Soaring Inflation To Send Gold To $5000 “Doomsday” Fund Predicts

Tyler Durden

Wed, 07/15/2020 – 19:10

Picking up on what Russell Napier said recently, when the formerly iconic deflationist threw in the towel and now expects inflation because “control of money supply has permanently left the hands of central bankers”, a fund manager who returned 47% this year by betting heavily on gold and Treasuries says the next decade is going to be marked by inflation that central banks are powerless to control.

Diego Parrilla, who heads the $450 million Quadriga Igneo fund dubbed “Doomsday” by Bloomberg, perhaps because unlike most of his peers he refused to buy into the biggest groupthink trade ever namely FAAMG stocks, said unprecedented monetary stimulus is fueling asset bubbles and corporate debt addiction, which renders rate hikes impossible without an economic crash. In the ensuing market mania, the manager whose portfolio is loaded up with cross-asset hedges says gold could rise as high as $5,000 an ounce in the next three to five years, more than doubling from its current price of $1,800 which is just shy of all time highs.

“What you’re going to see in the next decade is this desperate effort, which is already very obvious, where banks and government just print money and borrow, and bail everyone out, whatever it takes, just to prevent the entire system from collapsing,” Parrilla told Bloomberg in an interview from Madrid.

Actually, we get why Quadriga Igneo was called “Doomsday”: it does not shy away from the truth that the Fed has pushed the financial system into a corner where any deviation from massive money injections would lead to catastrophe. Also, unlike most hedge funds – which as we noted earlier no longer function as they should due to central bank interventions – and whose job is to compound steady returns over time, Parrilla’s fund is similar to a “black swan” fund in that it tends to hedge the next big crash while generating capital over time. Managers with a tail-risk bias position for extreme market events, typically bucking mainstream views on Wall Street.

While calls for surging inflation have been often made in the past decade, yet were confined to financial assets while the broader economy suffered from lack of aggregate demand, Parrilla believes that the stimulus packages have exacerbated deeper issues within the financial system, “such as central banks who have kept interest-rates near zero for more than a decade and are willing to re-write the policy rulebook in a crisis.”

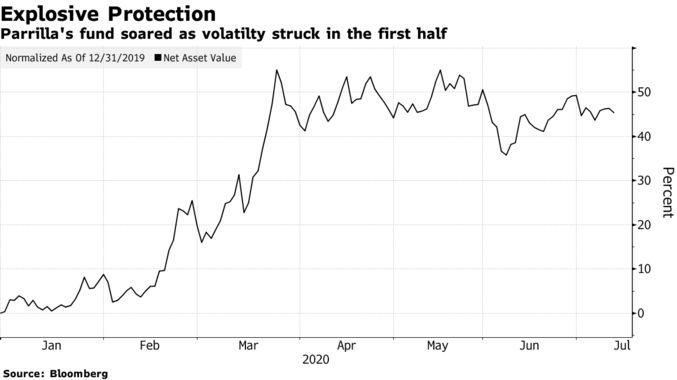

While the jury is still out on if and when soaring inflation will hit – although we should note that in recent weeks such prominent deflationists as Albert Edwards, Russell Napier and Horseman’s Russell Clark have all shifted to expecting runaway inflation in the coming year – Parrilla may be on to something if only based on the soaring value of his asset portfolio which soared as virus-fueled fear ripped through markets in February and March. The fund is about 50% invested in gold and precious metals, 25% in Treasuries and the rest in options strategies that profit from market chaos, such as calls on gold and the U.S. dollar.

“This is the part that makes us super explosive,” he said.

Quoted by Bloomberg, Parrilla, who previously ran the commodities department for Old Mutual Global Investors, described his investment process as search for anti-bubbles: unusually cheap assets that do well when bubbles burst. It had to wait patiently until its moment came: the Quadriga Igneo fund was launched in 2018 and had returned 10% by the end of the year. Performance was flat in 2019 before exploding by 50% in 2020.

“What we’ve seen over the last decade is the transformation from risk-free interest to interest-free risk, and what this has created is a global series of parallel synchronous bubbles,” said the fund manager, who is also the author of a book called “The Anti-Bubbles: Opportunities Heading into Lehman Squared and Gold’s Perfect Storm.”

“One of the key bubbles is fiat currency, and one clear anti-bubble in this system is gold,” he said, adding that other examples are volatility, correlations and inflation. “It’s a case of when, not if, they will reprice significantly higher.” We, and many others agree.

Parrilla is on a good start: gold has rallied 19% this year and captivated some of the world’s most prominent investors this year, who argue that the rapid expansion of central bank balance sheets will reduce fiat currency values and drive demand for hard assets.

“The bubbles are too big to fail and mommy and daddy will do whatever it takes to prevent this,” said Parrilla, referring to central banks who now step in and prop up capital markets after even a modest drop.

The 2018 Realvision clip below captures some of Parrilla’s core views.