Gold Smashes Above $1800 For First Time Since 2011

Tyler Durden

Tue, 06/30/2020 – 10:59

Just a day after the counterfeit China gold bar story hit the market, precious metals are bid this morning with Gold futures surging above $1800 for the first time since Nov 2011…

Breaking above May’s highs…

We asked yesterday – What happens next: a panicked scramble to procure physical gold, one which even our friends at the BIS will be powerless to stop from sending the price of the precious metal to all time highs.

It appears that has begun…

Silver also soared back above $18…

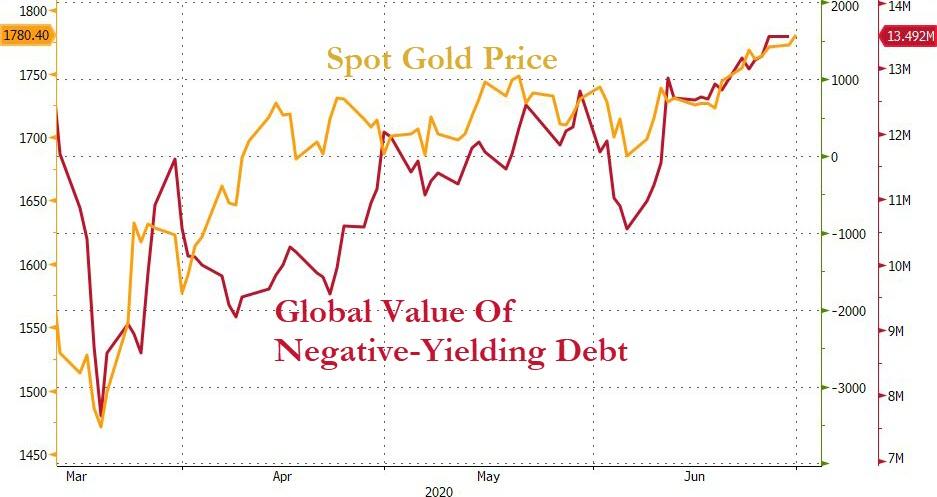

Gold is tracking higher along with global negative-yielding debt…

This move comes, as SchiffGold.com notes, as Citibank has joined other mainstream gold bulls calling for record gold prices.

Citi raised its gold price forecast this week. It now projects a three-month price of $1,825 per ounce and for the yellow metal to head into record territory in 2021. Citi analysts expect gold to eclipse the $2,000 mark early next year.

Citibank joins several other mainstream players that now project record gold prices in the coming months. Last week, we reported Goldman Sachs now forecasts record gold prices within the next 12 months and Bank of America released a note saying gold could break its US dollar record by the end of the year if it continues to breach key resistance levels.

Meanwhile, SGMC Capital Founder & CEO Massimiliano Bondurri told Bloomberg he thinks gold may hit close to $2,000 by the end of this year and could rally further due to dollar weakness.

It can rally much, much further than here, for a number of reasons. First of all, we expect dollar depreciation to continue, so that’s likely to benefit gold.”

And Edison Investment Research is even more bullish, saying gold has the potential to go as high as $3,000.

Gold has been on a strong run over the last couple of weeks as the number of coronavirus cases has surged. Bullion is up better than 12% in this quarter.

Safe-haven demand has given gold a boost, but the big driver is the Federal Reserve and its unprecedented money printing. As US Global CEO Frank Holmes recently pointed out, there is a strong correlation between the expansion of the central bank’s balance sheet and the price of gold. We’ve already seen the balance sheet balloon by over $3 trillion in response to the coronavirus pandemic and it currently stands at over $7 trillion. Holmes said he thinks the central bank will likely grow its balance sheet to $10 trillion before all is said and done. If history is any teacher, that could mean $4,000 gold.

Edison director Charles Gibson also emphasized the correlation between the Fed balance sheet and the price of gold.

The reason this is significant is because, since 1967, the price of gold has shown an extremely strong (0.909) correlation with the total US monetary base. Gibson. The more dollars that either are, or could be, in circulation, the higher the expected gold price.”

Along with bullishness for gold, we’re starting to see some mainstream concern about dollar debasement – something Peter Schiff has been talking about for years. In its note, Goldman Sachs cited “continued debasement concerns” and a weaker dollar as two of the factors it sees driving gold higher.

Yale economist Stephen Roach’s recently warned that “the era of the US dollar’s ‘exorbitant privilege’ as the world’s primary reserve currency is coming to an end.” Meanwhile, Guggenheim Investments Chief Investment Officer Scott Minerd said that while “there are no signs the world is questioning the value of the US dollar” right now, it’s clear that the greenback is “slowly losing market share as the world’s reserve currency.”

And he said buying gold is the key to offsetting the dollar’s decline.

With the Fed going all-in on financing the government deficit, the US dollar could be at risk to negative speculation of its status as the dominant global reserve currency. Investing in gold may help offset this trend.”

Is the world losing faith in fiat?