WTI Extends Gains After API Reports Biggest Crude Draw Since December

Tyler Durden

Tue, 07/14/2020 – 16:34

Oil prices rebounded from yesterday’s weakness today as vague signals that OPEC members are likely to comply with production cut promises trumped worries of a second wave of COVID impacting demand detrimantally.

“It’s all about risk appetite and the hope of continued demand growth here,” said Bart Melek, global head of commodity strategy at TD Securities. Iraq and Nigeria pledging to “to live up to their supply cut commitments made investors comfortable to take a long stance on oil.”

After last week’s surprise crude build and Cushing stock rise, all eyes are back on inventories…

API

-

Crude -8.322mm (-2.1mm exp)

-

Cushing +548k

-

Gasoline -3.611mm (-2.0mm exp)

-

Distillates +3.03mm (+1.1mm exp)

API reported the biggest crude draw since Dec 2019 (and a notable Gasoline draw too)…

Source: Bloomberg

“If crude oil storage posts a new all-time record, with a build at Cushing thrown in for good measure, I would tend to think the market would trade lower… possibly sharply lower,” Bob Yawger, director of the futures division at Mizuho Securities USA, said in a note to clients.

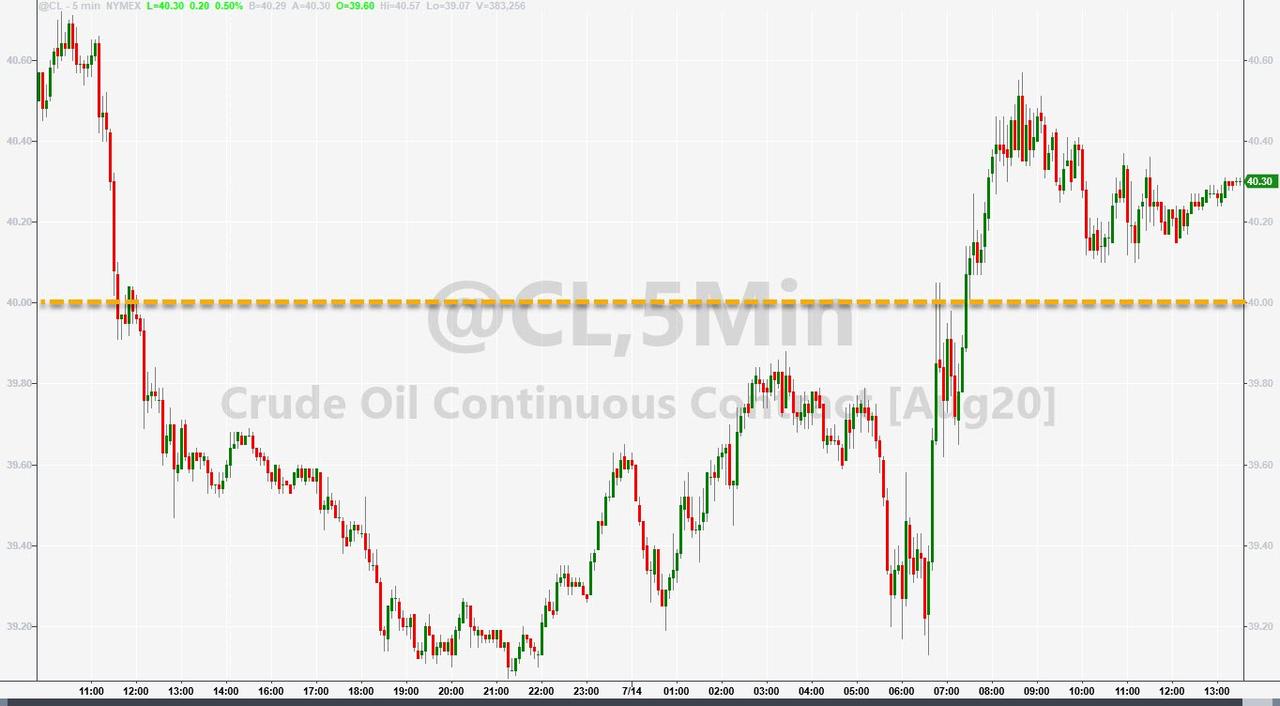

WTI pushed back above $40 today…

…hovering around $40.30 ahead of the inventory data, and spiking higher after the print…

“We’ve been in a market that’s been in clear consolidation for quite some time,” said Thomas Finlon of Houston-based GF International. “After a considerable rally or selloff, the interesting thing is the market seems to be drawn back to unchanged on the day pretty quickly.”