Global Instability, Soaring Deficits And Civil Disobedience: Are We Back In The 1960s, And What Happens Next?

Tyler Durden

Fri, 06/05/2020 – 17:00

For those concerned where our turbulent world is headed, Bank of America has an interesting observation: look back to the late-1960s of what is to come.

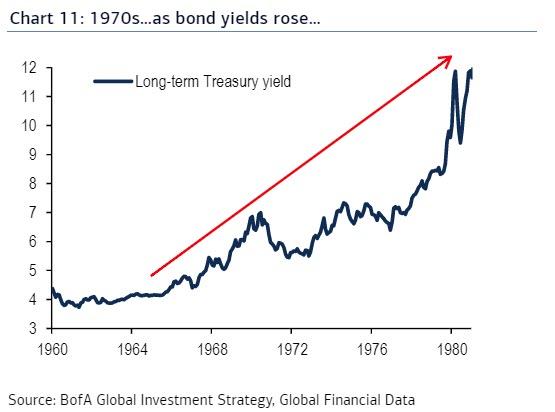

According to the bank CIO Michael Hartnett, just like now, the late-60s, early 70s period was one of social & civil unrest, soaring government/budget deficits, the end of globalization (end of Bretton Woods then vs collapse of global supply chains now), rising yields & inflation after a long period of calm, and ultimately, the start of stagflation.

If we are going “back to the past”, what lessons can we learn from a rerun of this challenging time? According to Hartnett there are four key ones:

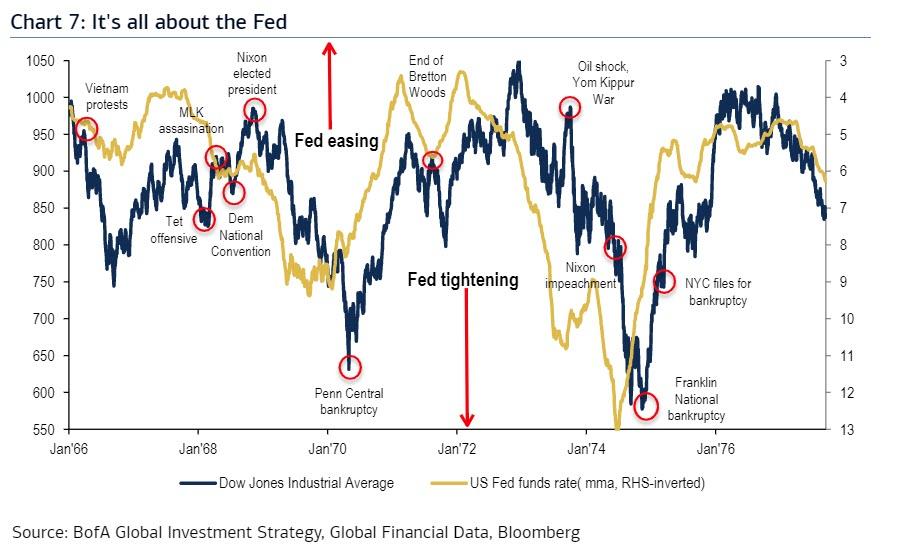

1. Just like now, Fed policy was the dominant driver of asset prices.

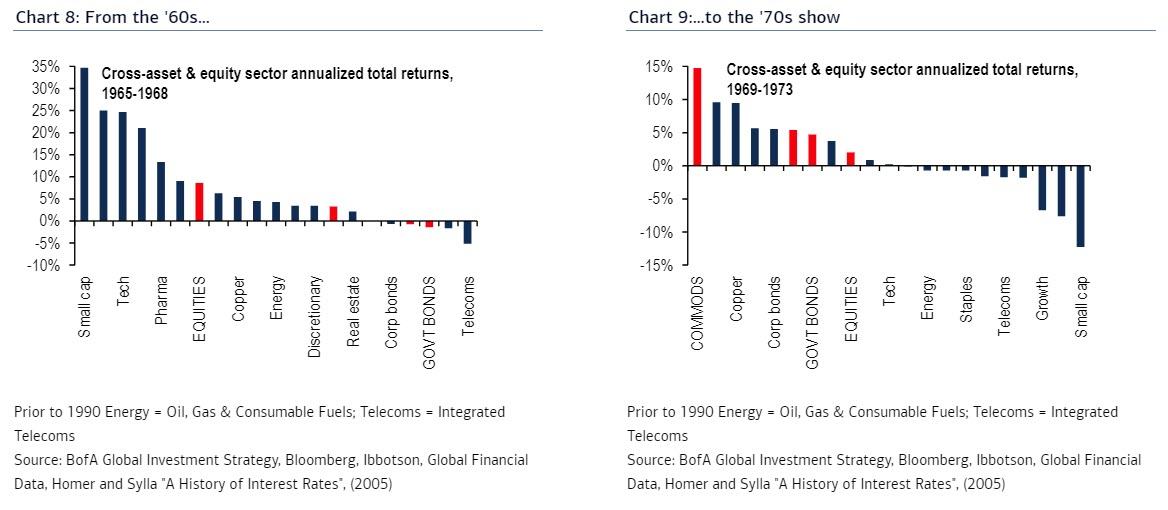

2. The initial period (1966 to 1969) of transition to stagflation, higher yields, higher inflation, higher volatility was characterized by small cap and value stock outperformance in conjunction with Nifty 50 outperformance (similar to the FAAMGs now).

3. Markets discounted the end of hegemony of the US dollar; non-US assets significantly outperformed US equities (despite Nifty 50) in late-60s.

4. The transition from the 60s to the 70s (stagflation, monetary & fiscal instability, breakdown in global cooperation, civil disobedience) coincided with 3 big simple trends: