30% Of Americans Didn’t Make Their Housing Payment In June

Tyler Durden

Mon, 06/22/2020 – 11:22

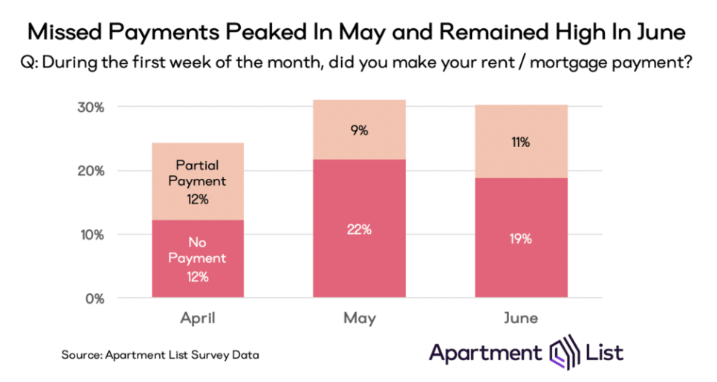

A stunning 30% of Americans didn’t make their housing payment for June – a figure that is likely going to ripple through the housing industry in coming months. According to a new survey by Apartment List, the rate is similar to May and shows that even though other industries are rebounding, the situation has not yet improved meaningfully in housing.

These figures stood at 24% in April and 31% in May, before falling slightly to 30% in June. One third of the 30% in June made a partial payment, while two thirds made no payment at all.

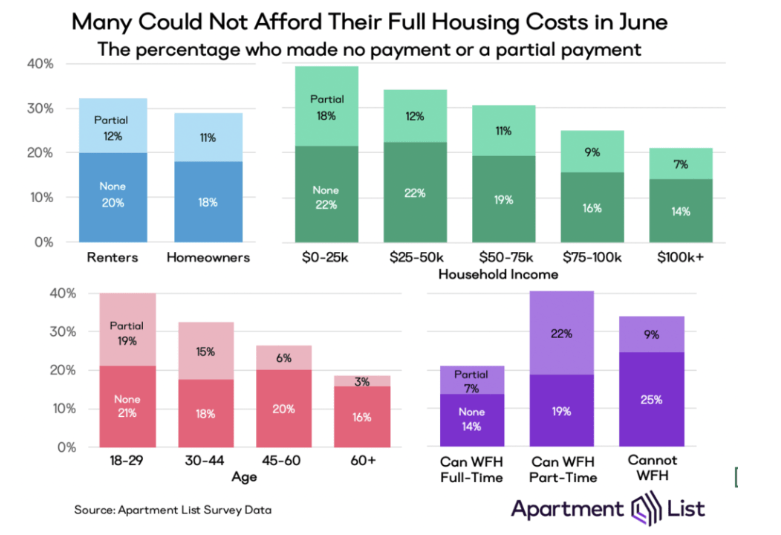

“Missed payment rates are highest for renters (32 percent), households earning less than $25,000 per year (40 percent), adults under the age of 30 (40 percent), and those living in high-density urban areas (35 percent). While the missed payment rate for mortgaged homeowners is just 3 percentage points lower than renters,” the survey showed.

Despite the trend of missing payments at the beginning of the month, households have been able to play catch-up later in the month and “narrow the gap” by making payments in the middle of the month. This was the case in May, where the missed payment rate “dropped from 31 percent at the beginning of the month to 11 percent at the end.”

We’ll see how long people can play catch up.

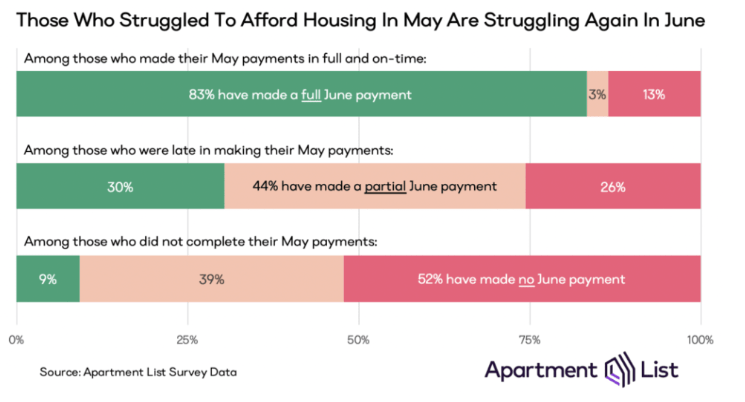

Meanwhile, as the survey notes, delayed payments in one month are a strong indicator for coming months. 83% of those who paid on time in May did so in June. Meanwhile, only 30% of those who were late in May have made their payment in full for June.

This means the data for the beginning of July is likely to be just as ugly as June.

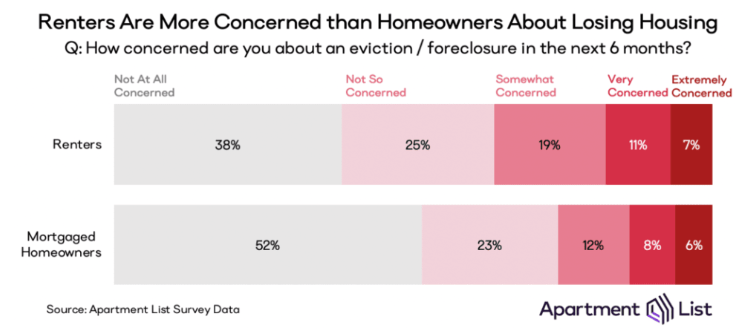

And, rightfully so, there continues to be concern over eviction notices in the coming months. The survey found that: “over one-third of renters are at least ‘somewhat concerned’ that they will be served an eviction notice in the coming six months.”

The number rises to 56% when polled just among those who have not yet paid their full rent for June.

Recall, just days ago we wrote that Americans had already skipped payments on more than 100 million loans while, at the same time, job losses continue to accelerate.

“The number of Americans that filed new claims for unemployment benefits last week was much higher than expected,” we noted.

To put this in perspective, let me once again remind my readers that prior to this year the all-time record for a single week was just 695,000. So even though more than 44 million Americans had already filed initial claims for unemployment benefits before this latest report, there were still enough new people losing jobs to more than double that old record from 1982.

That is just astounding. We were told that the economy would be regaining huge amounts of jobs by now, but instead job losses remain at a catastrophic level that is unlike anything that we have ever seen before in all of U.S. history.