Gordon Johnson: Tesla “Engaged In Accounting Games” To Make Their Q2 Profit

Tyler Durden

Thu, 07/23/2020 – 09:45

Gordon Johnson of GLJ Research put out a note after Tesla’s earnings telling us what we already know for the most part: Tesla’s growth story is an illusion and the company was only able to turn a profit when it reported yesterday due to the sale of regulatory credits an other financial engineering.

Post-earnings, Johnson wrote that it was how the company achieved the numbers that was the real feat.

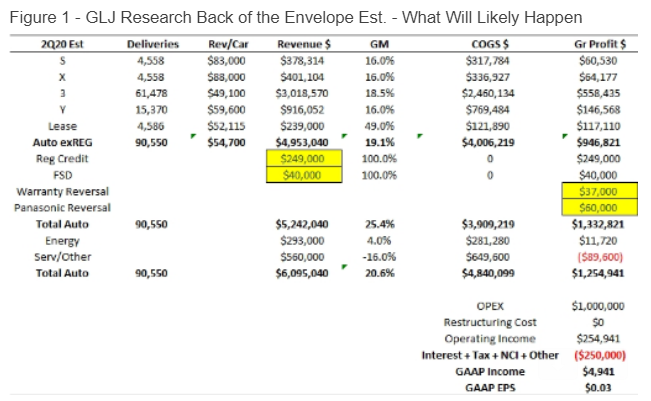

Johnson had predicted prior to earnings that the company would turn a profit, though even his wildest expectations in terms of how many regulatory credits the company would sell would turn out to be way short of the massive $428 million worth that they sold this quarter (a new record).

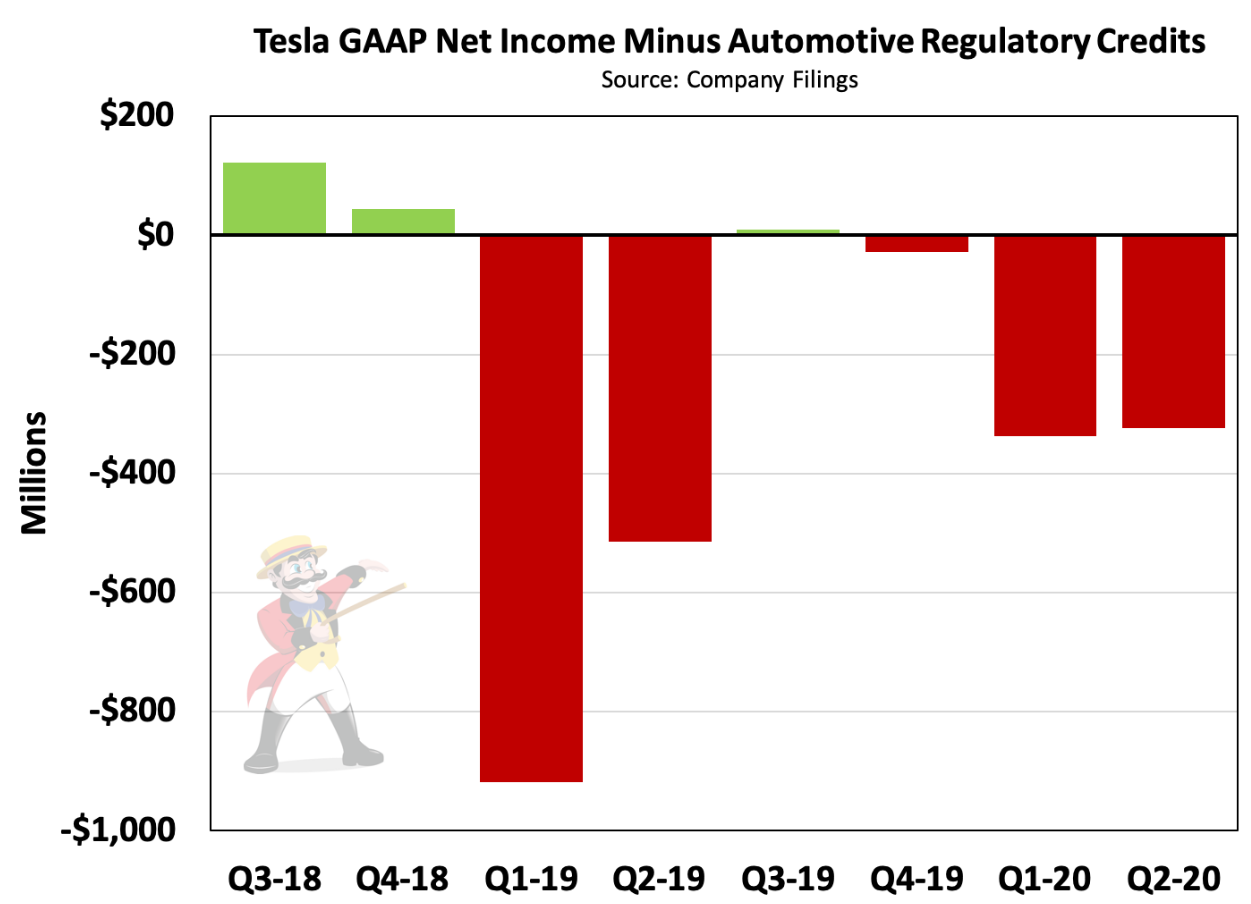

Without regulatory credit sales, as @TeslaCharts points out, it is a starkly different picture for Tesla’s earnings:

Johnson wrote in his note that Tesla’s CFO, Zach Kirkhorn, pointed out on the company’s conference call that the ongoing sale of regulatory credits was not a guarantee going forward.

“We don’t manage the business with the assumption that regulatory credits will contribute in a significant way to the future. Yeah, I do expect regulatory credit revenues to double in 2020 relative to 2019, and it will continue for some period of time, but eventually this stream of regulatory credits will reduce,” Kirkhorn said on the call.

Johnson also noted that in Q2, the company broke out its A/R distribution by segment for the first time:

That is, in 2Q20, TSLA, for the first time, disclosed that its accounts receivable (“A/R”) distribution was segmented by: (1) $594mn – Regulatory Credits (40%), (2) $448mn – Auto Sales (30%), and (3) $448mn – Mystery (30%).

He then made note of the fact that there were tons of regulatory credit revenues still stuck in A/R. He thinks this is a result of revenue recognition engineering – or even Tesla possibly not selling the credits to begin with:

Stated differently, half of 1Q20, and all of TSLA’s 2Q20 regulatory credit revenues are still in accounts receivable (“A/R”). So what’s the big deal? Well, we interpret this as one of two things, namely: (1) TSLA sent a regulatory credit invoice to a customer and claimed it as revenue up-front (i.e., we’ll give you a price break on the regulatory credits you are buying, and let you pay us at a later date when the credits are actually needed, if you “buy” the credits now – such a transaction would create a receivable), or (2) TSLA did not sell the credits to anyone. We see the former as the most likely scenario.

Reading the tea leaves, Johnson also notes that this was a key quarter to make numbers (S&P inclusion depended on it) and that the company immediately guided these credits lower and backed away from them for Q3:

Why? Well, when looking at TSLA’s credit-revenue-per-car-sold by quarter 1Q18-2Q20, we notice a sharp spike in both 1Q20 and 2Q20. Furthermore, and also rather telling, coincidentally right after the quarter in which TSLA needed to achieve positive GAAP net income (i.e., 2Q20), its CFO is guiding 3Q20 regulatory credit sales to fall >50% QoQ (likely pushing the company back into deep losses) – at risk of stating the obvious, we see TSLA’s 1H20 quarterly credit sales as highly arbitrary/managed/inorganic.

Recall, pre-earnings Johnson had predicted regulatory credit sales of $249 million.

Johnson’s conclusion post-earnings is that Tesla may have “pulled forward cashless/one-time regulatory credit sales based on cars Tesla may not have sold to people who have not paid for them, enabling ‘goal-sought’ 100% gross-margin ‘paper’ sales in order to be included in the S&P 500.”

“We see this quarter’s earnings as among the lowest in TSLA’s history,” he concluded.

For our full wrap-up of Tesla’s earnings yesterday, you can view our write-up here.