Treasurys Are Trading As If Yield Curve Control Is Already Here

Tyler Durden

Mon, 06/08/2020 – 14:55

Markets are reluctant to unwind speculation the Federal Reserve will embark on curve control to keep front-end yields in check. That has helped two-year bonds weather the storm in the long end of the Treasury yield curve.

According to a Sunday leak by the WSJ’s Fed watcher, while the Fed is debating whether to put a lit on rising long-term bond yields in the form of yield curve control caps, “Fed officials aren’t prepared to announce any decision on so-called yield caps when their two-day policy meeting concludes Wednesday.”

And yet, as Bloomberg’s macro commentator Ven Ram writes overnight, the bond market is already trading as if YCC is already in place, with two-year yields trading “almost immune to the ructions at the long end, and are trading much richer than implied by a modeled framework.” And while the Fed was careful to leak that YCC will not be announced on Wednsday, Ram notes that “the Fed has often followed the market’s lead, and may do so again on this issue.”

Below he explains why:

Two-year notes are trading at a premium to fair value, while 10- and 30-year bonds are near levels where they need to be, a multi-factor analysis shows. At around 0.22%, two-year yields are just a fraction of where they ought to be, with fair value at 0.76%. In contrast, 30-year Treasuries are trading at a minor discount to the predicted value of 1.64% (see table below)

Bond yields can be conceptually broken down into the expected real rate and estimated inflation together with real and inflation risk premiums. My modeling framework assumes that yields can be bootstrapped from market-embedded expectations on the evolution of interest rates, the trajectory of inflation and correlations with leading macroeconomic indicators

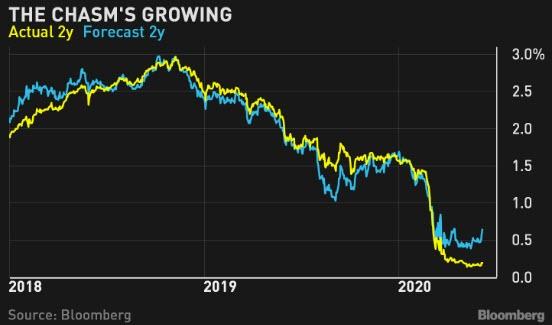

A backtest of the model shows how closely it would have tracked the actual yield (see chart below) before the pandemic

The divergence between the forecast and actual values hasn’t been this pronounced since at least the start of 2018. That reflects aggregate fears about the economic downturn, the prospect of the Fed embarking on a control of the yield curve and speculation on negative rates.

While the jobs data for May showed the economy holding up better than forecast, the premium on front-end Treasuries still reflects deep skepticism about growth.

The Fed is “thinking very hard” about targeting specific yields on Treasury securities to ensure borrowing costs stay low, New York Fed President John Williams said late last month.

If the central bank were to take a leaf from Australia, it would target just the front end of the curve. The RBA targets around 0.25% on the three-year rate.

Meanwhile, speculation regarding the prospect of negative rates refuses to die despite speaker after Fed speaker having reiterated that the global experience with sub-zero rates shows mixed success and is not something that makes sense in the U.S. context.

Even if the Fed gives negative rates a skip – as I think it should given the experience in Japan and the euro area – just taking control of the yield curve would ensure that the front end remains anchored at low levels

Treasury markets have pretty much usurped the Fed’s agenda this year. For instance, two-year yields collapsed by almost half from year-end 2019 through Feb. 29 to 0.91%, prompting the Fed to slash the lower bound of its policy rate to 1% in an out-of-cycle policy review. Yields then slumped further, prompting a cut to zero barely two weeks later.

Treasury two-year yields have gone nowhere in the past few weeks, and have essentially been trapped in a thin range that seems to be centered around 0.16%-0.18%. That, in effect, is yield-curve control as envisioned by the markets. That may mean the Fed will follow their cue yet again.