Big-Tech Wrecks Short-Shorts In Another Melt-Up, Bonds Shrug

Tyler Durden

Mon, 07/06/2020 – 16:01

A weekend full of scaremongering headlines about soaring COVID cases (though oddly very little mention of the plunge in deaths)…

Source: Bloomberg

Combined with mass shootings across many American cities, didn’t damped the enthusiasm for buying stocks, bigger the better, and more expensive the best… but as the chart below shows, bonds weren’t buying it…

Source: Bloomberg

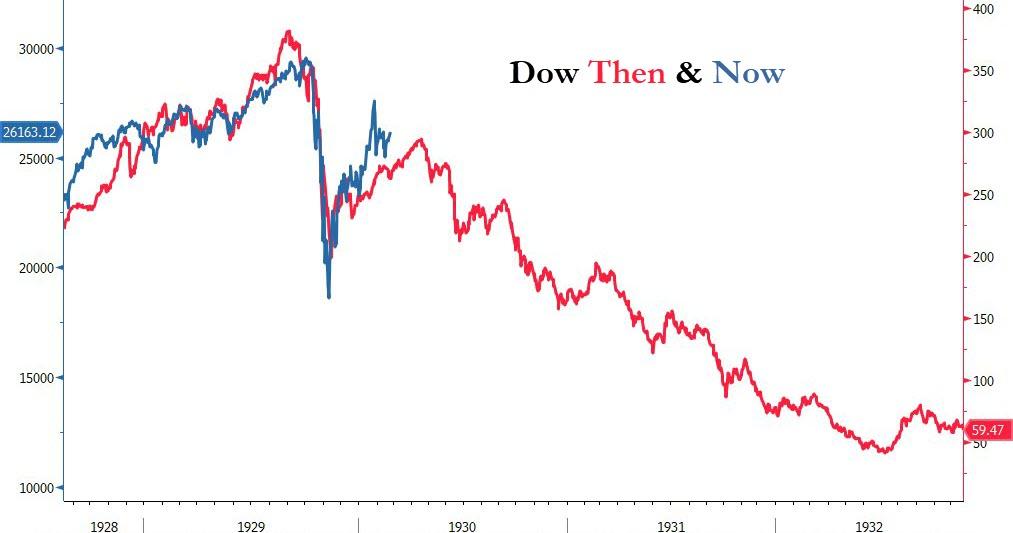

An oldie but a goodie…

This followed an explosion higher in Chinese stocks (as outflows soared) on officials jawboning retail to invest in stocks… Yes, that is Chinese mega caps up 7% on the day!!

Source: Bloomberg

The S&P up 5 days in a row – the longest streak since Dec 2019… Nasdaq hit a new record high, surging over 2% from Thursday’s close…

Stocks soared in the last few minutes – as they have tended to do recently – pushing The Dow back above its 200DMA…

The market also shrugged off the following headline…

- *FAUCI SAYS ASSUME ANY VACCINE WILL OFFER `FINITE’ PROTECTION

But that wasn’t going to stop the short-shorts getting crushed…

Source: Bloomberg

MAGA stocks soared, with all now back above $1 trillion market cap again…

Source: Bloomberg

AMZN >$3000

TSLA >$1300

Tech valuations are absurd again…

Source: Bloomberg

And then there’s Consumer Discretionary stocks’ valuations…

Source: Bloomberg

Everything was squeezed at the open but defensive were sold back to unchanged as cyclicals held gains…

Source: Bloomberg

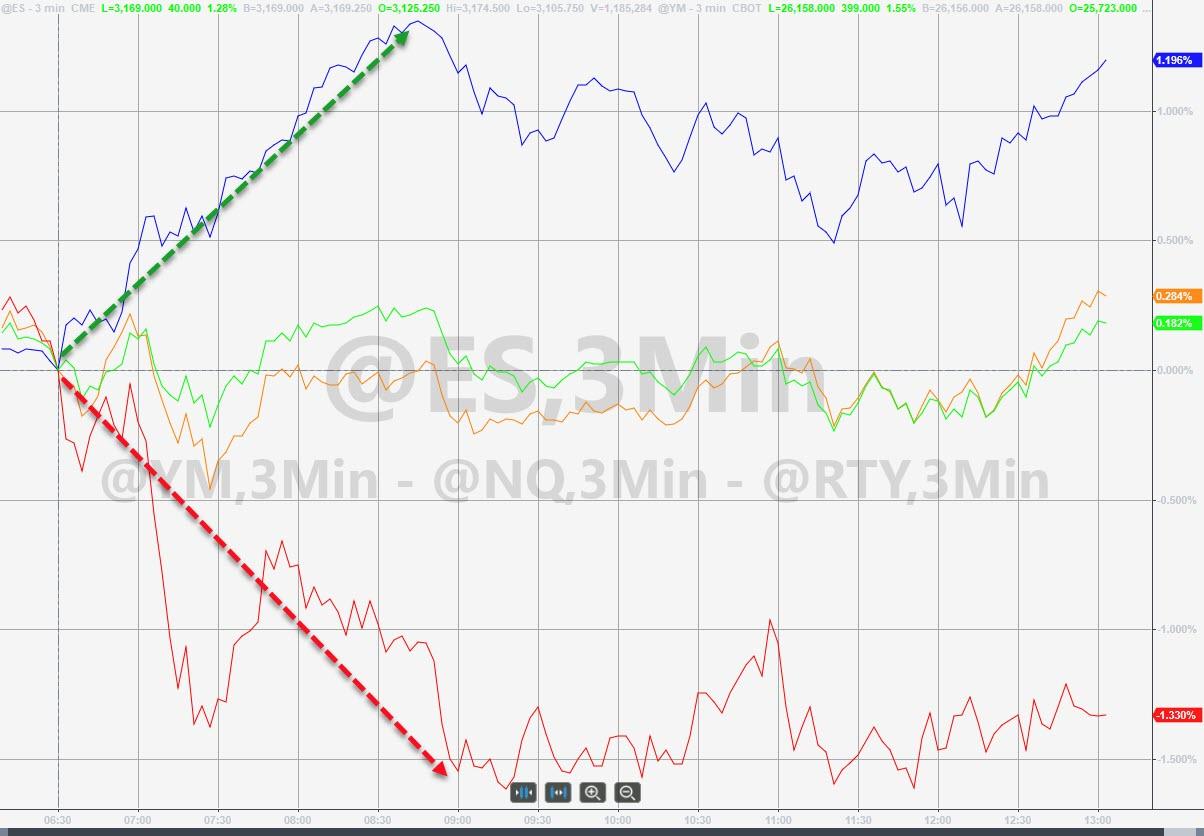

Just for some context, from the US Cash open, things diverged quite notably today with Nasdaq panic bid, Small Caps dumped and S&P and Dow flat…

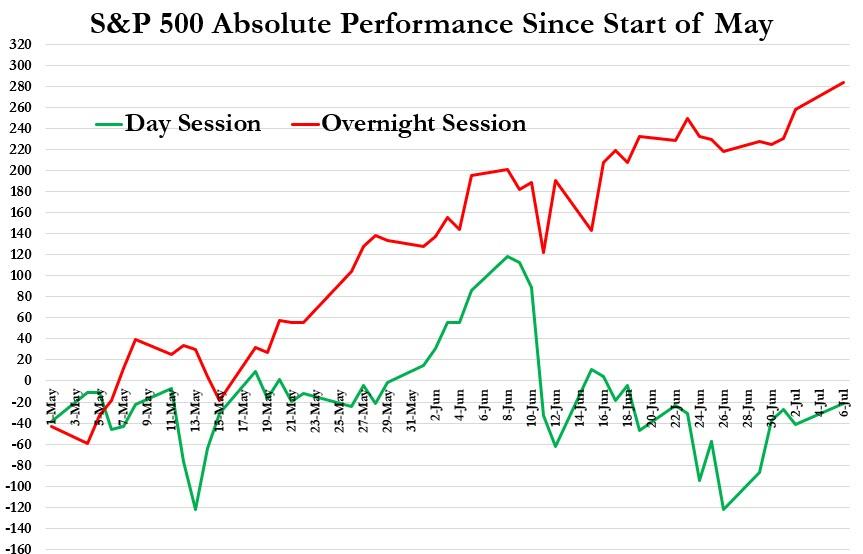

And what that has meant since the start of May – S&P +284pts during overnight session, -22pts during day session…

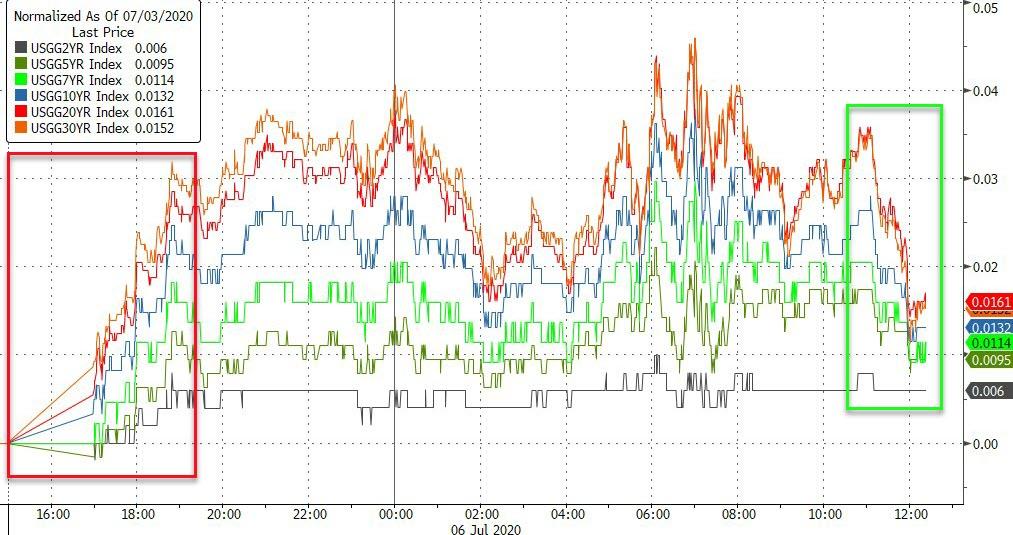

Treasury yields were around 1bps higher across the curve on the day…

Source: Bloomberg

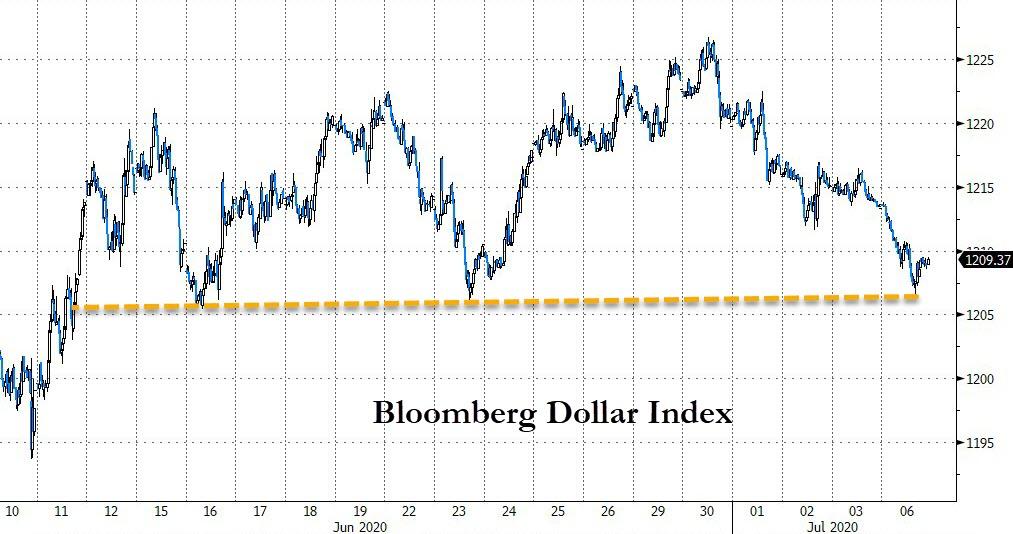

The dollar slipped lower once again…finding support…

Source: Bloomberg

Cryptos surged higher in the last 24 hours…

Source: Bloomberg

Silver outperformed among the major commodities with WTI flat…

Source: Bloomberg

Gold futures tried (but failed) to regain $1800…

Source: Bloomberg

Finally, this is probably nothing…

Source: Bloomberg