According To Nomura The “Largest Pain Trade In The World” Will Hit In September

Tyler Durden

Thu, 07/23/2020 – 15:15

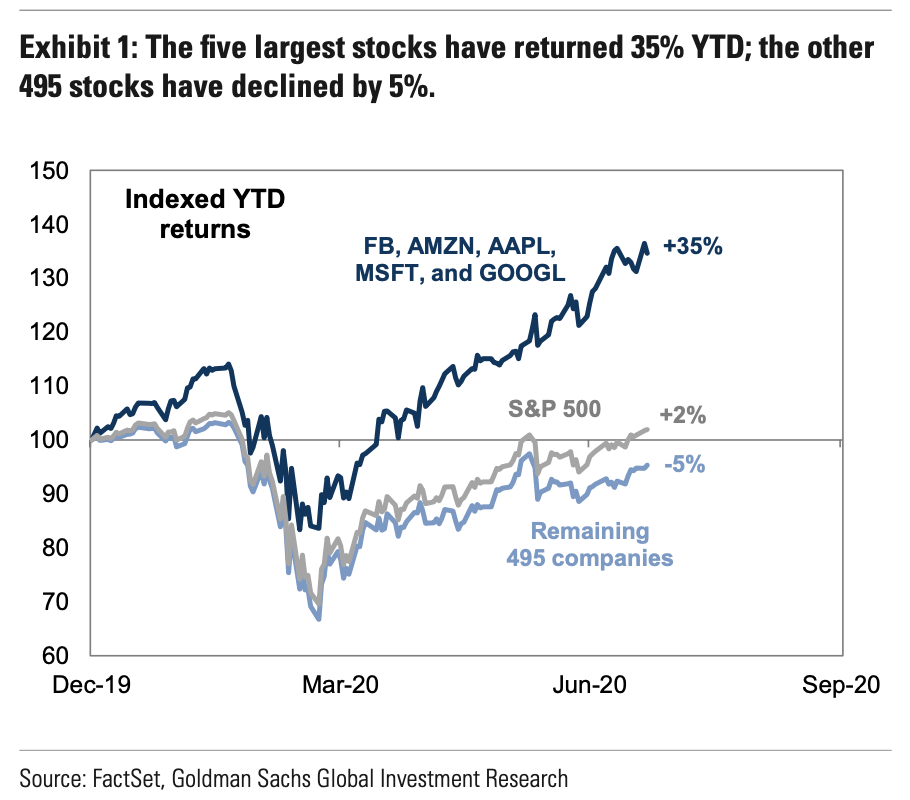

If one looks at sto(n)ks, it appears that nothing can dent their relentless ascent as virtually everyone is now convinced that central banks will never again allow even a modest correction and so even the slightest dip is bought with reckless abandon… or rather a handful of stonks are bought now that the S&P500 is the S&P5.

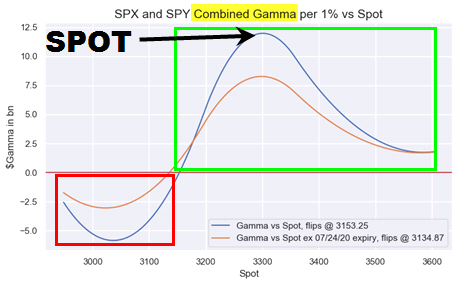

And while the VIX remains elevated, sliding to the mid-20s in recent days and finding it challenging to descend further, the market’s technicals and internals show that there is little pent up imbalance. Indeed, according to Nomura quant Charlie McElligott, after last month’s near-record Op-Ex, things are far more calm now and “3300 looks like the truth in Spooz, with nearly double the aggregate $Gamma ($4.5B) of the next closest line (3250 with $2.4B) as we head into expiry, thus exhibiting some “gravity” with Spooz up nearly 90 handles in just over 3 sessions and right between these two big strikes (ref 3277).”

Providing an additional layer of comfort is that SPX/SPY options Dealers are very long Gamma and are In the Money, with Nomura not expeting much of drop in Gamma afterwards as only 14% of options come-off post-expiry

It’s slightly more exciting in the tech space, where not only do investors remain really long (with Delta in the 90th percentile) but we also see nearly 31% of the Gamma coming-off after expiration “so it is likely opening-up to a larger distribution of outcomes range thereafter (in either direction)” according to McElligott.

Still, absent a major exogenous shock, op-ex should be a non-event with the drift higher likely to continue.

So are there any risks on the immediate horizon in an economy that just plunged (and emerged) from the deepest and fastest recession in history? Well, according to Nomura there is one red flag that is about to emerge on the horizon, and it has to do with bonds.

To be sure, nothing is imminent, with McElligott noting that “the grind continues” in Treasuries and rates, “where the Fed’s ZIRP in perpetuity and soul-crushing fwd guidance has simply beaten traders into submission and smothering rate vol, as we see further incremental bull-flattening yet again overnight.”

Yet while everyone is just as certain that yields will only sink lower, McElligott counters that precisely because of that, a spike in yields would be “the largest pain-trade in the world”, one which sends shockwaves across both equities (Value vs Growth) rotation and Commodities (send gold tumbling). As the Nomura quant explains, a spike in yields would trigger counter-moves across the asset spectrum:

- Gold’s recently “grabby” vertical move as everybody owns it now (real yields higher would mean gold lower), with any potential bond selloff also likely to:

- trigger a reversal in crowded legacy US Eq “Growth” factor over “Value” positioning as well (particularly into any bear-steepening, which sees “Value” benefit to the pain of “Momentum”)

Of course, this is hardly rocket science and so many have proposed just this counter trade only to be carted off feet first as yields continued to grind lower. However, what is novel in McElligott’s thesis is that a specific catalyst is coming as soon as September that would precipitate said “largest pain-trade in the world.” Below are his observations:

… in light of this currently “bulletproof” bond market, what could possibly act as catalyst for a selloff? After all, August over the past 15 years has been the single strongest 1m return period for TY, especially as supply dwindles into this “peak holiday” month…alongside the recent tendency for “vol events” into August’s “peak illiquidity,” with the VIX also seeing its strongest 1m return period in August over the same 15 year window—supportive of “flight to safety” USTs.

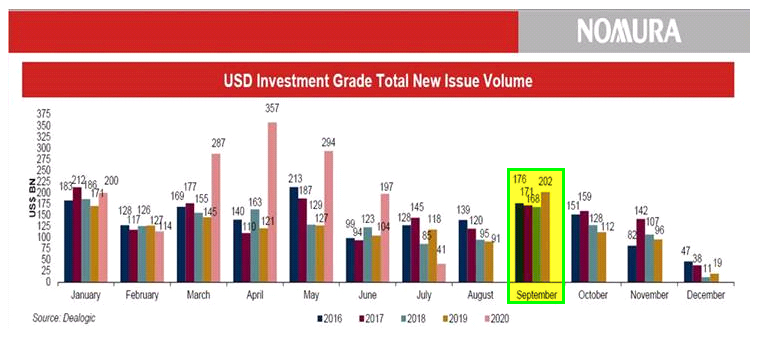

So if not August, then when? Well, as the Nomura quant answers, “the key window then for a UST bond selloff becomes September (and Q4 thereafter)” because that’s when traders and bankers come back from vacation, and the result is a flood of new bond issuance which is “likely to tilt the supply/demand dynamic finally in favor of tactical “bears” when traders return following the Labor Day holiday.”

Here McElligott quotes fellow Nomura strategist Darren Shames who discussed this dynamic earlier in the week, snapshotting the previous four Septembers in particular (also worth noting that September is the 2nd weakest month of TY returns on average over the past 15 years,which is at least a partial function of the same “issuance impulse”):

“IG issuance this month is running at 30% of June’s pace, and August is traditionally a slow month for issuance given vacations, so I wouldn’t be surprised to see corporate issuance ramp back-up in a meaningful way come September. This issuance in conjunction with the ongoing steady deluge of government supply could prove to be the catalyst for a revisit to the upper-band of the recent yield range.”

And some recent historical observations:

- In ’19, September was the largest month for IG issuance, predominantly traditional corporates and SSA’s (10yr notes sold off 40 bps in first two weeks in Sep, and finished the month 16bps cheaper. The extreme repo blow-out during this period was also a big part of the move)

- In ’18, Sep was 2nd largest month for IG issuance (10yr notes sold off 14 bps in first two weeks in Sep, and finished the month 20bps cheaper)

- In ’17, Sep was 4th largest month for IG issuance (10yr notes sold off 6 bps in first two weeks in Sep, and finished the month 22bps cheaper)

- In ’16, Sep was 3rd largest month for IG issuance (10yr notes sold off 11 bps in first two weeks in Sep, and finished the month 2.5bps cheaper)

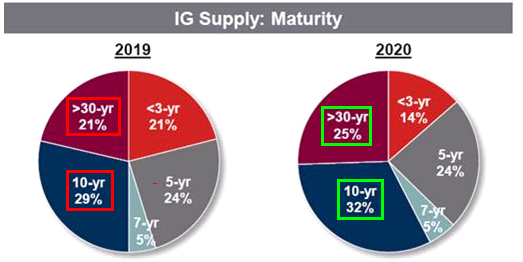

The Nomura analysts then highlighted that the YoY change in issuance trend with regard to supply maturity, “which has seen paper shift out on the curve to an average life greater than 10 years, and therefore a further steepening catalyst:”

Not helping is that longer curves and duration have been highly correlated over the past few months, meaning that “sell-offs and steeping have been largely “one in the same” (particularly as YTD issuance has hit long-end, while Fed has pinned yields under 5Y).”

As McElligott summarizes, “so after this likely expected “issuance impulse” tilts the supply/demand dynamic into the start of Fall (and barring another de-stabilizing vol-event from COVID-19, US Elections, US / China), I believe the next headwind for USTs/Rates would likely need to originate out of the Equities market, particularly with the powerful historic Q4 “risk-ON” seasonality.”

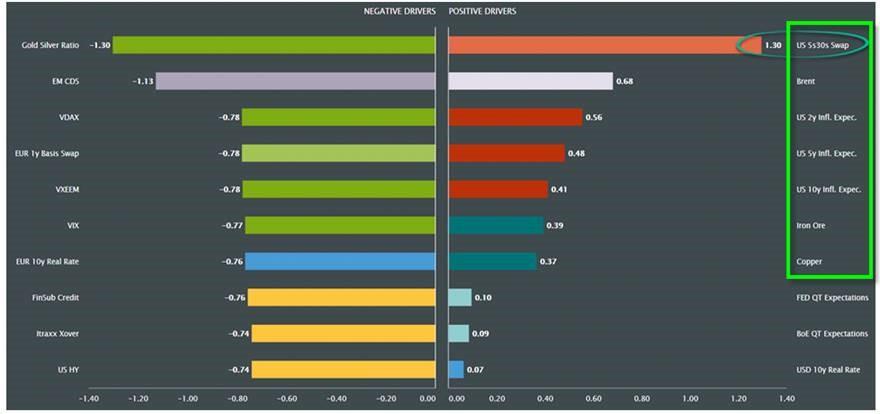

One final point validating McElligott’s concern about a September rate-led domino effect is that as the table below shows, the largest positive macro factor drivers for US Equities around this time of year are steeper curves in conjunction with higher inflation expectations and commodities as part of the same feedback-loop:

Taking all of this into account, McElligott expects a major “pain trade” triggered by a spike in rates to emerge just after the anticipated August rally peak which then plays for “a tactical September UST reversal lower/curve bear-steepening/higher Rate vols –trade” which would spark chaos across all markets, as it would go hand-in-hand with a “Value over Growth” trade in US stocks in September/Q4 as well, per the bond selloff and pro-cyclical Sep-Dec cross-asset seasonality, which the Nomura strategist believes is best to trade by buying outright Calls in “Cyclical/Value” sectors.