The Fed Is Now A Top 5 Holder Of The Biggest Corporate Bond ETFs

Tyler Durden

Tue, 06/30/2020 – 15:22

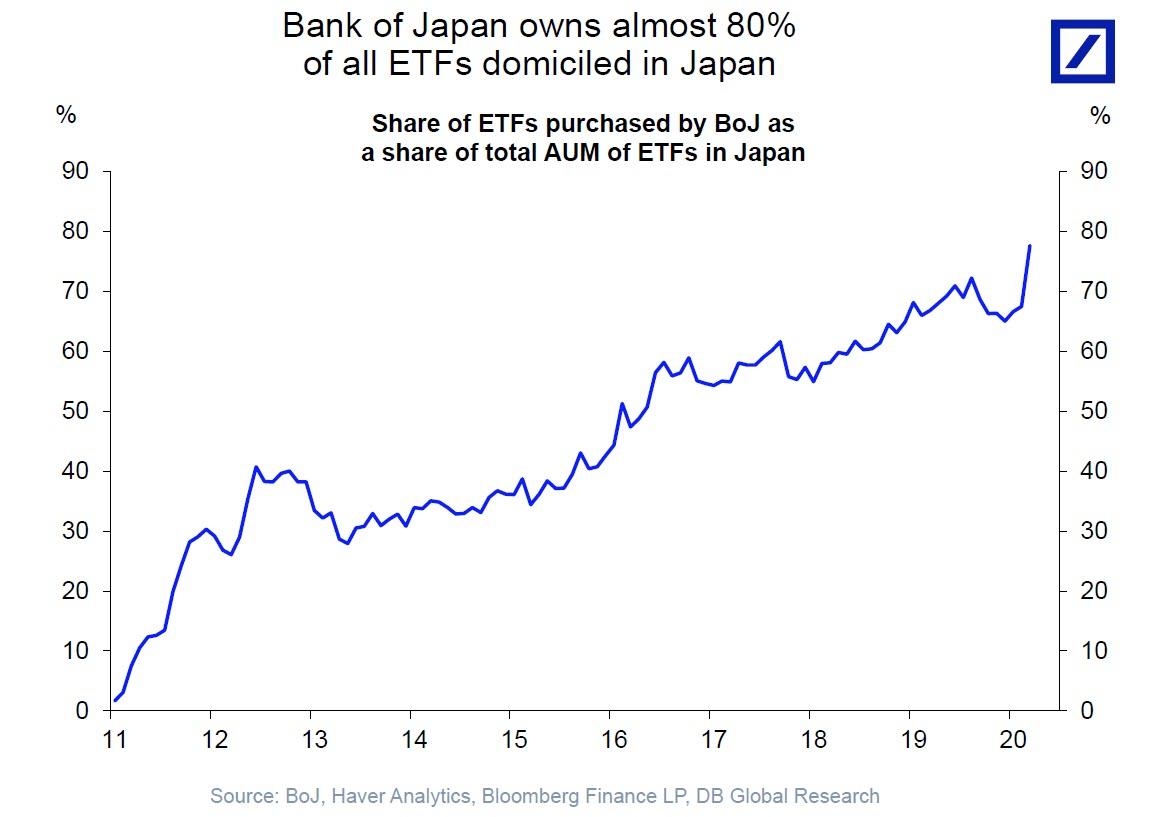

For much of the past decade, the Bank of Japan – which owns about 80% of all ETFs in Japan…

… was the butt of capital markets jokes, or rather jokes involving central planning, of which the Japanese central bank had become the “new normal” poster child. Alas, the joke is now on the US, where Jerome Powell is now boldly going where Haru Kuroda has gone so many times before, and bought anything that is not nailed down. Of course, for now the Fed is “only” buying corporate bond ETFs (while waiting for the next crash before buying stock ETFs), but even here its footprint is already massive.

While the Fed’s own disclosure of which ETFs it owns is minimal on its own H.4.1 weekly filing, Bloomberg has been kind enough to compile the Fed’s bond ETF holdings. What it has found is the following: the Fed now owns $6.8 billion market value in corporate bond ETF, of which LQD, VCSH, VCIT, and IGSB are the top holdings. In total, the Fed now has a stake in no less than 16 ETFs (that Bloomberg is aware of).

What is more striking, however, is that drilling into these holdings reveals that as of this moment, the Fed is a Top 5 holder in some of the biggest bond ETFs, including the biggest Investment Grade ETF, the LQD, where the Fed is now the 3rd laragest holder…

… the VCSH, the Vanguard Short-Term Bond ETFs, where the Fed is the 2nd biggest holder…

… the VCIT, the Vanguard Intermediate-Term Corporate Bond ETF, where the Fed is the 5th biggest holder…

… but it’s not just investment grade ETFs: indeed, as of this moment, the Fed is also the 5th biggest holder of the JNK junk bond ETF…

… and is the 21st biggest holder of the other junk bond ETF, the HYG. Don’t worry it won’t be there for long.

The good news: while the Fed has now effectively taken over the corporate bond market, it still has to buy equity ETFs. The bad news: we are just one 20% drop in the S&P away from the Federal Reserve taking over all asset prices markets and ending all markets and price discovery… at least until the Fed is finally destroyed.