Chesapeake Prepares To File Bankruptcy After Stock Surges 300%

Tyler Durden

Mon, 06/08/2020 – 17:14

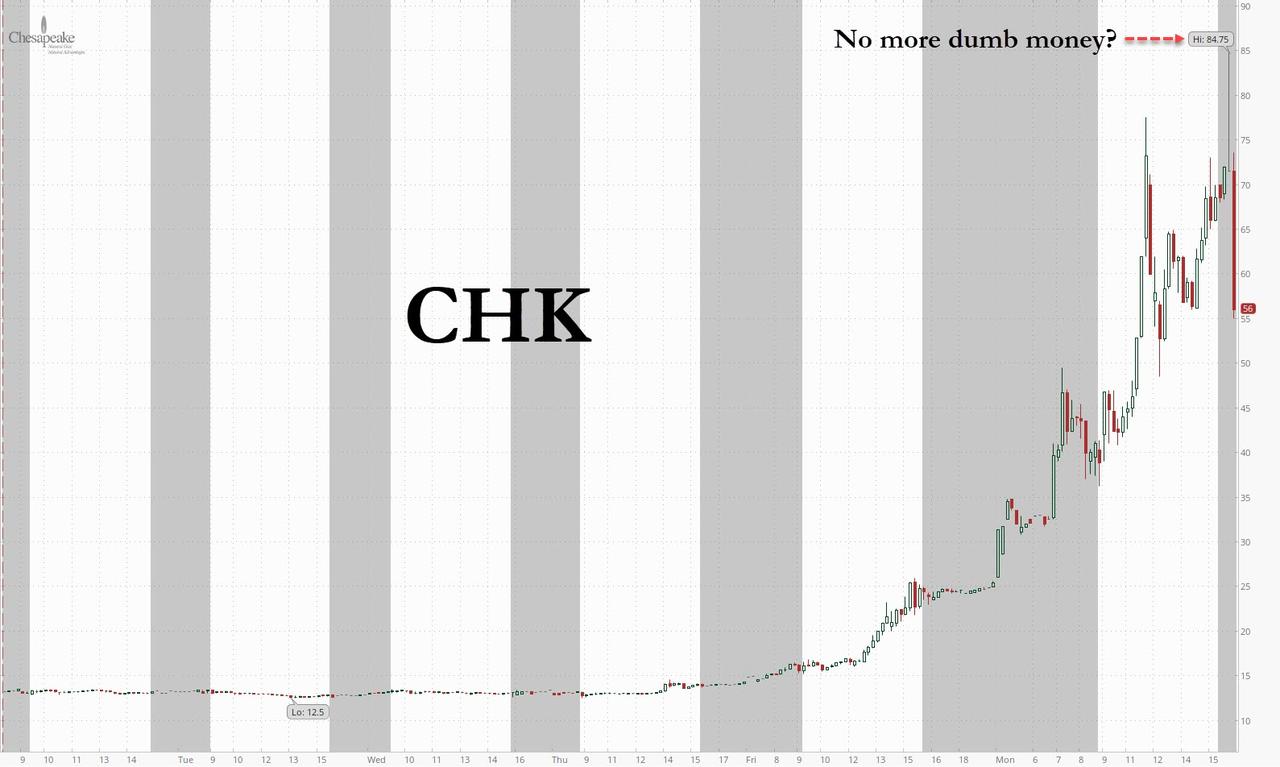

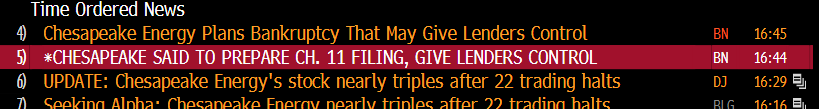

How insane is this “market”? So insane that shale pioneer Chesapeake, which for weeks has been rumored to be on the verge of bankruptcy, exploded by over 300% from Friday’s closing print of $25 to $84.75 after the close.

Well, the daytrader gambler who bought at $84.75 after hours in hopes of finding an even greater idiot to sell to – such as Jerome Powell perhaps – will be disappointed because as Bloomberg reported shortly after the close, Chesapeake is preparing a bankruptcy filing that could hand control of the oil and gas company to its senior lenders, as in no value to existing equity, which as of the close on Thursday had a market cap of $684 million, an increase of over 425% in the past two days!

The timing of these Bloomberg headlines is without doubt the best testament to the absolute idiocy that the moron in charge of the Marriner Eccles buildings has unleashed.

According to the Bloomberg report, the shale driller which was once the largest American gas producer before things turned south, including the March 2016 suicide of founder Aubrey McClendon, owes about $9 billion in debt and is debating whether to skip interest payments due on June 15 and invoke a grace period while it talks with creditors. The company has also begun soliciting lenders to provide debtor-in-possession financing to fund its operations during bankruptcy, according to one of the people.

The Oklahoma City-based producer is negotiating a restructuring support agreement that could see holders of its so-called FILO term loan take a majority of the equity in bankruptcy, the people said, who asked not to be identified discussing confidential matters. The support agreement remains fluid and the terms could change, the people said.

The company has retained Kirkland & Ellis and Rothschild as bankruptcy advisors while the FILO lenders are organized with Davis Polk & Wardwell and Perella Weinberg Partners.

Rumors of Chesapeake’s inevitable demise were already swirling well before the coronavirus pandemic crushed commodity prices and crude demand plummeting. At its height more than a decade ago, the producer was a $37.5 billion juggernaut commanded by McClendon, an outspoken advocate for the gas industry. But Chesapeake’s success at extracting the fuel from deeply buried rock – funded by billions in cheap junk debt – contributed to a massive gas glut, and the eventual collapse of the company.

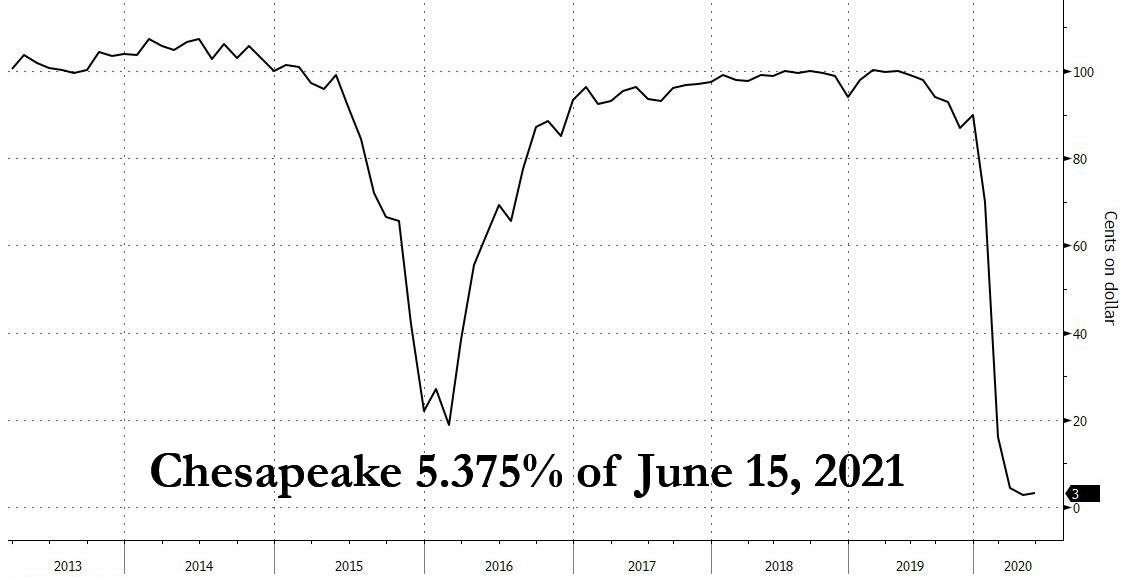

Finally, for those are about to say that there may be some value to the equity, just a take look at the June 2021 bonds which are about to default and are trading at 3 cents on the dollar and just keep your mouth shut.