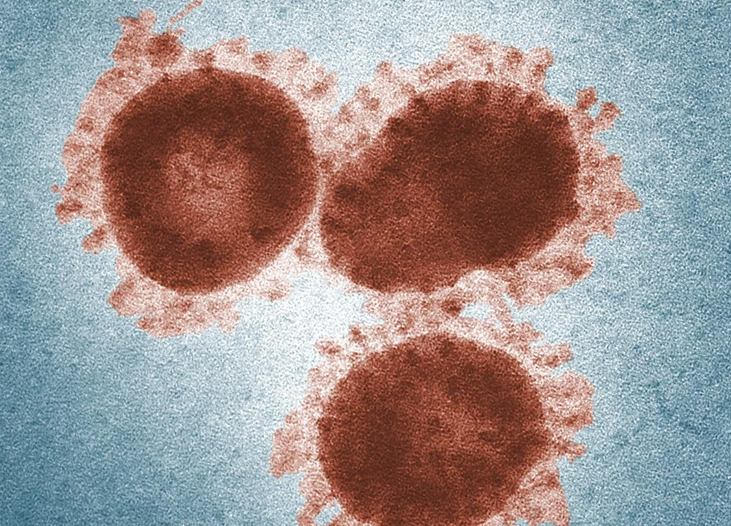

You have to decide if you’re in or out. We all know the risks around the virus and the current economic data and it takes a huge leap of faith to pile in here but betting on humanity has been the best bet in world history.

1) We’re in the post pandemic world

You can look at this a number of ways:

-

The virus is somehow weakening and hopitalizations/ICU admissions are falling even with infections high

-

It’s only the elderly/sick getting very sick and the rare healthy person but numbers are low enough to be ‘acceptable’

-

Summer is helping to cut the numbers

Naturally, you need to watch the data as they’re reporting but at this point it’s going to take a significant spike to reverse the sentiment on the virus.

2) Fiscal conservatism is dead

Fiscal conservatism died in March when the pandemic hit. I’ve been writing about it since then.

This is a wholesale generational secular change that is far more important than the virus. The US might have an $8 trillion deficit this year if another stimulus bill passes. At the same time, the Treasury is borrowing at 0.80% for 10-years.

Deficits don’t matter anymore. Obviously there is no free lunch but fiscal conservatism doesn’t win elections anymore. So why not another $8 trillion deficit next year? What’s possible in the economy when government spending is unlimited?

The most-telling headline this week was that momentum had grown in Congress to hash out more stimulus because of the protests. The reaction function of governments is now to spend.

There will be a reckoning and it will mean currency debasement. The S&P 500 crossed 3000 last month on virus optimism but it will one day cross 6000 but not because of economic growth, but because of debasement.

I think this will go on far longer than almost anyone believes. I think it will define the decade as huge deficits everywhere become the new normal.

3) Low rates forever

The paradigm shift in central banks that was announced on Halloween is now complete.

Central banks spent the last decade forecasting inflation that never came. They hiked rates in anticipation of it coming or because they wanted a return to ‘normal’. The failure of the policy and forecasts was a constant source of embarrassment.

Now they’re flipping the script and the will keep rates low until the inflation actually arrives. Once it arrives they’re also talking about letting the economy run hot to make up for the previous shortfalls.

That’s a revolution in central banking and it means that zero-rates are here for the foreseeable futures.

There are so many knock-on effects from low rates. Namely, that they make bonds un-ivestible for the majority of investors. Savers have no choice but to pile into equities and hope for the best. The corporate debt-fueled buybacks will be return in no time.

What’s so important about the low rates and fiscally unrestrained story is that it lasts way longer than the virus, no matter if it ends this year, in 2021 or 2022.

The other side

I get it. This is all madness. We’re going to have 20% unemployment in tomorrow’s non-farm payrolls report and it will still be around 10% at year-end. Business are closing at unprecedented rates and they’re never coming back. The virus isn’t dead and could rage in a second wave. It’s all non-sense. The economy is aging and young people are crushed under student debt.

But the choice you have to is either believe in the bull case or get on the sidelines because this party is just starting. Of course it will end it tears and there will be an ebb and flow but unless virus numbers start to spike, it’s not going to end soon.