Bonds Laugh At Today’s Idiotic Surge In Hertz Stock

Tyler Durden

Wed, 06/24/2020 – 15:45

After trying, and failing, to sell worthless Hertz stock to Gen-Z Robinhood traders, mid-bracket investment bank Jefferies has now become a used car salesman.

In a bizarre – and for now successful – attempt to pump HTZ stock, Jefferies analysts Hamzah Mazari and Bret Jordan wrote this morning that the bankrupt company could sell its roughly 150,000-car inventory and somehow pocket $3 billion in proceeds (roughly $20K per used car) as it looks to stay afloat after filing for bankruptcy.

According to the Mazari and Jordan, who probably did not know that one of their roles as a “research analyst” would be to moonlight as the world’s biggest used car salesmen, “channel checks” suggest used-car firms like CarMax and AutoNation could be among the firms looking to purchase used Hertz vehicles amid rise in demand for used cars. The very hypothetical move could, in theory, help ease some pressure for Hertz, as a sale of its used-car fleet would shore up some cash concerns and could fetch about $3 billion, the analysts said.

“Given what appears to be robust demand for inventory in a rapidly recovering used retail market, we see ~150k HTZ cars as an attractive option for retailers such as AN and KMX with strategic focus on expanding used volumes,” Mazari said.

“The most logical step would be to buy the fleet of cars which are available at a good price and shape … that’s where the value lies,” the Jefferies used car salesman noted, adding that the sale of cars – taking place at rather overinflated values – would help HTZ pay its lenders but also shore up some cash. As a reminder, in 2019, HTZ operated peak rental fleet in 567,600 vehicles in the U.S. and 204,000 vehicles in international locations.

The report did not address two very salient questions:1) why would anyone buy the cars for more than their book value on the HTZ balance sheet, and 2) how is any of this not already priced into the bonds which are still expected to be impaired by more than 70%, meaning that the stock is still a clear and total zero.

Unfortunately, those were not questions that any of the rabid Robinhood traders that had bid up the stock three weeks ago as high as $6 were asking, and as a result HTZ shares soared following the report like clockwork, at one point surging as much as 100%…

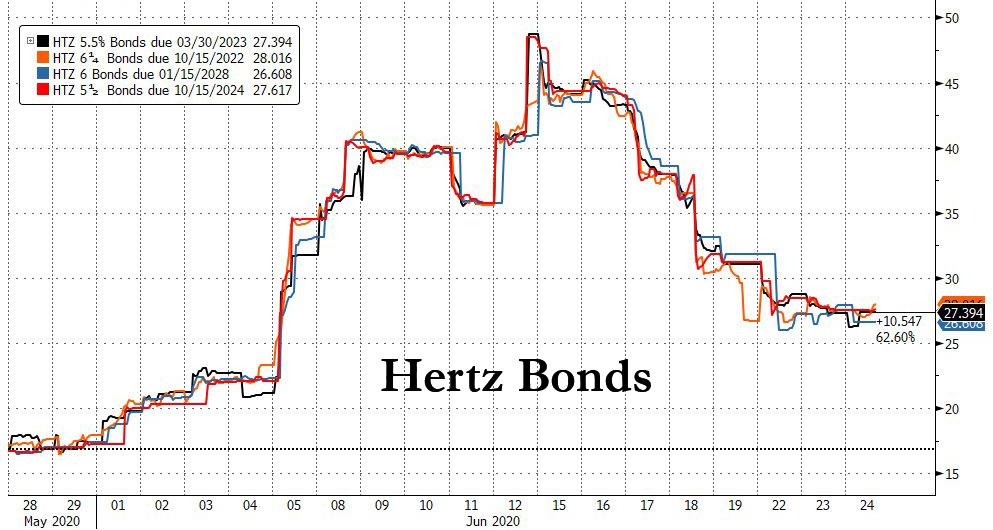

… even as bonds continued to laugh at the stupidity of retail investors who were merely doing a favor to institutional Jefferies clients who had bought up the stock in recent weeks in hopes the Initial Bankruptcy Offering would take place, and now needed to catalyst to sell at higher prices.

And yes, the fact that bonds did not even budge today confirms that HTZ stock remains a total loss, no matter what some used car salesman on Wall Street thinks.