On Tesla Believers…

Tyler Durden

Thu, 07/02/2020 – 09:50

Authored by Bill Blain via MorningPorridge.com,

“What’s wrong with a horse?”

I was going to be writing a promised “Reasons to be fearful” note this morning on sectors likely to struggle most the consequences of Coronavirus: Banking, Finance, Aerospace and Tourism… but.. they will still be there tomorrow. (Or not, as the case may be for struggling hospitality businesses sunk by second lockdowns.)

Instead, I’m going to focus on the story of the day – Tesla has become the most valuable automaker on the planet. (Also – quick note on the implications of the demise of UK shirt-maker TM Lewin.)

Before I start, pass the salt cellar please..

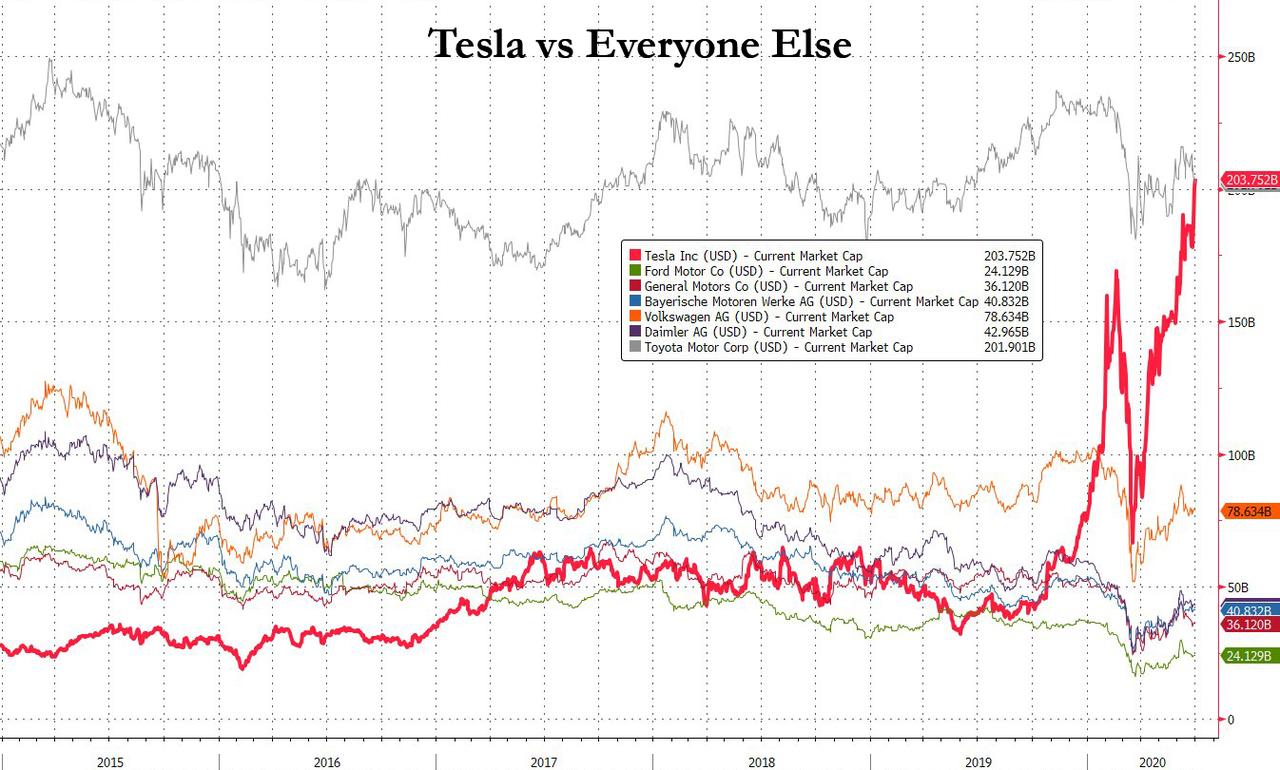

Yesterday Tesla’s market capitalisation topped $208 bln, overhauling Toyota which is worth a mere $203 bln… depending on how you measure it.

I resisted the temptation to buy Tesla. My mistake. My bad. I am cursed by a strictly Vulcan approach to stock investment – logic over hype. It hasn’t helped me this time. By not buying Tesla I’ve missed out on a massive rally. (Well, not completely… there are these 6 Tesla shares I accidently own. Who knows.. some-day perhaps they will save my pension pot?)

I am not going to try and tell the market it’s stupid and wrong in its adoration for Tesla. That would be foolish thing to try to do. You can’t argue with the Tesla fan-boys. They are just so much smarter and cleverer than folk like us.

I will even admit to liking Tesla cars. They pack a surprising grunt and are pleasant enough… And I am quite sure they will find a solution to the minor inconvenience of having to plug them into the wall for 3 hours out of every 5 you want to drive them.

The fans understand the value of Tesla is embedded in the invention and ownership of the new EV market its messianic founder has singlehandedly and gloriously created.

I am not going to dwell on the usual arguments about how Tesla has never actually made an annual profit. Anyone who knows anything about Tesla will know making a profit is just a distraction. The company is far too busy creating value by reinventing the automobile. (Which is why it is able to charge customers $8k for a Fully Automated Driving system, that isn’t actually available yet. Elson Musk says the system will be worth $100k in years to come. So buy it now. He’s a genius you know…)

The Tesla believers who’ve seen through the straight-jacket of conventional market wisdom have ridden Tesla 500% higher from $185 to $1121 over the last 13 months. They aren’t concerned about the past. They see the glorious future ahead.

They are very happy with the trend. Over the last 12 months (Mar 2019-Mar 2020), Tesla posted its first profitable three quarters in a row, making a staggering £144 million in profit. (It doesn’t actually matter that Tesla has only had 7 profitable quarters over its 40 quarter life.) The fact its lost money every single year is irrelevant history. For the record – in CY 2019 Tesla made a loss of $862 million.

Over the past 10 years, Tesla has been able to tell such a strong story that it’s successfully been able to raise over $20 billion plus of billion in Equity from some of the smartest investors on Earth! It’s also persuaded the bond market to finance over $8.3 bln of debt outstanding (as of March 2020). At the same time it had $8.1 bln of cash sitting in bank…

Do not concern with yourself with the simple maths (or math for American readers). Tesla’s cumulative losses over the past 10-years effectively exceed all that equity and debt that markets have given it. In return its left with its current small profit, cash in the bank, its assets and the brand…

What’s to worry about when the brand’s Market Cap is $208 bln? And that it’s now the most valuable and number one car maker on the planet.

Respect.

Nor do we need to focus on story behind this week’s share spike. Anyone who suggests Tesla CEO Musk has been spoofing the market via a leaked staff email about upcoming Q2 profits simply doesn’t understand his genius. (To be fair; his record on tweeting, his “issues” with the SEC and the fact he’s struggling to find indemnity insurance for him or his board of Musk-bots, are completely irrelevant to the firm’s success. Absolutely.)

In the next few day, Musk expects/hopes/has-already-said, to announce his firm will make its 4th consecutive quarterly profit by making around 25% gross margin on the 367,000 cars its sells (2019 production number.) If it happens, Tesla will make the S&P 500 – which will boost the price again.

Runner up the valuable global Car Maker stakes is the venerable Toyota. It also makes around 25% margin on the 10 million plus autos it sells every year after year after year. It’s worth slightly less that Tesla. It trades on a P/E ratio around 15%. To be fair, it’s best-selling model is the dull, predictable and very boring Corolla, which sells 1 million plus units a year, year in, year out, or a very healthy margin.

Tesla trades on its PE somewhere north of infinity (above 200 – numbers are meaningless.) It’s a la-la number which doesn’t matter. Tesla is clearly worth as much because…

Well why?

The Tesla fan boys – and they are an obsessive set – love it because they believe Musk has invented, innovated and now dominates a whole new massively valuable global market which is reflected in the stock price.

Tesla is the Electric Vehicle Market.

It has no rival! It owns the future of personal transport. It is run by the smartest, cleverest, most visionary engineering genius who is the dearly-beloved leader of the company state he represents and leads..

Which basically sums up Tesla as hype and a cult.

Telsa no more owns the EV market than I’m the only financial commentator worth reading (although, like Elon Musk, I believe I am…)

Let’s not waste time on Musk’s personality, his run-ins with authority, his abuse of the British cave diver who oversaw the rescue of trapped Thai kids, or his dominance over Tesla’s board. These all suggest a serious corporate governance issue at Tesla – my investment logic puts that down as a massive black mark against the firm. It’s clearly not a view everyone shares.

The cars are good. It is going to make profits going forward. It is going to increase production. The problem with Tesla is its first mover advantage, and is it building the cars folk will want to buy?

What is fact is that Tesla spotted and innovated the opportunity in Electric Vehicles. The timing was exquisite – catching a renewed green wave and the shift to a belief that tech solutions can solve everything. What Tesla did was very clever and innovative – identified a niche, dominated the niche and is making the niche mainstream.

But they have not created a revolution in personal transport. They took a car (automobile to our American chums), stripped out the gas tank and replaced it with about 5,000 AA batteries which it links in series to power the car for a far as it will go.. and then you wait while it recharges.

The first problem with the batteries is their weight – which is why they are stuffed on the floor of the cars. The second thing they did was put in very efficient electric engines. Batteries and electric engines are not new. Lithium batteries are 50 plus years old and mature tech.

Every other car market on the planet is now playing catch-up, but the smart ones are looking at the science for a better way of creating a true EV paradigm shift.

There are many alternatives to Telsa’s approach. All you need to do is look at the science to figure cars that run on lithium batteries might be the easiest to innovate, but they aren’t necessarily the best, and aren’t even close to a Green Environmental solution.

All the electricity Tesla crams into its batteries comes from.. same sources as all the other electricity comes from – some renewables, maybe nuclear, but mostly gas, a fossil fuel.

The batteries are made of lithium, a scarce and difficult to obtain metal dug out the ground in appalling conditions. Lithium batteries work by a chemical reaction each time the charge and discharge, which means they deteriorate each time they are used and eventually have to be replaced. They are very difficult to recycle, and deadly if they leak into the groundwater. And they can spontaneously ignite.

Other technologies exist. Hydrogen fuel cells are one – but hydrogen is (currently) expensive to make, difficult to transport, and, as the Hindenburg demonstrated.. somewhat explosively combustible. If these issues can be addressed then Hydrogen could be an excellent cleaner and more efficient solution for powering personal transportation. Toyota is the current leader in hydrogen tech.

Battery technology is evolving. There are alternatives to lithium in sight. New Carbon Ion batteries hold the promise of clean production, easy to recycle and infinite charging cycles, plus the advantage of being able to fully charge in minutes rather than hours. (Telsa has actually bought one of the leading firms in this area, but we aren’t seeing any sign that Musk would want to make his giga-factory joint- ventures obsolete overnight.)

Supercapacitors – which can capture and store car breaking power, effectively an onboard renewable power source – offer a new take on the hybrid. Toyota created the whole non-gas buzz that led to Tesla when it introduced the Prius hybrid many years ago. Part electric and part petrol/gas driven it was a moderately successful technology. Evolved supercapacitors can make it vastly more efficient as a car propulsion system. Eventually we could get to hybrids of supercapacitors and new carbon batteries.

Tesla’s current cars and the “truck” are all basically conventional vehicles with batteries on the floor. In the future new technologies could see the structure of the car become the battery or supercapacitor – allowing massive leaps in design towards new efficiencies. Telsa has no lead in these new tech alternatives. It may have been first mover, but that doesn’t mean it’s the end winner.

Take a look at aviation. You won’t see the Wright Brothers Aircraft Company anywhere today. Tommy Swopwith funded his attempts to win the America’s Cup on the back of the success of the WW1 fighters. Neither company name is anywhere today.

We ‘celebrate’ Tesla for being the most valuable car maker on the planet today. Where will it be tomorrow and the day after that… ?