The Myth Of The V-Shaped Recovery In One Chart

Tyler Durden

Wed, 06/17/2020 – 11:31

Authored by Mike Shedlock via MishTalk,

Retail sales surged in May but manufacturing is another story.

The Fed’s Industrial Production and Capacity Utilization puts a big negative spotlight on the emerging V-shaped recovery thesis.

Industrial Production Highlights

-

Industrial production increased a weaker than expected 1.4% in May. The Econoday consensus was 2.9%.

-

A negative revision took April from -11.2% to -12.5% so essentially there was no rebound at all.

-

Industrial production in May was 15.4% below its pre-pandemic level in February.

-

Manufacturing output rose 3.8% in May but languishes near the lows in the Great Recession.

-

At 92.6% of its 2012 average, the level of total industrial production was 15.3% lower in May than it was a year earlier.

-

Capacity utilization for the industrial sector increased 0.8 percentage point to 64.8% in May, a rate that is 15.0 percentage points below its long-run (1972–2019) average and 1.9 percentage points below its trough during the Great Recession.

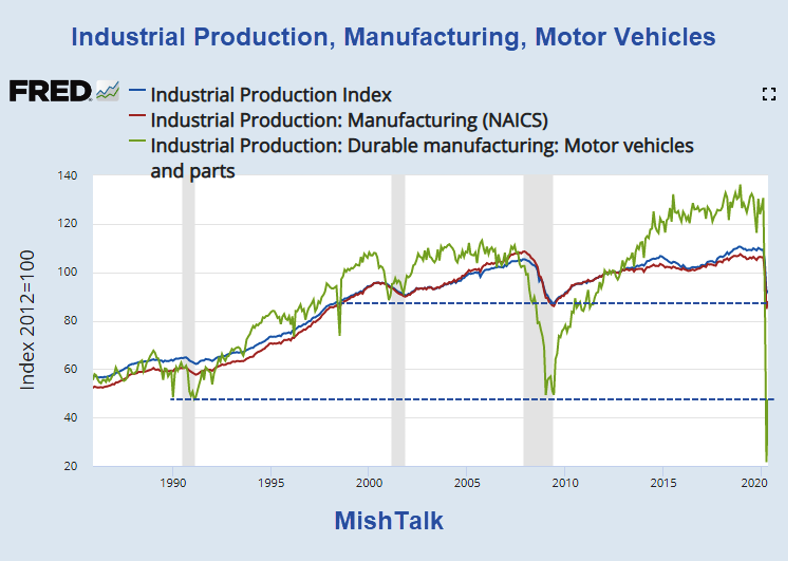

Manufacturing and Motor Vehicles and Parts

-

Motor vehicles and parts production has “rebounded” to a level “below” the bottom of the 1990 recession.

-

Manufacturing is at a 1988 level

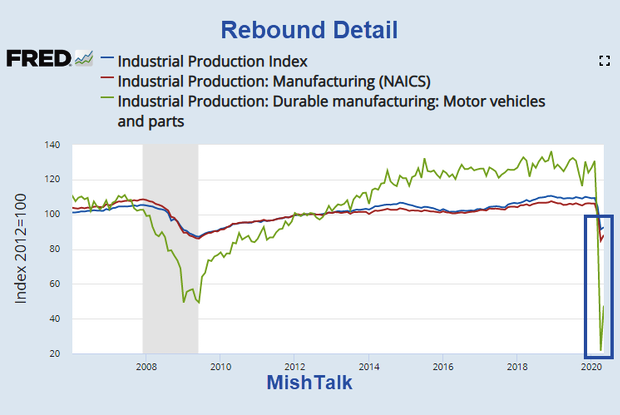

Rebound Detail

V-Shape Recovery?

These numbers are not remotely close to anything one would ever associate with a V-shaped recovery.

Retail Sales vs Industrial Production

Earlier today I reported Retail Sales Surge Most on Record But Number is Misleading.

-

Retail sales surged a greater than expected 17.7% in May but the numbers are still well below the pre-pandemic levels.

-

Despite the surge, sales numbers are back to levels seen in late 2015 and early 2016.

Stimulus Checks

People got money and spent it, but they also skipped mortgage payments and credit card payments.

What happens when the checks run out?

Those Out of a Job

There are still 20 million people out of work.

It is foolish to believe they will all be back working the same number of hours at the end of June.

Fed vs Kudlow

-

Larry Kudlow says “The Economy is Off to the Races“.

True State of the Economy

Today’s dismal industrial production numbers put a better spotlight than retail sales on the true state of the economy.

Off to the Races Not

There are too many things that can go wrong and many of them will.

It will take years for this economy to recover.