The Retail Daytrading Euphoria Has Finally Peaked: Here Come The Sellers

Tyler Durden

Wed, 06/17/2020 – 09:58

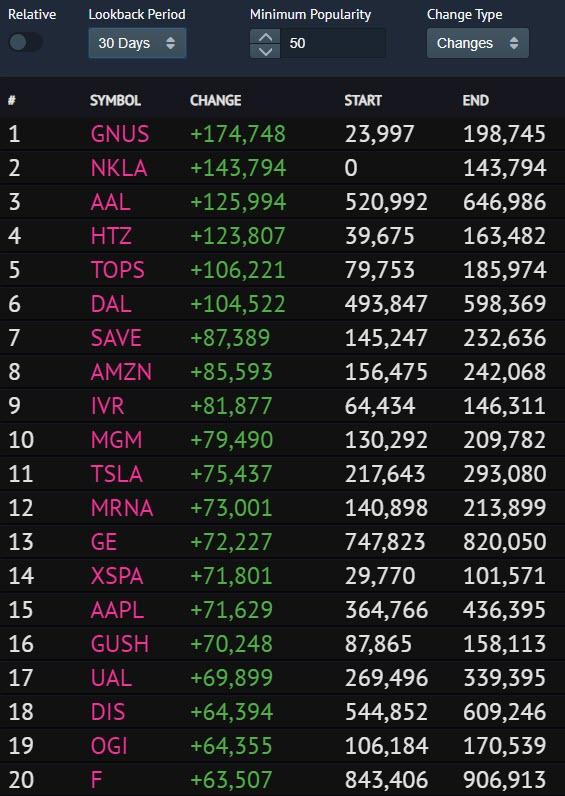

In the latest installment tracking the retail euphoria phase of the bubble now known by everyone as “Jay’s Market” (recall that for much of the past decade, the recurring complaints among bulls was that there was zero retail participation so it wasn’t really a bull market, well… how about now), Bloomberg profiles not the now infamous Robinhood trading platform which has emerged as the “battleground” for an entire generation of 10-year-old traders, but rather its derivative – the website that tracks the action on Robinhood and which we have frequently used to show recent moves and changes in retail trading momentum: Robintrack.

As Bloomberg reports this morning, RobinTrack – which is not affiliated with the Robinhood investing app, but uses information gleaned from it to show trends in positioning among the brokerage’s users – is a two-year old product of Casey Primozic, “who was wrapping up his undergraduate years at Valparaiso University in Indiana. He was also building a website — for fun. Little did he know it would grow into a Wall Street obsession.”

Now in 2020, his college side project, Robintrack.net, has seen site traffic explode as everyone from day traders to institutions flock there for a picture of what retail investors are buying. Primozic says there’s evidence hedge funds are scraping his data. The 23-year-old programmer can hardly keep up with an overflowing email inbox and is getting barraged with pitches from advertisers.

Why is Robinhood – and by extension Robintrack – so popular among trend watchers? Because “no other brokerage provides this data publicly and directly – making Robinhood users a proxy for all individual investors.”

Robinhood displays stock ownership data publicly for informational purposes, according to a company spokesperson.

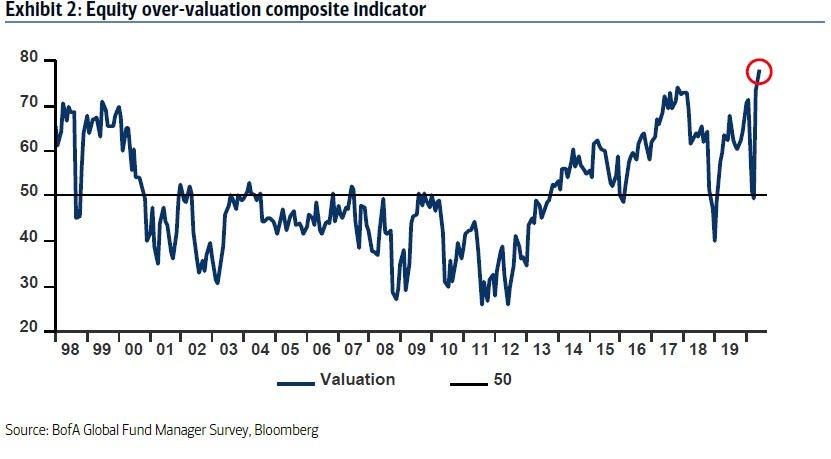

And in a time when as we reported one month ago “retail traders have taken over the market“, as institutions remain paralyzed unable or unwilling to buy stocks in a market where a record number of Wall Street professionals say the S&P is overvalued…

… the result has been a reflexive cottage industry of Robinhood “analyst”, or as Peter Tchir, head of macro strategy at Academy Securities says, there’s a “cult of Robinhood watchers developing.”

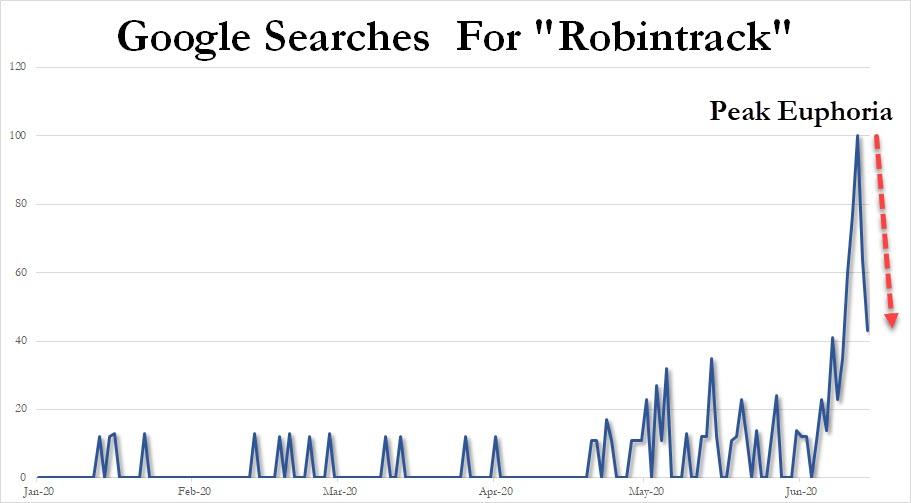

Anywhere between 20,000 and 50,000 unique users now visit Robintrack on an average day, according to Primozic. Before this year, a typical day would only see up to 4,000 visitors. In the seven days before Monday, the website attracted 167,000 unique users and 286,000 separate sessions. The spike began back in late April, as Robinhood users piled into the United States Oil Fund LP (USO) amid negative crude prices.

On the other hand, as SocGen quant Andrew Lapthorne wrote in a note Monday: “The number of ‘odd’ trades coupled with the availability of Robinhood data via Robintrack.net, has increased the noise level.” Yet in world where markets make no sense, coupled with their own reflexivity, the noise generated by millions of retail daytraders chasing momentum is neatly repackaged as “big data” (i.e. trends and paterns), as “strategists” seek to justify investing theses based on what a bunch of teenagers are buying or selling at any given moment:

Primozic has had to make a couple changes to the site’s operations to keep up with the overflow. Visitors to the site aren’t just perusing. Rather, many are pulling the available data into their own programs.

“These days, especially, there’s at least three or four people who will run these scrapers at any given time,” he said. “I’ve actually had to limit the rate at which they can do it just to prevent them from overloading my hardware.”

So starved is Wall Street for noise signal that according to Primozic, there is “evidence that users at hedge funds including D.E. Shaw & Co. and Point72 have looked into or are directly collecting data from Robintrack. Representatives of the firms declined to comment on whether they’re plugging into Robinhood.”

I’ve confirmed one more hedge fund to be looking into Robintrack data: Capital Fund Management from Paris.

That brings the total up to 4 so far: D. E. Shaw, Point72, Two Sigma, and CFM

In case you were wondering if this data is useful, here’s proof the pros are interested too! pic.twitter.com/7EXDKSUEpD

— Robintrack (@robintrack) May 6, 2020

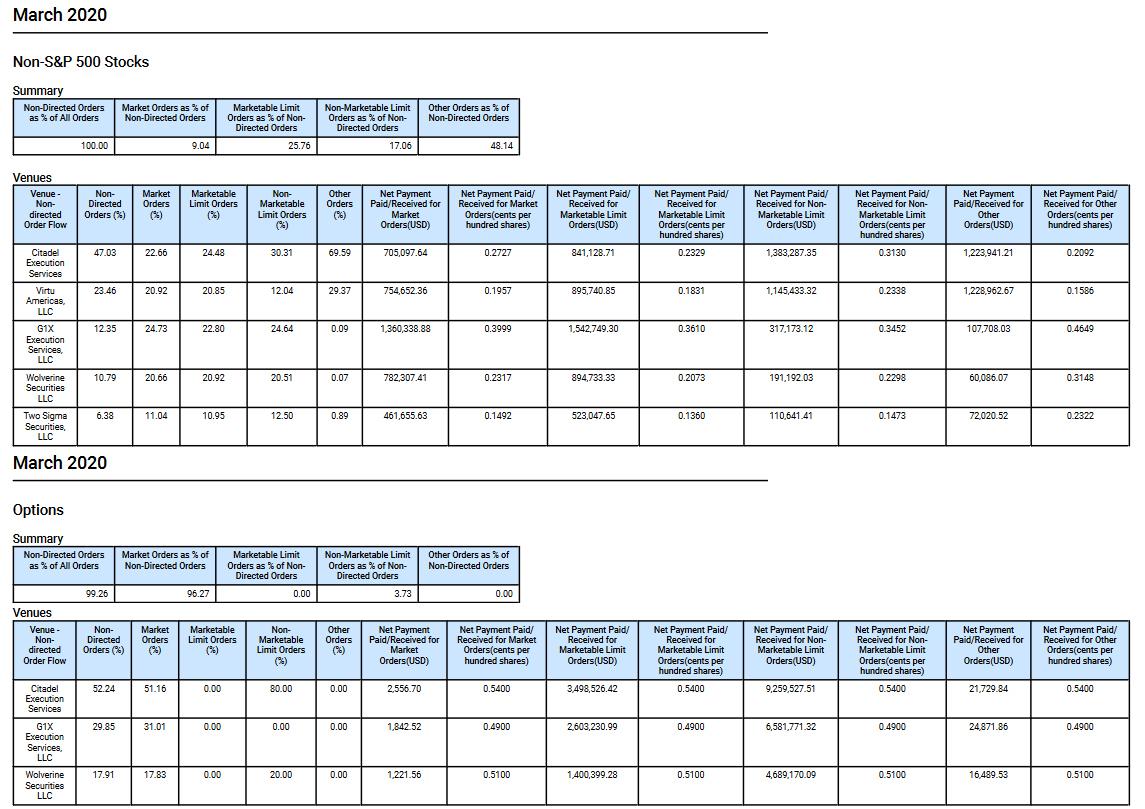

What was left unsaid by the Bloomberg expose (and we may have an idea why) is that by the time the RH trade data hits Robintrack, it’s extremely stale and virtually non-actionable except for those looking at very big picture trends (on Wall Street nanoseconds matter – minutes do not) which is why HFT firms pay tens of millions in dollars to Robinhood every month for its orderflow enabling the “free brokerage” model in the first place – to have real-time access and in some unspoken cases to frontrun, the massive retail orderflow.

Below is an example of how much various HFT venues paid Robinhood in March alone to “execute” its stock and option trades, based on the company’s latest 606 statement.

It goes without saying that if firms are paying millions for this orderflow, one can be absolutely certain that they are making hundreds of times more in revenue on the same Robinhood data.

Yet if Robintrack is a first derivative of Robinhood, which in turn is a derivative of overall retail euphoria in the market, then traffic and search interest in Robintrack is a second derivative, and based on Google searches for Googletrack, the retail euphoria peaked last week, and is finally rolling over.

Remember: Robinhood – and retail daytrading in general – is all about momentum, and it just turned down.

Perhaps the government stimulus money that millions of bored Millennials and teenagers were using to fund their trading accounts h as finally ran out?

Whatever the case, as retail investors realize that upside momentum is suddenly missing – and one look at HTZ stock shows that last week’s upside insanity is long gone – watch as the euphoric scramble ensues in reverse, and all those trading warriors who were buying suddenly turn sellers as even retail investors realize that once the euphoria peak is behind us, those who sells last are the biggest losers.