Miners Can’t Keep Up With Gold’s Breakneck Rally

Tyler Durden

Thu, 07/23/2020 – 12:30

By Michael Msika, macro commentator at Bloomberg

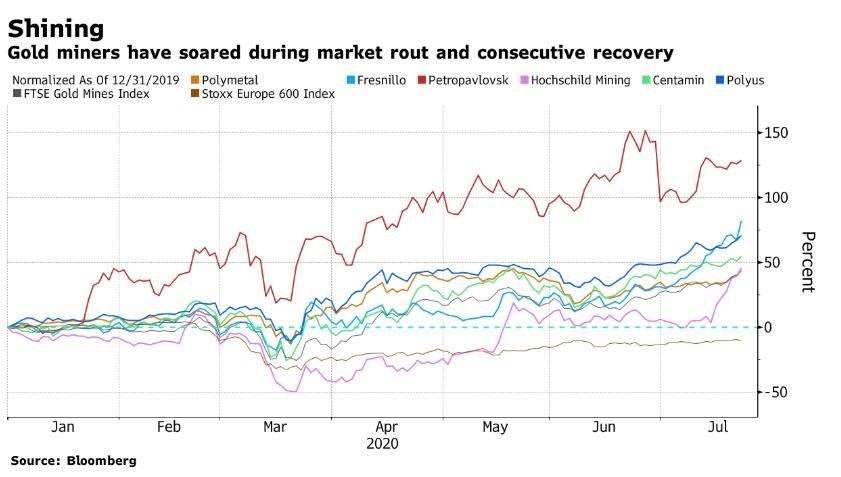

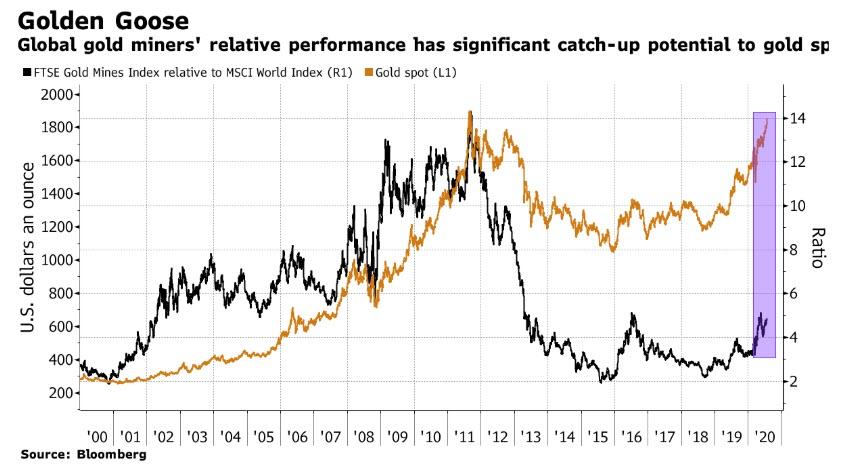

Gold prices have been rising since March, and the rally still has legs as the Covid-19 pandemic, dovish policies, a weaker dollar and potential inflation all bode well for the metal. But while prices are getting close to record highs, miners of the precious metal are still far away from their 2011 highs, which means there could be room for a catch-up rally in the sector.

Gold miners have outperformed during this year’s market rout, and have continued to climb during the recovery. Meanwhile, escalating tensions between the U.S. and China are adding to the case for the haven.

“Both fundamentals and positioning look aligned for gold miners to shoot higher,” Societe Generale SA strategists led by Sophie Huynh say, adding that gold and gold miners “have a very temporary strong relationship whenever powerful market shifts are underway.” The strategists note that unlike bullion, the miners are still far from 2011 levels, but with anticipation of a new mini-cycle, the stocks could offer a way to boost portfolios as “embedded call options” on the metal, while providing a hedge against inflation.

“The environment is still looking very good for gold and gold miners,” Amundi Asset Management fund manager Arnaud du Plessis wrote earlier this month, arguing that central banks are staying on full alert as the resurgence of Covid-19 in some parts of the world is creating fears of a second wave.

Analysts are upbeat on bullion, with Citigroup forecasting prices to reach $2,000 in the next few months. The broker has upgraded Fresnillo Plc this week and reiterated its top buy rating on Polymetal International Plc.

M&A could be an additional driver for gold miners, as historically such global activity in the sector accelerates when the metal’s price is buoyant, says Bank of America analyst Michael Jalonen. In fact, deals heated up in the second quarter with 12 transactions announced, the highest quarterly total since 2012, with a total transaction value of $2.86 billion, nearly double that in the first quarter, he says.

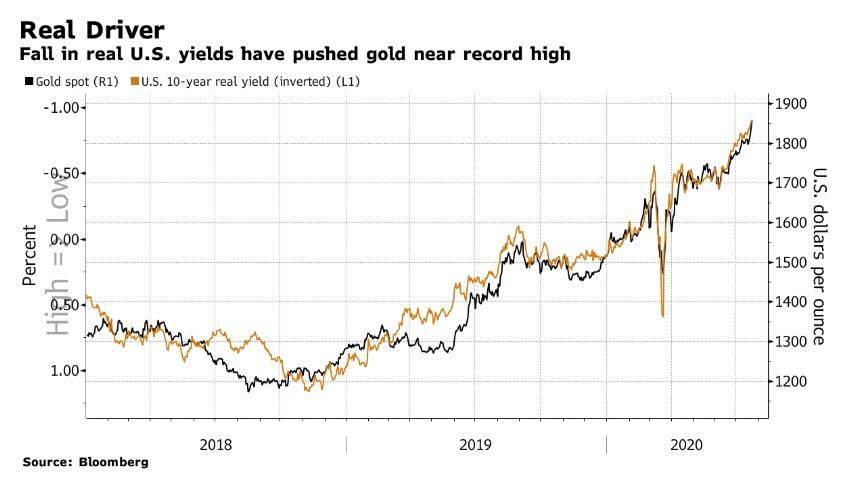

Gold prices have been boosted as rising inflation expectations pushed real yields to new lows, but central banks’ demand has also been strong, according to the Invesco Sovereign Management Study. Some 4.8% of total central bank reserve portfolios are now alloted to gold, up from 4.2% in 2019, and almost half of those increased allocations made with a view to replace negative yielding debt.

The recent price action still pushes toward caution and Goldman Sachs Group strategists warn that the S&P 500 Index and gold have become more positively correlated owing to their link to real yields, suggesting lower diversification benefits, they say.

A move significantly higher for gold toward $3,000 an ounce, as suggested by economist David Rosenberg in March, is “a possibility but seems unlikely,” says Paul Jackson, global head of asset allocation research at Invesco. That’s because the path for such an advance would mean a loss of confidence in central banks and the monetary system, and would likely rely on a dramatic further weakening of the global economy and deeper declines in real yields, he adds.