Saudis Dumped Record Amount Of US Treasuries In April As Gold Reserve Holdings Rise

Tyler Durden

Mon, 06/15/2020 – 16:14

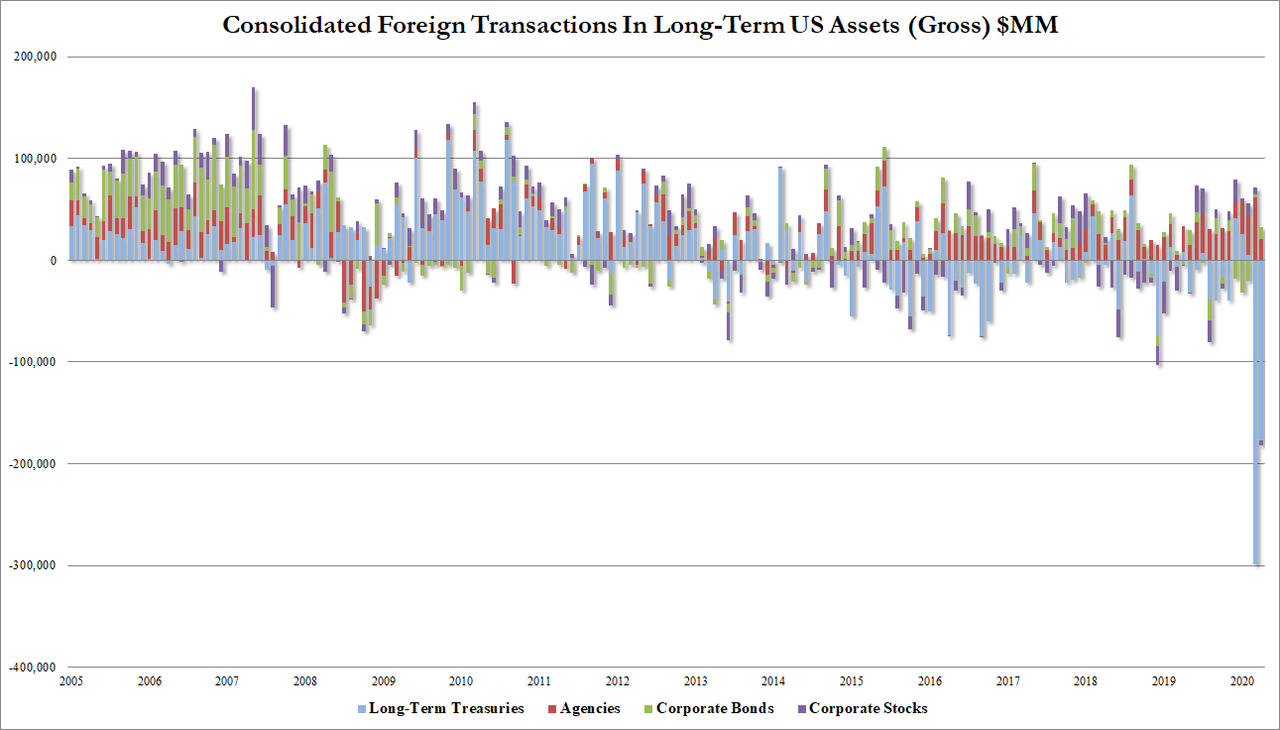

Foreign holdings of U.S. government debt fell to a four-month low in April, as the COVID-19 pandemic shut down most of the global economy.

Foreign TSY sales eased from $299BN in March to $177BN in April and while foreigners bought $10.9BN in corporate bonds in April, up from $3.2BN in March, they sold $5.6BN in corporate stocks in April, from $7.1BN in purchases in March, and the biggest selling since Aug 2019.

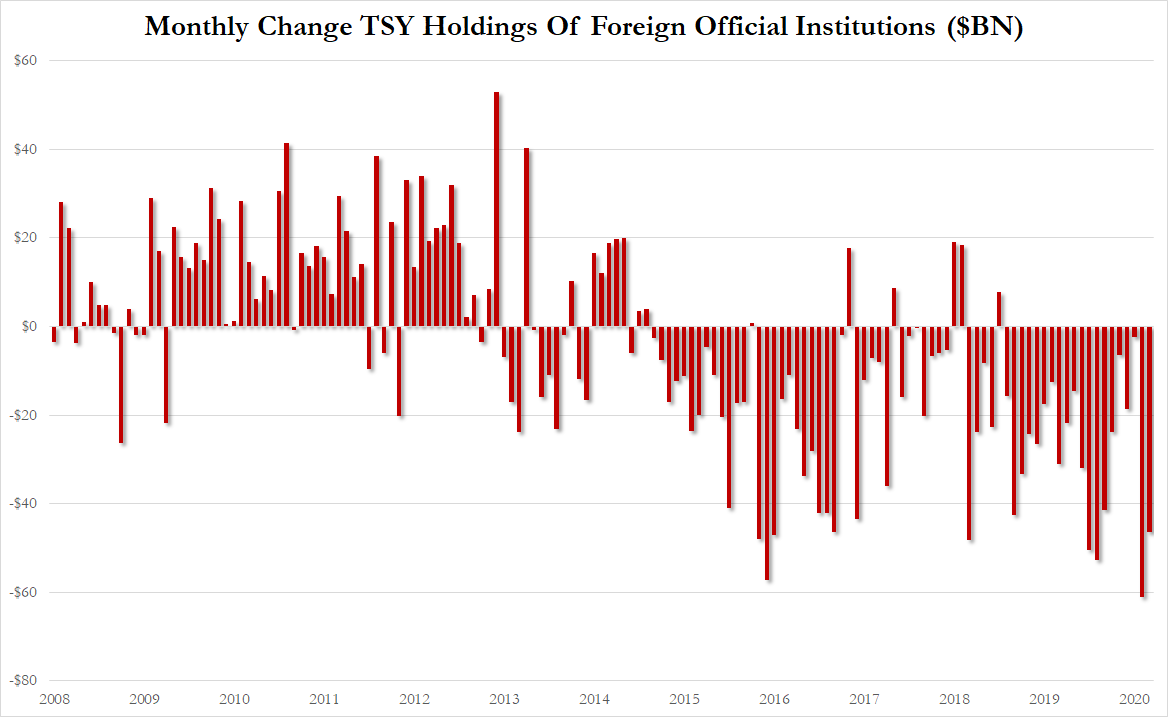

The biggest seller by far was Saudi Arabia who dumped almost $60 billion in US Treasuries in March and April (as oil prices collapsed)…

Source: Bloomberg

China and Japan also reduced their US Treasury holdings.

The total for China — the second-largest holder of U.S. government debt — shrank by $8.8b in April to $1.07t

Source: Bloomberg

Japan still has the largest pile of Treasuries outside the U.S.; the value of its holdings fell $5.7b to $1.27t

Source: Bloomberg

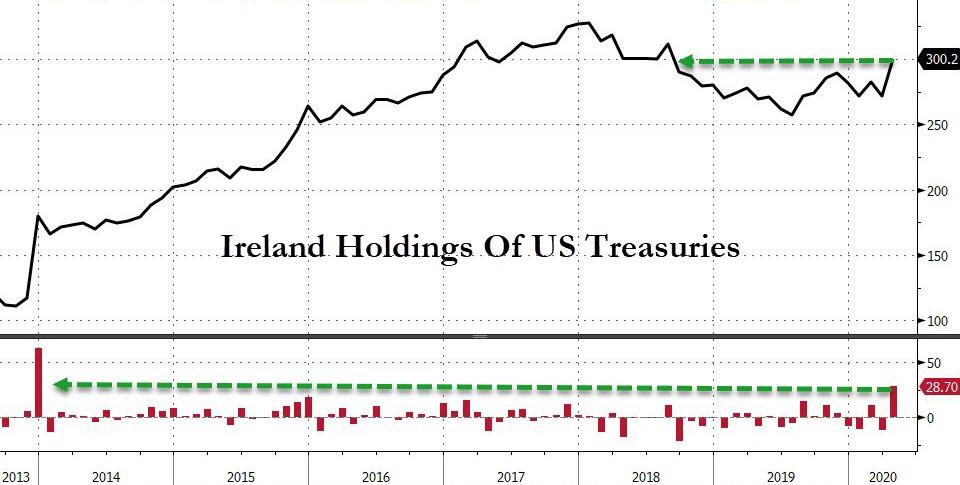

Interestingly, Ireland, the fourth-largest holder, boosted its holdings to $300.2b, the highest since Aug. 2018, from $271.5b.

Source: Bloomberg

As a reminder, The Fed’s FX swap lines were also in place throughout April, offering foreign central banks an alternative to selling Treasury holdings to meet their dollar-funding needs and support their currencies.

LTM selling of TSYs by foreign central banks and reserve managers rises to $372.3BN, just shy of the $397BN record in Nov 2016.

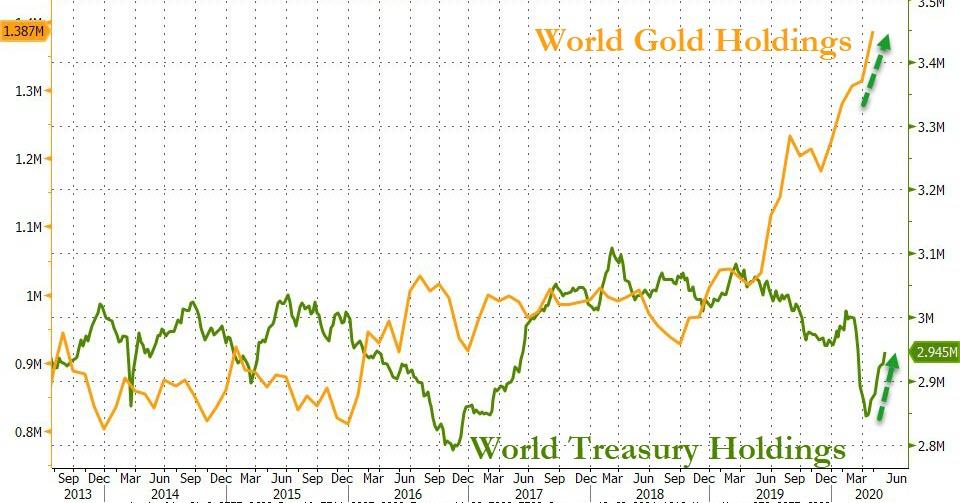

And finally, we note that while gold holdings are soaring, safe-haven flows into TSY (Within Fed Custody) also rose…