Demographics, Debt, & Disappointment – The Japanifation Of America’s Economy

Tyler Durden

Mon, 07/13/2020 – 19:45

Authored by Chris Hamilton via Econimica blog,

I’m not an economist nor a Wall Street analyst. I get paid nothing to write this, have nothing to sell, make no buy recommendations, and leave it up to the reader to determine what it all means. Today, just some comparisons of the Japanese and American demographic driven zero interest rate policy kickoffs, resulting in debt explosions, ongoing collapses in births, and declining energy consumption…yet (thus far) resulting in divergent asset depreciation/appreciation.

Also of note should be that regardless the crisis (Lost decade(s), Fukushima, 9/11, GFC, Coronavirus) the answer has been the same; cheaper debt to incentivize more debt and call it “growth” (without a concern how it would ever be repaid).

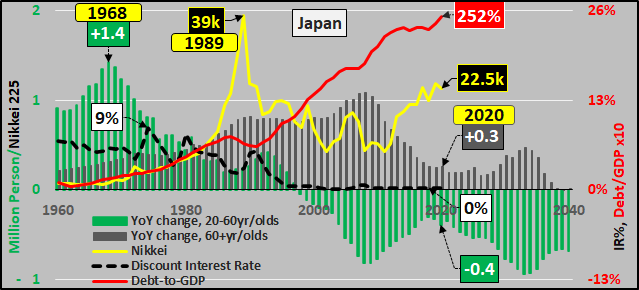

For Japan, 1991 was the conclusion of the last bit of demographic driven demand growth. Since then, interest rates have been pushed to zero to incent an ever decreasing quantity of consumers to consume more…with little positive impact. Instead, the Japanese government has decided to do what Japanese consumers couldn’t…grow spending via blowing out official government debt to GDP. Interestingly for all the government market intervention, equity prices are still down over 40% from peak valuations.

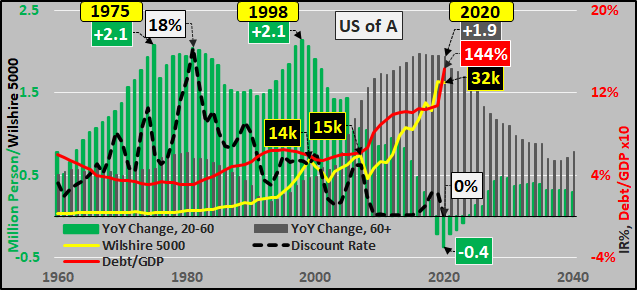

For the US, the last bit of demographic driven momentum concluded in 2018 but the US went to ZIRP a decade earlier in the demographic cycle (’09) than Japan. Now the US government has decided even the best efforts of US consumers to consume beyond their means isn’t adequate…and thus official government debt to GDP is soaring (and of course, this doesn’t take into account the 2x to 4x larger unfunded liabilities that did not exist prior to 1950). Like Japan, the US federal government and Federal Reserve have taken an ever increasingly “interventionist role”, to great effect for asset valuations. One note on the estimated return to working age population growth in the chart below…it is entirely dependent on the unlikely return to high rates of immigration.

Annual Change Working Age/Elderly, Discount Interest Rate, Debt/GDP, Equities

To read the charts, five variables – annual change in 20 to 60 year old populations (green columns), annual change in 60+ year old populations (grey columns), discount interest rates (black dashed lines), Nikkei 225/Wilshire 5000 (yellow lines), and debt to GDP ratios (red line).

JAPAN

US

BTW – In retrospect, the talking heads and market gurus agree the market peaks of 2000 and 2007 were “bubbles”, but these same folks are now suggesting “this time is different”!?!

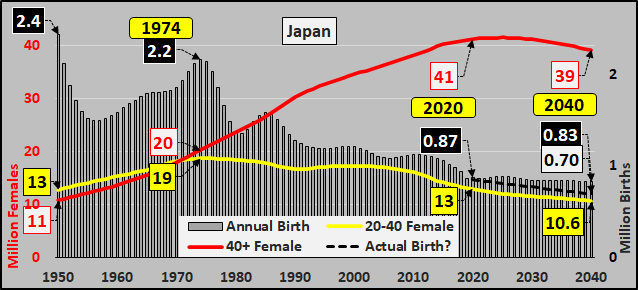

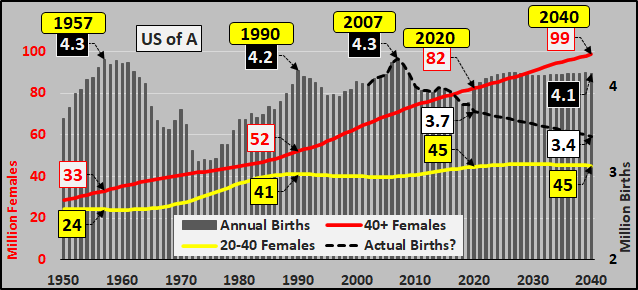

Childbearing, Post-Childbearing, & Births

JAPAN

Below, no anecdotes or happy stories, just demographic facts that drive the real world…annual births plus UN estimated births through 2040 (grey columns), likely births (black dashed line), childbearing females (yellow line), post childbearing females (red line). Japan (and its domestic consumption) will only continue shrinking and likely at an accelerating rate!?!

US

Annual births plus Census/UN estimated births (grey columns), actual births since ’00 and likely births (black dashed line), childbearing females (yellow line), post childbearing females (red line). BTW – US female childbearing population is inclusive of anticipated immigration, but actual immigration in 2019/2020 is running far below estimates…and may essentially be zero for 2020. Beyond that, who knows, but continued lower immigration means significantly fewer females of childbearing age and subsequently significantly fewer births…and significantly smaller present and future consumption (GDP).

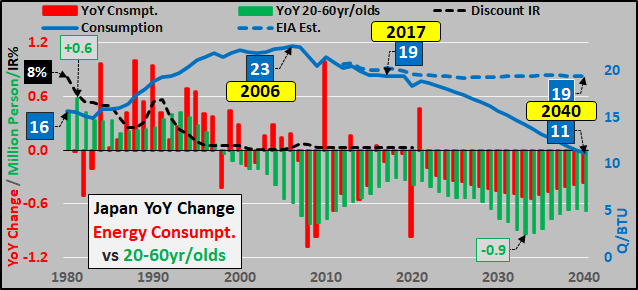

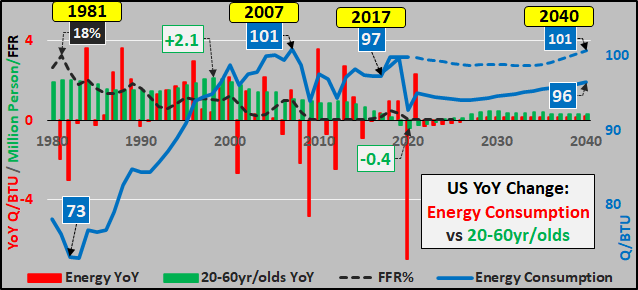

Demographics & Energy Consumption

To round out the picture, I show the correlation of demographics in energy consumption. Charts below are total primary energy consumption (oil, coal, renewable, nat. gas, etc) blue line, year over year change in energy consumption (red columns), year over year change in 20 to 60 year old population (green columns), and the central bank set discount interest rate (black dashed line). Consumption data is from EIA through 2017 and then my estimates through 2040 following existing demographic reality. After decades (centuries) of energy consumption growth, both Japan and the US continue falling for over a decade now…mirroring their domestic demographic and import/export realities.

JAPAN

US

Make of this data what you will and invest accordingly.