JPMorgan Warns Of $170 Billion In Forced Month-End Selling

Tyler Durden

Mon, 06/22/2020 – 10:31

Last week, when previewing Friday’s massive, $1.8 trillion quad witching Op-Ex, which culminated a material swing lower in stocks if without any major fireworks, we also observed that according to Goldman, as of last Tuesday’s close, there was a net $76bn of equities to sell as pension funds rebalance for quarter end; this would be the third largest estimate on record, only behind Mar 2020 and Dec 2018, both of which happened to be extremely volatile periods.

In retrospect, Goldman may have been conservative because when adding all the other possible sources of month- and quarter-end forced rebalancing, the total amount “for sale” soars to an unprecedented $170 billion according to calculations by JPMorgan.

In the latest Flows and Liquidity report from JPM’s Nikolas Panagirtzoglou, writes that after correctly pointing out at the market lows on March 23 that there is a massive $1.1 trillion in rebalancing flow into equities, all of that has since been balanced out and three months later, we are looking at a substantial outflow of about $170BN before month end, resulting in a “small correction.”

To reach his ominous conclusion, Panagirtzoglou looks at the five main entities that have either fixed allocation targets or tend to exhibit strong mean reversion in their asset allocation. These are:

- balanced mutual funds such as 60:40 funds,

- US defined benefit pension plans,

- Norges Bank, i.e. the Norwegian sovereign wealth fund,

- the hedge fund formerly known as the SNB

- and the Japanese government pension plan GPIF

Here are some more details on each of these rebalancing vehicles:

- Balanced mutual funds including 60:40 funds, a $6.9tr AUM universe globally at the end of 2019 but closer to $5tr at the equity market low on March 23rd, had according to JPMorgan around $460bn of pending equity buying as of March 23rd. Given the tendency of these funds to rebalance relatively quickly on a monthly basis, 2/3rds of that rebalancing flow was done by the end of March and by the end of April these funds were close to be fully rebalanced. For both the end of April and the end of May JPM estimated modest negative rebalancing flows of -$25bn and -$60bn respectively. By taking into account the MTD performance of global equities and bonds, the bank estimates that around -$70bn of negative equity rebalancing flow by balanced mutual funds globally into the current month end.

- US defined benefit pension plans, with $7.5tr AUM at the end of last year but below $6tr at the equity market low on March 23rd, had, on around $500bn of pending equity buying as of March 23rd. Given the tendency of these pension funds to rebalance more slowly over 1-2 quarters or so, a quarter of that rebalancing flow was done by the end of March and then largely concluded by the end of May. Fast forwarding to June 30, the bank estimates that the pending equity rebalancing flow by US defined benefit pension funds into the current quarter end is likely modestly negative at around -$65bn, or roughly in line with Goldman’s estimate noted above.

- Norges Bank, with $1.2tr AUM at the end of last year but closer to $900bn at the equity market low on March 23rd, had, on our estimates, around $63bn of pending equity buying as of March 23rd. Like with Pension funds, JPM calculates that most of the rebalancing has been concluded, and concludes that the pending equity rebalancing flow by Norges Bank into the current quarter end is likely modestly negative at around -$10bn.

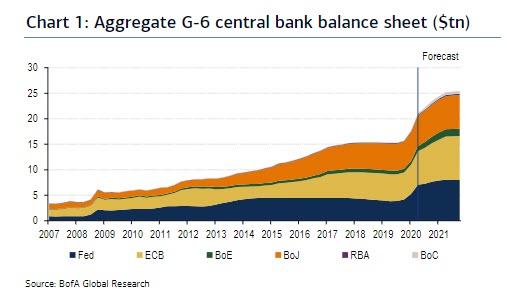

- The SNB also invests a considerable proportion of its foreign currency assets, accumulated over the course of its FX interventions since 2008, in equities, which are laid out in the

central bank’shedge fund’s quarterly 13F reports. For bonds, JPM looks at the SNB’s quarterly fixed income allocations as well as the currency allocation, and approximate the returns of its bond portfolio by using our GBI country indices for 1-10Y maturity buckets in order to better match the SNB’s reported average duration, which was around 4.6 years in its most recent report. Based on the SNB’s reported allocation, the JPM strategist estimates that the SNB bought around $30bn of equities in 1Q20 and sold around $8bn of bonds. Essentially, it appears that much of foreign currency accumulated as it began to intervene more aggressively in March was invested in equities. As a result, for 2Q, the bank assumes that the allocation is unchanged from 1Q, and given the level of reserves up to end-May as well as equity and bond returns over the same period this suggests the SNB may need to sell around $15bn of equities given the recovery from March lows, and buy around $33bn of bonds. - The Japanese government pension plan GPIF, with $1.5tr AUM at the end of last year but closer to $1.2tr at the equity market low on March 23rd, had around $73bn of pending equity buying as of March 23rd, of which about a quarter was completed by March 30. Additionally, JPM believes that the pending rebalancing flow by GPIF had declined to around $30bn by the end of March and to $10bn by the end of April. Assuming half of that rebalancing flow was done by the end of April or so, and by taking into account the global equity and bond performance since then, Panigirtzoglou estiamtes that the pending equity rebalancing flow by GPIF into the current quarter end is likely negative at around – $25bn.

Looking at the continued surge in stocks which however has failed to mirror a similar move in bonds, JPM concludes that “not only has the continuation of the equity market rally into June naturally eroded all of the previously estimated positive equity rebalancing flow, but it has likely created a need for negative rebalancing flow, i.e. equity selling, of around $170bn into the current month/quarter end.” Still, before the bank’s clients who read other JPM strategist – such as Mislav Matejka who just upgraded the US to a buy overnight, freak out and ask why there are so many conflicting messages coming from the same bank, Panigirtzoglou caveats that “this $170bn should be thought of as an upper estimate as it is possible that same of this equity selling was done before quarter end.”

And while the JPM quant acknowledges the risk of a small correction in equity markets over the coming two weeks as a result of this negative equity rebalancing flow, he “continues to believe that we are in a strong bull market in equities and any dip would represent a buying opportunity.”

Because, well… you know.