What Comes After The “Deepest Economic Crisis Since The Great Depression”

Tyler Durden

Tue, 06/09/2020 – 19:25

Authored by Huge Erken, head of International Economics at Rabobank

Coronavirus causes deepest economic crisis since the Great Depression

Summary

-

COVID-19 is expected to result in contraction of the global economy by 4.1% in 2020

-

This means that the corona crisis will be the deepest economic crisis since the Great Depression in the 1930s

-

We expect a relatively limited recovery in 2021, as many countries will continue to be bound to a ‘six-foot economy’ for a long time

-

Businesses in these countries will not be able to offer as many goods and services as they did previously, and demand will remain low for a long time Political tensions between the US and China have flared up again, and we expect the truce in the trade war to come to an end

-

Downside risks such as a second wave of infections or a financial crisis continue to dominate

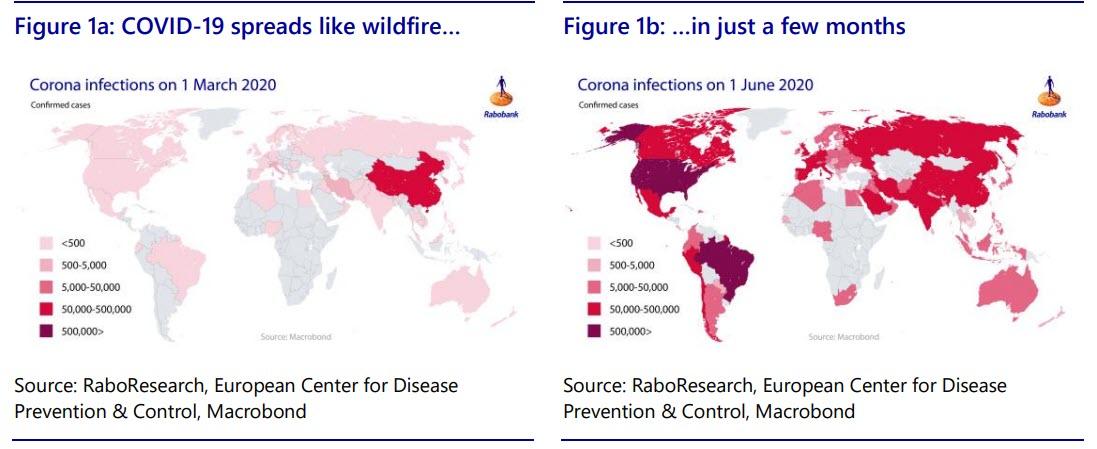

The global economy will contract by 4.1% The rapid succession of developments relating to the coronavirus (see Figure 1a and 1b) is leaving deep scars in the global economy. We have therefore had to downgrade our estimates several times (here and here and here).

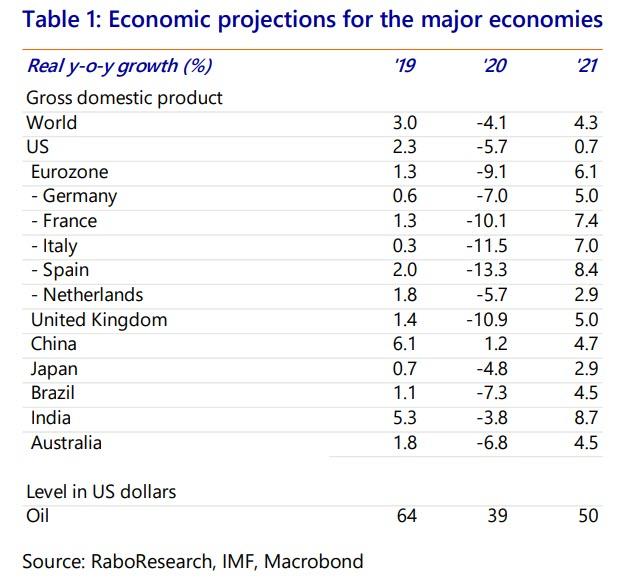

We are currently forecasting that the global economy will contract by 4.1% in 2020, and then grow by 4.3% in 2021 (Table 1). This means that the corona crisis will be the deepest economic crisis since the Great Depression in the 1930s (Figure 2). The sharp contraction in mainly Western Europe and Latin America will be offset by more moderate GDP declines in Asia, where stronger underlying growth in China in 2020 and in India in 2021 will go some way to limiting the damage.

The deepest economic crisis since the 1930s For France, Italy, Spain and the United Kingdom we are even forecasting a contraction in gross domestic product (GDP) of more than 10% in, mainly due to the long and stringent lockdowns in these countries. Another factor is that the sectors that are the worst hit by the corona crisis, such as tourism, recreation and hospitality, are relatively strongly represented in these countries compared to other eurozone countries.

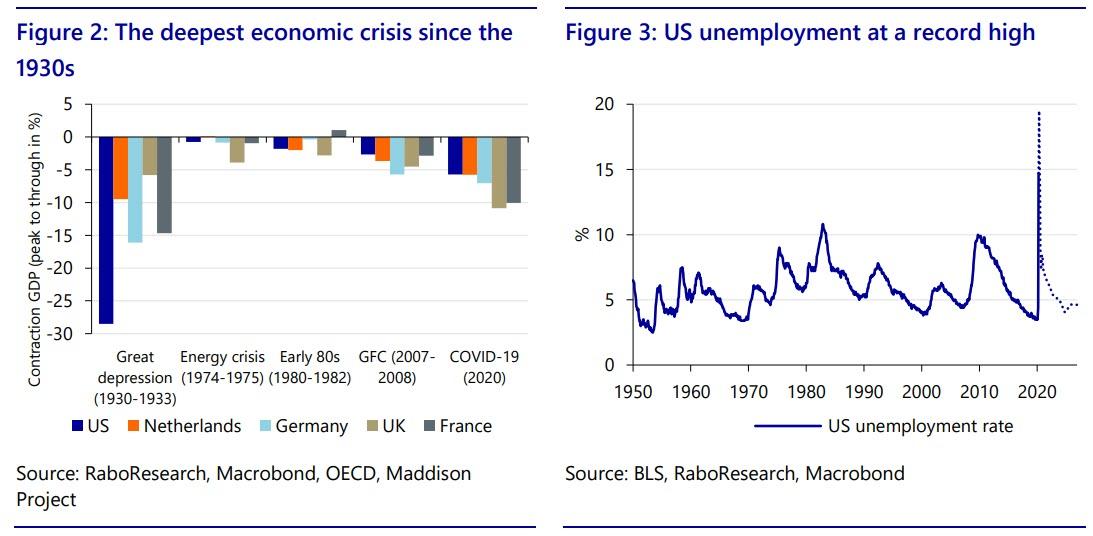

In the United States, we expect a more limited contraction of 5.7%, again followed by a relatively modest recovery in 2021. In the US, this relates to the flexible labor market, which lead to a rapid rise in unemployment which started to come down again recently (Figure 3). April saw the highest post-war unemployment figure of 14.7%, although figures for May show that it is coming down again. Corrected for classification errors, unemployment was as much as 19.5%. With a fifth of the American working population temporarily out of work, private consumption will be slow to pick up after the hard lockdown period, and these effects will continue to be felt into 2021. This expected weakness in the demand side of the economy will be intensified by the fact that the US economy was already in pretty poor shape before the advent of the corona crisis, something we have been warning about since the beginning of 2019.

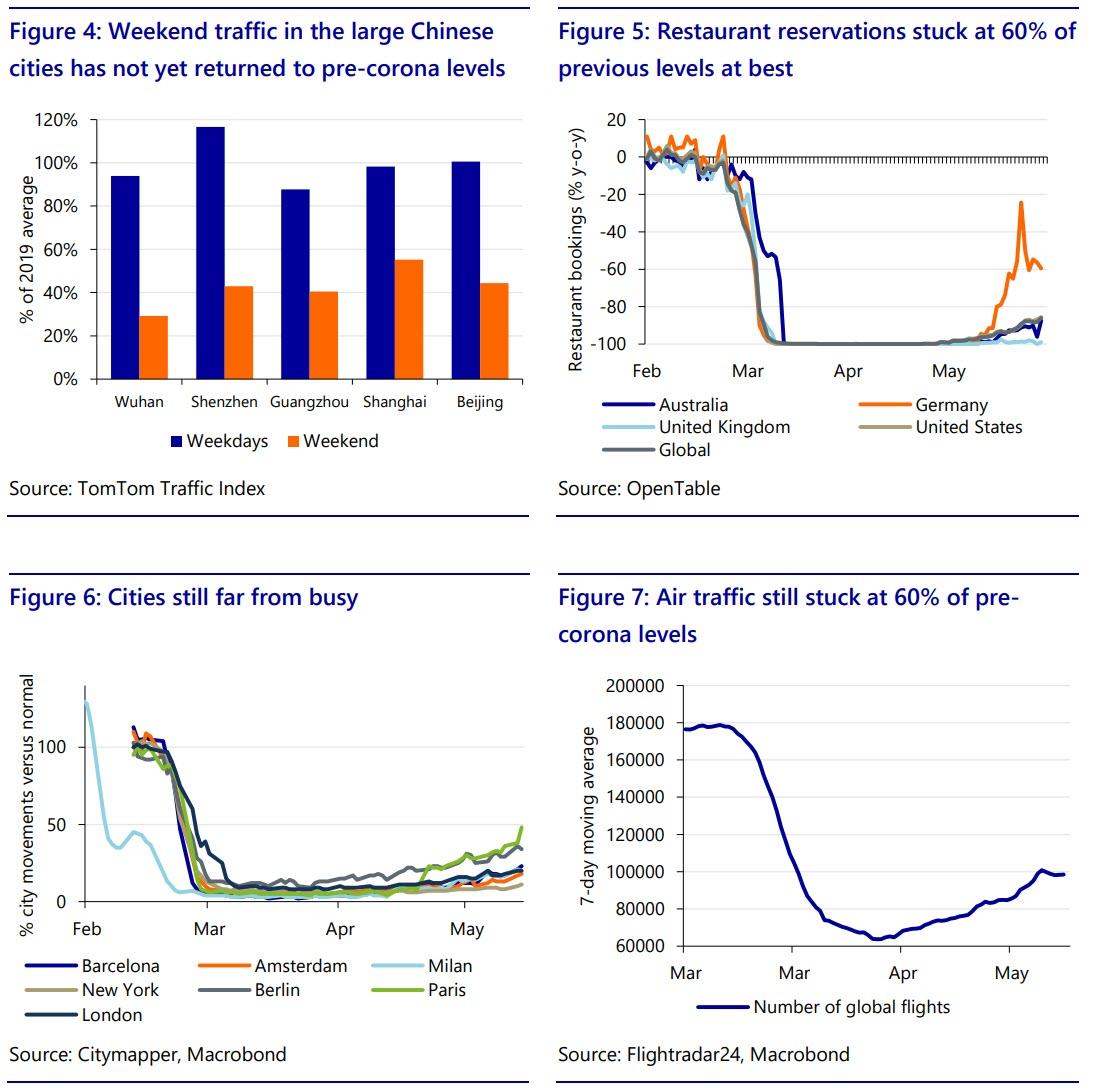

Reopening the economy is proving difficult

The US is not the only country where we expect lower growth in 2021 than we previously forecast. We currently expect the recovery to be more moderate in virtually all countries. Despite the easing of the lockdown in many countries, economic activity is increasing only marginally. On the one hand this is due to lack of demand, as people continue to avoid restaurants, cafés and stores, and also due to economic uncertainty and loss of income. On the other hand, there are limitations in the supply side of the economy as businesses and entrepreneurs are forced to adapt to the six-foot economy. A recent academic study argues that social distancing will be needed until 2022 to prevent a resurgence of the virus.

A lengthy period of social distancing and lower potential growth

Countries will be stuck with the six-foot economy for many months yet. For the Netherlands, we have calculated that there could be adaptation problems for 16% of jobs in this economy, while in the US this figure is 23% (see this report). In this situation a V-shaped economic recovery will be hard to achieve and a U-shaped recovery may be more likely (see this study for a detailed discussion on the possible shapes the recovery might take). We have calculated that the corona crisis could also damage the long-term growth potential of countries, so that the effects could continue to be felt even after 2022. For the Dutch economy, we forecast that annual potential economic growth in 2022-2030 will fall from 1.4% to 1.2%, and in the US we foresee a decline from 1.6% to 1.4%.

Political tensions between the US and China are flaring up again

Following the long-awaited truce between the US and China in the form of the ‘Phase 1 deal’ on January 13 and the subsequent outbreak of the corona virus, a period of quiet broke out in the trade war between the two superpowers. However, diplomatic relations between the US and China have now taken a rapid and serious turn for the worse. This started in March, with accusations from both sides regarding the approach to the virus.

US measures

The US is working on legislation to use grants and tax breaks to persuade foreign businesses in China to transfer their operations to the US and on measures to reduce dependence on China in areas such as medical and defense-related products. President Trump has also instructed his administration to remove Hong Kong’s special status in response to a Chinese security law that the Americans believe threatens Hong Kong’s autonomy. Withdrawing this status would mean that Hong Kong, which is a major trading hub in Asia, would face higher trade tariffs and that access to US dollars by businesses and banks in Hong Kong could be restricted. Finally, Trump has signed a presidential executive order, under which US businesses are no longer permitted to use products from the Chinese telecoms giant Huawei.

Anti-China rhetoric as a lightning conductor

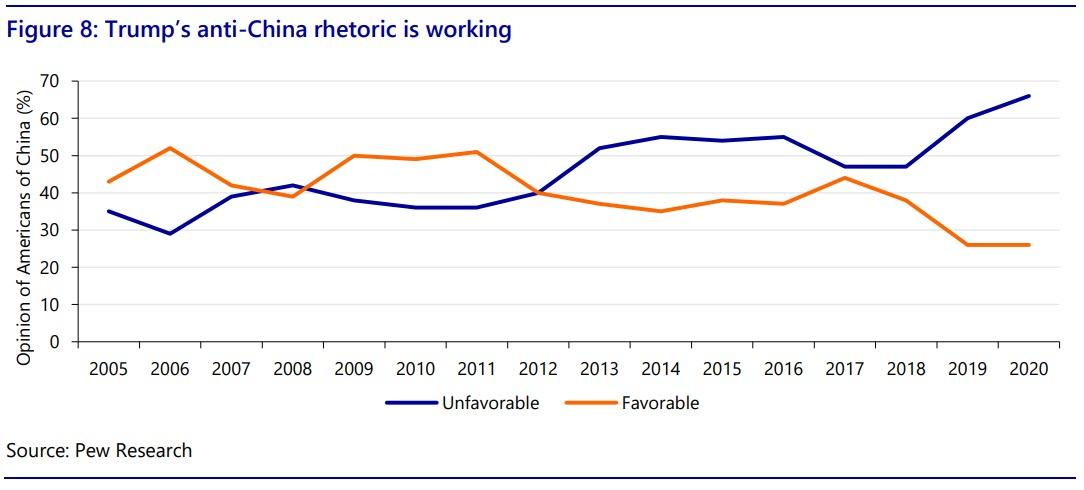

All these measures are part of President Trump’s ‘America First’ doctrine, and address what he sees as unfair trading practices on the part of China. This view is starting to gain traction with the US public (see Figure 8). Trump seems to be using anti-China rhetoric as a diversion from his domestic problems. Trump has lost much needed popularity in the polls due to his handling of the corona crisis, the rapidly worsening economy and his threat to deploy the military to subdue recent demonstrations and social unrest.

With the presidential elections upcoming in November, Trump is trying to make electoral gains with his tried and tested anti-China tactic. Trump is indeed not alone in this stance, as his Democratic opponent Joe Biden is also planning to act against China, albeit in cooperation with Europe.

Chinese measures

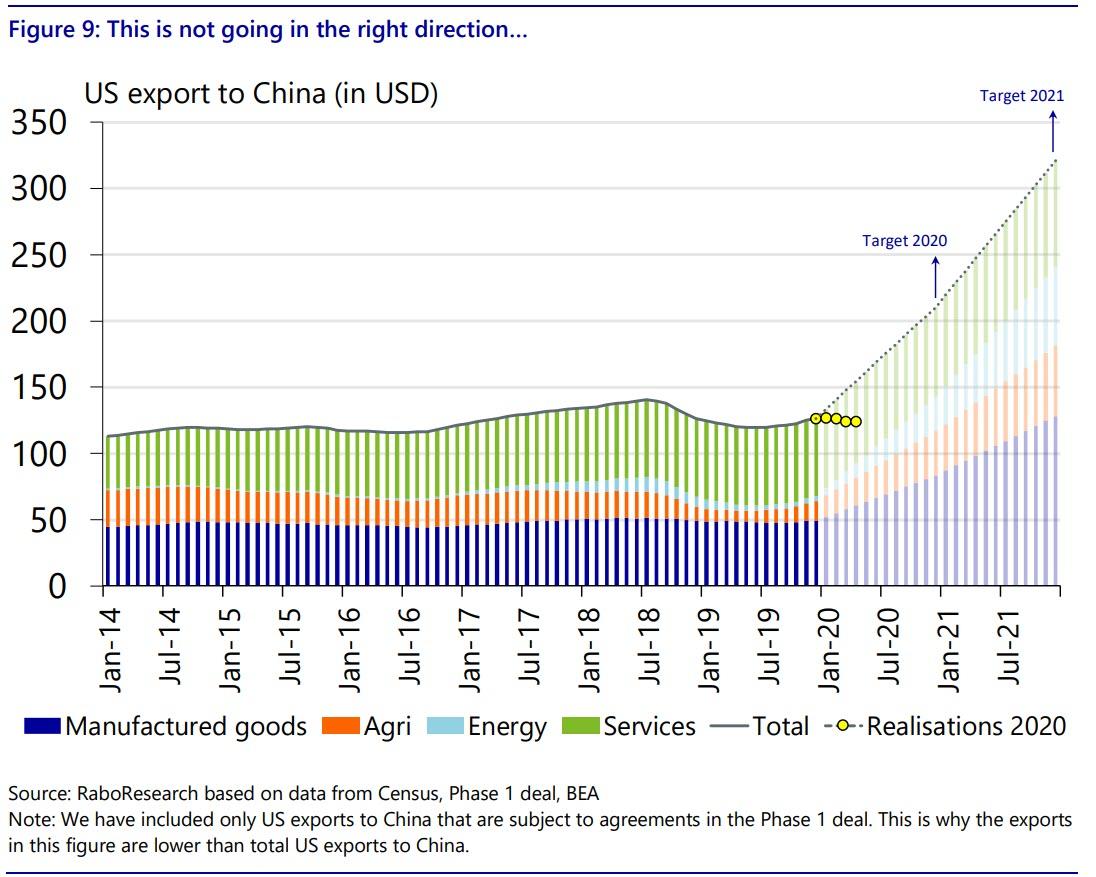

China has not been sitting on its hands either. It expelled several American journalists in March, and state-run food companies (Cofco and Sinograin) have been instructed to buy fewer products from the US. This fits the view that China is apparently not ready to observe the trade agreements in the Phase 1 deal, as available import data for the first three months of 2020 are showing a negative rather than a positive trend (see Figure 9). This also confirms that China’s import commitment was always highly unrealistic right from the start. In combination with the recent political tensions between the two countries, we believe the deal is likely to break down before the year is out.

Downside risks

Despite our heavily downgraded economic forecasts and rising geopolitical tensions, there are several risks that could make the outlook even worse. Four of these risks are discussed below. A second wave of infections Countries around the world are currently easing their lockdowns. There is a possibility that this easing will open the door to a new wave of infections, forcing countries to impose a new period of lockdowns to restrict the spread of the virus. Previously we published estimates of the additional economic damage if lockdowns were to be extended by a further three months. A return of the virus in emerging markets is potentially a much greater risk than in developed countries. It remains to be seen whether it is realistic that people in densely populated countries such as Indonesia, India and Brazil will be able to maintain adequate social distancing. There is also the question of whether these countries have sufficient testing capabilities to identify a resurgence of the virus at an early stage.

A financial crisis

The current economic crisis could turn into a financial crisis, in which financial institutions get into difficulties. For instance, if there is a second or third wave of infections that leads to a sharp increase in bankruptcies, a rapid deterioration in bank balance sheets and liquidity issues for banks themselves. The consequence could be that lending to businesses comes to a halt, putting more businesses in trouble and creating a vicious circle.

At this time we do not expect any friction in the financial system, partly because the banks have generally improved their buffers since the Great Financial Crisis and partly because central banks around the world are providing sufficient liquidity to the banks. The volatility in the financial markets that marked the start of the corona crisis has therefore also waned.

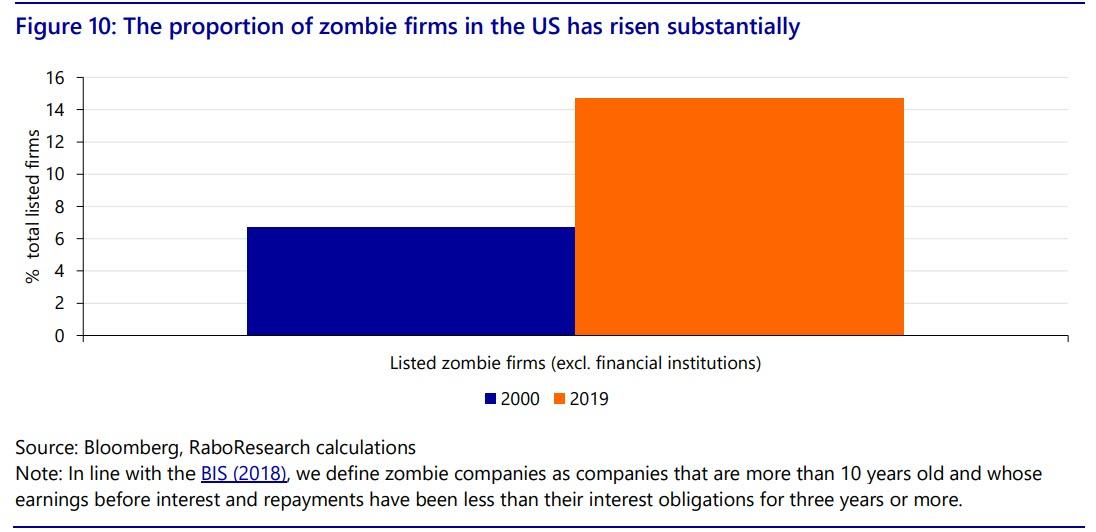

Zombie companies

Another risk in the longer term is that the proportion of what are known as ‘zombie companies’ will increase in some countries. Zombie companies are businesses that are barely profitable now and their outlook for future profitability is bleak. These companies thrive in an environment of low interest rates and a financial system that rolls over loans to loss-making companies. Even more loose monetary policy by central banks encourages this ‘zombification’ process. We saw the number of zombie companies increase rapidly in the wake of the Great Financial Crisis. In the US, the proportion of zombie companies among listed companies rose to 15% in 2019 (figure 10). In Japan as well, the proportion of zombie companies among SMEs is now 21% according to some estimates. Zombie companies represent a problem for the post-crisis recovery as they are less productive and innovative than healthy businesses. According to the BIS, a one percentage point increase in the proportion of zombie companies in a country leads to a decline of 0.3% in annual GDP growth.