Platts: 5 Commodity Charts To Watch This Week

Tyler Durden

Mon, 07/20/2020 – 12:20

Via S&P Global Platts Insight blog,

A look at the sharp drop in EU carbon prices, and major drivers in the market, kicks off our selection of energy and commodity market trends this week. Plus, the OPEC+ rollback of production cuts, US LNG exports, and a new record for Texas peakload power demand.

1. EU carbon price rally comes to abrupt halt

What’s happening? EU carbon allowance prices fell hard July 16 after a steep rally to 14-year highs ran out of steam at over Eur30.00/mt ($33.76/mt). EU Allowance futures contracts for December 2020 delivery on the ICE Futures Europe exchange fell as low as Eur26.37/mt in late trades, down more than Eur2.00/mt on day. July 16 marked the first day of larger EU carbon auction volumes, which now include 50 million allowances from the EU’s Innovation Fund, to be spread evenly through common EU auctions until mid-December.

What’s next? EU carbon prices have rallied from below Eur15.00/mt in March in the immediate aftermath of the coronavirus lockdowns, with analysts noting the likelihood of a correction on weak near-term fundamentals and some profit-taking. However, commentators also believe the rally was linked to bullish longer-term strategies in Europe, with compliance buyers taking seriously the European Commission’s proposal to tighten greenhouse gas emission cuts to 2030. Market players will be watching closely this week to see where the next support level may be. Primary supply of allowances from government auctions will be slashed by 50% in August, but is set to rise again in September through November. Traders will also be watching in September for the European Commission’s expected proposal to tighten the EU’s 2030 emissions target.

2. OPEC+ overproducers pose risk to recent oil price gains…

What’s happening? With oil prices back above $40/b, the OPEC+ alliance plans to relax its crude oil production quotas by about 2 million b/d in August but says the new volumes will not flood the market. In fact, some of the production rise will be offset by so-called compensation cuts that countries that violated their quotas in May and June will have to implement in the next few months.

What’s next? Countries required to make compensation cuts are supposed to submit their planned schedule of cuts by the end of July. They will be closely scrutinized by the market to see if they follow through, as any discipline slippage could endanger the alliance’s hard-won price gains.

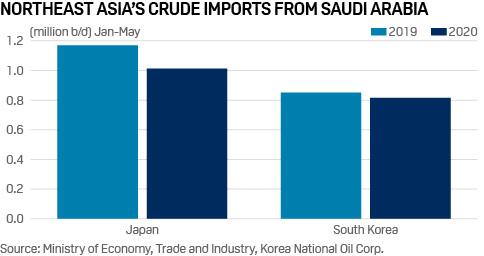

3. …. while Asia wary of overcommitting to crude imports

What’s happening? Demand for oil products in key Asian markets continues to show signs of recovery. South Korea’s domestic gasoline demand rebounded to 7.81 million barrels in May from 6.58 million barrels in April. In Japan, weekly domestic gasoline shipments were estimated to have risen above the pre-crisis level of 4.72 million barrels in recent weeks, according to Platts calculations based on Petroleum Association of Japan data. China’s crude oil imports surged 34.4% on year to a record-high 12.99 million b/d in June, customs data showed.

What’s next? Due to the easing of production cuts by the OPEC+ group, Middle Eastern sour crude supply is expected to increase from August but Northeast Asian refiners are determined not to abruptly boost crude imports and refinery run rates as fuel demand recovery remains fragile across Asia. Japanese and South Korean industry sources said refiners in both countries would be cautious about not overcommitting to crude procurement. Meanwhile, Chinese refiners are wary of tilting the supply-demand balance as expected severe floods and heavy rain could curb transportation and industrial fuel demand this month.

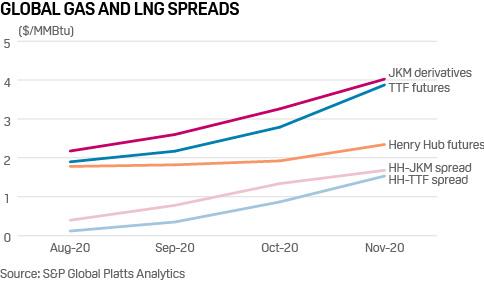

4. Improving spreads suggest way out of US LNG doldrums

What’s happening? LNG tankers loading on the US Gulf Coast and delivering to East Asia are continuing to slow steam to their destinations in search of better netbacks in the fall. Increases in average voyage days are generally tracking widening of contango in the price curve for future months in end-user markets, Platts Analytics data show.

What’s next? A ramp in US exports for deliveries starting in October would be a welcome rebound from the sharp drop in terminal utilization in recent months due to cargo cancellations. Improving economics in China and India could spur growth in imports, while lower nuclear output in Japan due to maintenance and terror-proofing measures would support LNG deliveries there. In South Korea, languishing power sector demand could drag down LNG consumption.

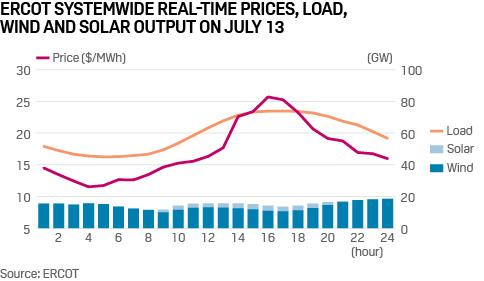

5. ERCOT set new July peakload record, but power prices hardly moved

What’s happening? Triple-digit temperatures in major metro areas caused the Electric Reliability Council of Texas to set a monthly power demand record on July 13, but strong wind output kept real-time power prices low – peaking around $26/MWh system wide. Peakload demand hit 73.96 GW around 4 pm CDT, the highest level ever in July, with the previous record peakload of 73.30 GW set July 19, 2018. Hourly wind output barely dipped below 10 GW on July 13 and remained in 10.5 GW to 14.6 GW range throughout the period when system-wide peakload exceeded 70 GW.

What’s next? With more wind and solar capacity being added in Texas, output from these resources could moderate power prices going forward. However, underestimating wind and solar forecasts could result in price spikes and volatility during extreme weather.