This Week’s Market Malaise Was Entirely Predictable… But Should You Buy This Dip?

Tyler Durden

Thu, 06/25/2020 – 11:10

As June started, Nomura’s Charlie McElligott warned of the Option-expiration line in the sand this month that could ruin (albeit briefly) the V-shaped recovery narrative in stocks:

“It is then VERY IMPORTANT to turn our attention back to the sequencing of the month – particularly as there might then be “two trades” based around the first two weeks of June being the “historically risk / equities bullish” trade up into Serial / Quarterly June Options Expiration, vs the last two weeks of June being more “defensively” postured.”

Given this week’s post-op-ex plunge, it would appear the cross-asset strategist nailed it.

However, the question is – what happens next?

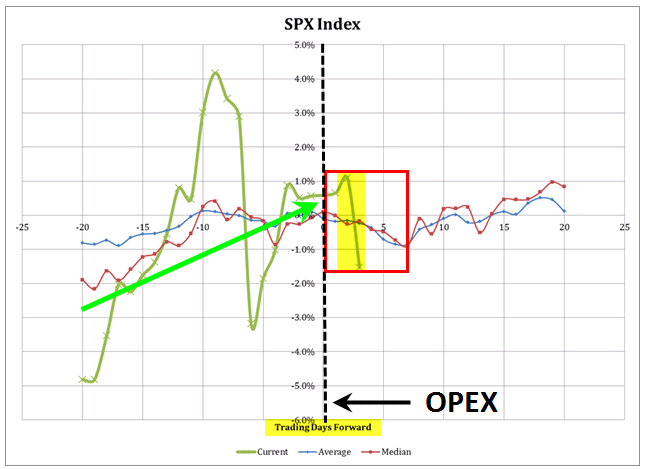

The last three weeks are exactly how it was supposed to look all along – the “trade up into-, trade down out of-“ the June serial options expiration phenomenon finally kicking-in.

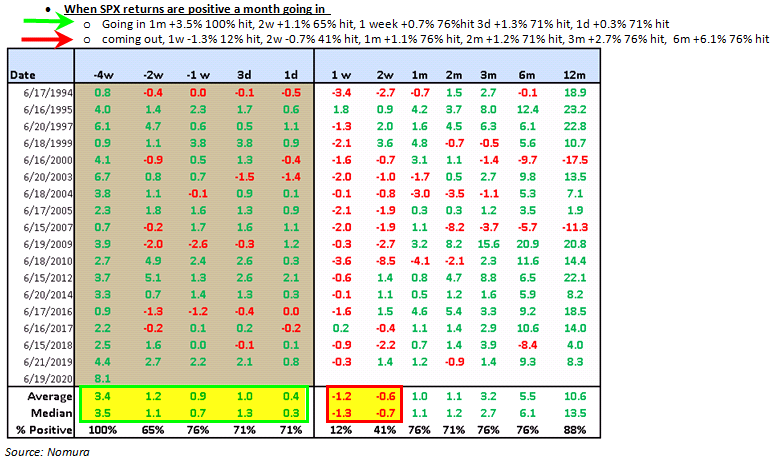

As history shows, the more robust the trade “UP” was into June Op-Ex, the larger the down-trade thereafter (from 1993):

While this week’s weakness has been pinned on second-wave COVID concerns, McEllligott notes some more technical factors that are more likely to the drivers:

The gamma “unclenching” (after last Friday’s large quarterly expiration options de-risking) would allow for a broader distribution of trading outcomes this week due to reduced Dealer hedging flows which had been suppressing the range, in conjunction with overwriter call “rolling” flows abating, the corp “buyback blackout” commencement and qtr-end pension rebalancing out of stocks into bonds all conspiring to send index lower… just as the seasonal phenomenon has conditioned us to expect in the back-part of June, which already sees a period of “Defensives over Cyclicals” leadership.

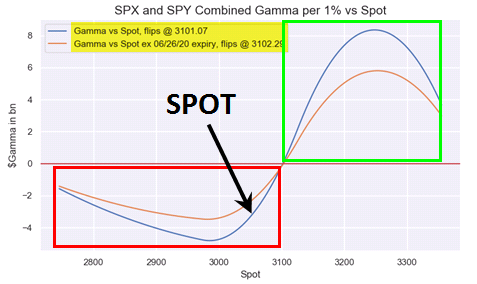

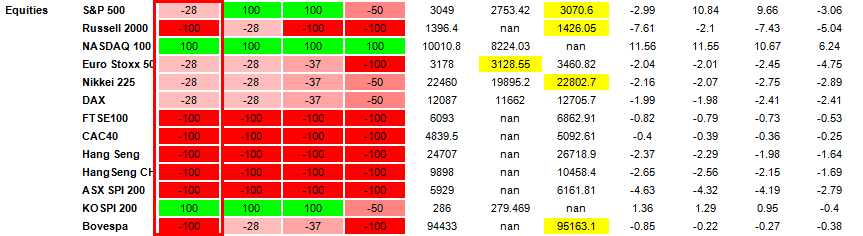

The aforementioned catalysts then grew particularly interesting due to the anticipated clustering this week of 1) the Dealer “gamma flip” level (from “long” to “short”) around the same 3050-3080 approximate location over the course of the week where too we expected 2) CTA deleveraging in the legacy S&P futures “+100% Long” signal, which triggered on the close below 3053 yesterday and was likely a large part of the flow on the trade down to 3005 overnight (the S&P signal is now “-28% Short” FWIW), both of which would act as “accelerant” flows on a move lower.

Dealers are now even more incrementally deeper “Short Gamma”:

And now, here we are in the June Op-Ex day-count analog:

And so, as McElligott notes, here’s the good news for longs:

Due to the ferocity of this down-trade (-4.5% from Tuesday high to the overnight low), we have already achieved DOUBLE the median downside trade typically experienced for the 2w window post Op-Ex

As such, the Nomura MD suggests (going back to the second chart above), we can see that the 1m-, 2m-, 3m-, 6m- and 12m- out median returns turn incrementally bullish again – and also come with very high “hit rates,” higher 76%, 71%, 76%, 76% and 88% of the time, respectively. Additionally, McElligott points out that he expects the TVIX delisting (and its recent ~85m of Vega) to lean on front VIX futures over the ~1m, especially as its not certain that this exposure will go 1:1 back into other remaining VIX ETN products, as it is almost exclusively a retail spec trading vehicle and not a “holding”.

And so, at this point, McElligott thinks the next trade sets up pretty bullishly for the next 1-2m, with potential for a “stocks up, USTs down / yields up” trade – especially as clients have continued to voice a desire to “buy the dip” into negative earnings revisions (a +++ for fwd S&P returns), and too with the recently highlight mentions of ongoing re-allocation into Equities exposure from the Vol Control universe (which likely then too could look like Variable Annuity “sell” flows out of USTs)…

…and all with a fresh CTA “Equities Short” base as fodder for a squeeze higher into any additional macro relief after this latest “wave 2” swoon (perhaps as investors grow numb to “case growth” and instead theoretically see hospitalization rates remain low).

Here’s Charlie explaining the way forward on CNBC this morning:

Nomura’s McElligott breaks down a technical analysis of market volatility from CNBC.