“Optimism Has Become Excessive” – Speculators Are The Most Levered Long In A Decade

Tyler Durden

Fri, 06/05/2020 – 13:44

While many have applauded the fact that VIX is back below 25, that remains an extremely elevated level historically speaking and has decoupled from the exploding price levels of the broad market…

Source: Bloomberg

This decoupling – relative demand for ‘options’ – is typically interpreted as a more risk averse perspective. However, instead of put demand (protecting soaring profits), the decoupling could signal call demand (levered long and all in) and that is exactly what we are seeing.

The Put-Call ratio has crashed to its lowest since

Source: Bloomberg

Which, while not an imminent indicator of peril, has not ended well in the past…

Source: Bloomberg

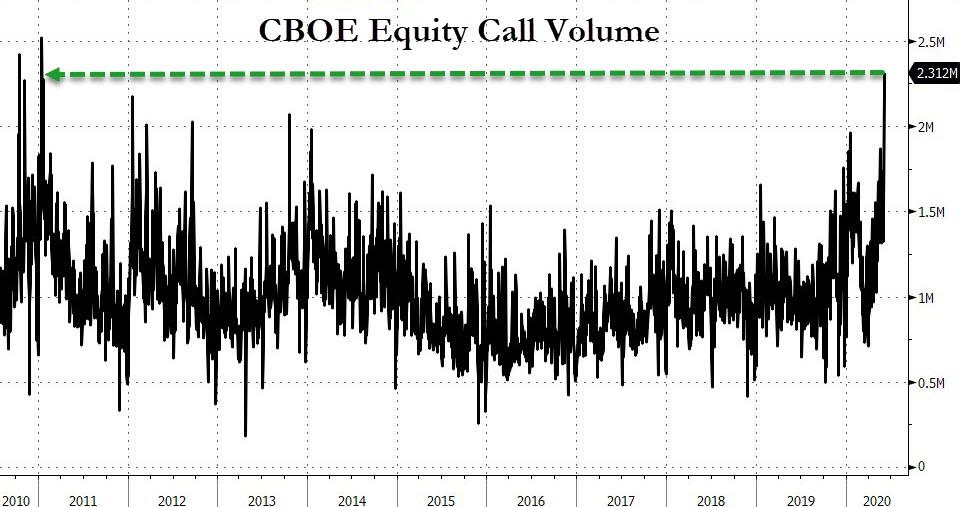

However, as Bloomberg reports, exuberance in American stocks is spurring speculators to unleash bullish bets in the options market at a rate unseen in almost a decade.

Volumes in levered bets on individual stocks going higher exploded this week to a massive 2.3 million calls trading yesterday – the most since 2011…

Source: Bloomberg

So it appears the Millennial masses have discovered that while making money in stocks is “easy”, making more money from “levered” bets on stocks is awesome…

What could go wrong?

“We are seeing a lot of bullish options speculators, and I think the ‘message board flow’ is playing a part,” he said, referring to retail speculation typified on the Reddit forum r/wallstreetbets.

The demand for hedges is almost non-existent as traders chase the greatest stock surge in 90 years with levered money…

“A high level of equity call volume as we are seeing now becomes a warning sign to me that optimism may have become excessive,” said Mike Shell, founder of Shell Capital Management LLC.

This won’t end well.