Default Wave Arrives: Weekly Bankruptcy Filings Suddenly Soar Most In 11 Years

Tyler Durden

Tue, 06/23/2020 – 15:30

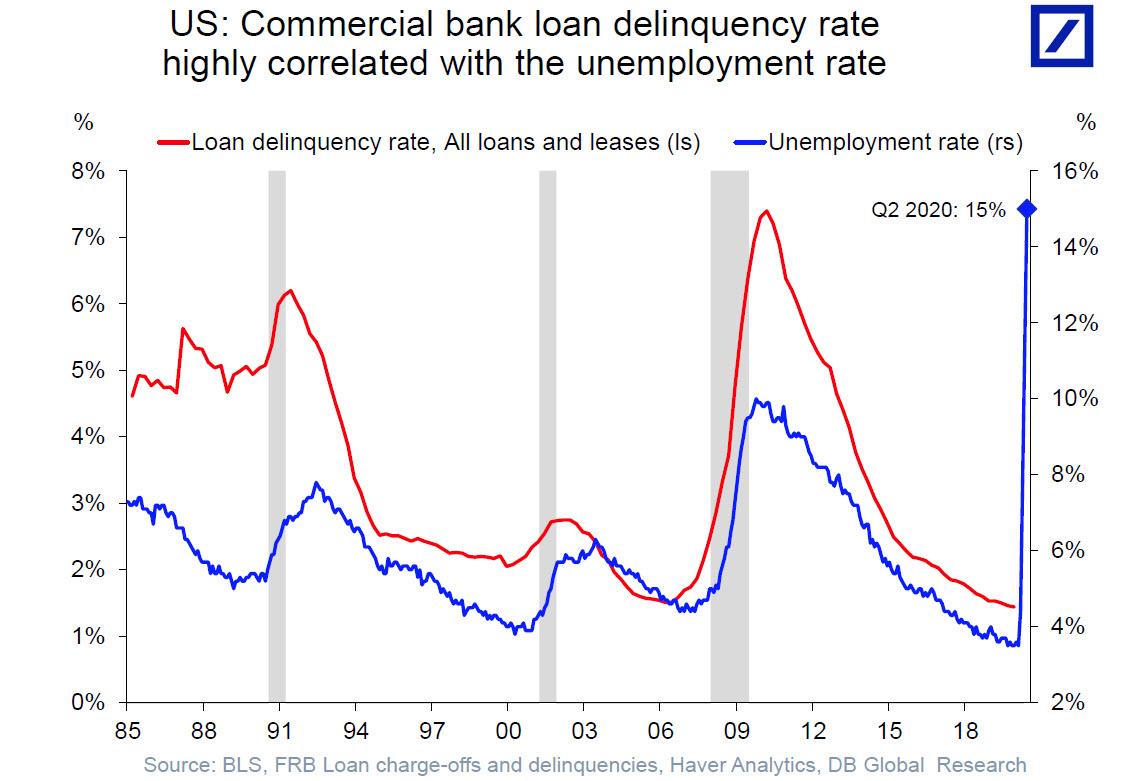

One month ago, when looking at the recent flurry of chapter 11 filings and a striking correlation between the unemployment rate and loan delinquencies, we said that a “biblical” wave of bankruptcies is about to flood the US economy.

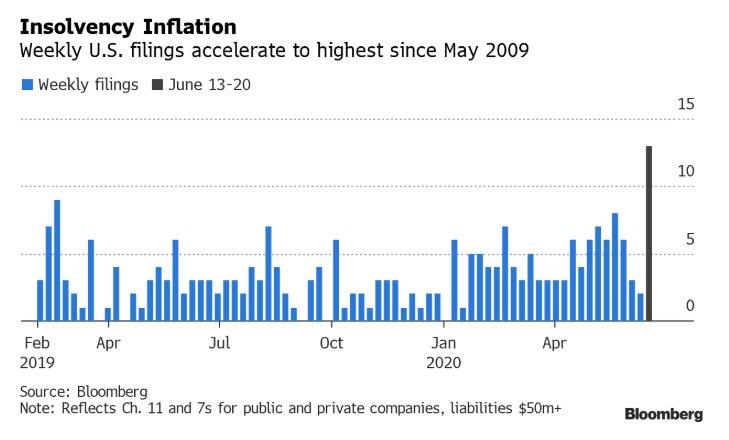

It appears that the wave has now arrived, because according to Bloomberg data, no less than 13 US companies sought bankruptcy protection last week, matching the peak of the global financial crisis. The filings, led by the perennially weak consumer and energy sectors, were the most for any week since May 2009.

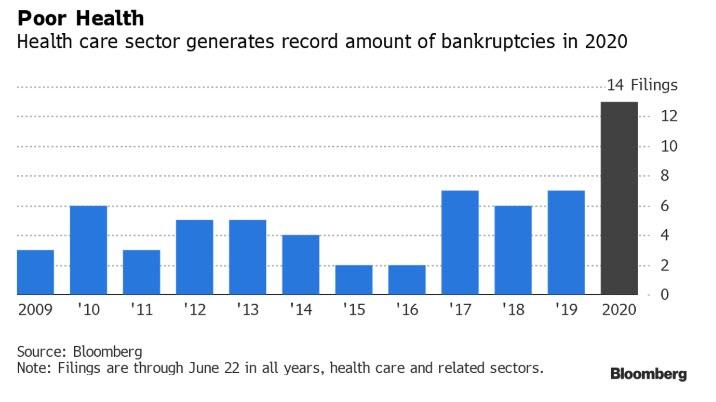

At a time of pervasive service closures, it is not surprpising that there were four consumer non-cyclical filings last week, taking to 28 the sum for 2020. That according to Bloomberg is the most since 2009 and the sector remains under pressure from lockdowns that have crushed demand.

And while energy has been the second-biggest contributor to this year’s bankruptcy surge, there is much more coming here. Chesapeake is preparing for a filing while California Resources got an extension until June 30 to make interest payments originally due May 29. Seadrill is also considering bankruptcy.

A Deloitte analysis has found that almost a third of U.S. shale producers are technically insolvent with crude at $35 a barrel. And while WTI has been trading slightly higher, this does little to prevent 15 years of debt-fueled production growth catching up with many shale producers, Deloitte said in a study. Adding to the pain is the spring redetermination season which resulted in most high-yield borrowers seeing their reserve-based loans. Borrowing bases, which are determined by the collateral value of oil and gas reserves, were cut by an average of 23%, which means that most energy companies now have roughly 25% less access to liquidity.

The following table from Bloomberg shows the biggest issuers who have yet to file and who are currently trading at distressed levels. Note that #2 on the list, American Airlines, is scrambling to raise fresh funds to help get it through the current crisis.

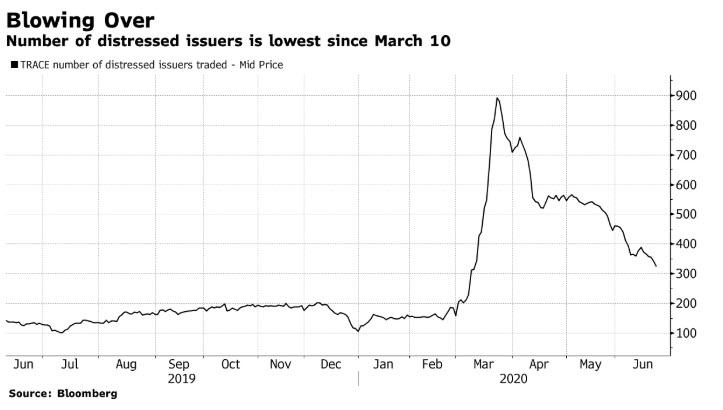

There was some good news: according to Bloomberg the amount of distressed bonds and loans outstanding fell to $344 billion as of June 19, a 1.5% drop since June 15 and down from $544 billion on May 15. The distressed bond universe is shrinking faster than that of leveraged loans, which grew slightly last week. There were a total of 621 distressed bonds from 324 issuers as of June 22, compared with 1,896 issues from 892 companies at the March 23 peak. The emerging market pool is also shrinking.

Why the improvement: it has nothing to do with fundamentals, and everything to do with a wall of liquidity unleashed by the Fed’s intervention: this has lifted credit across the board and given some troubled borrowers new life.

But, ominously, Bloomberg analyst Phil Brendel compares the current rally to the healing of April 2008, which didn’t last, and predicts a resurgence of distressed supply. It culminated with the global financial crisis 6 months later.