US Personal Spending Rebound Continues Despite Sinking Incomes

Tyler Durden

Fri, 07/31/2020 – 08:35

US Personal spending and income habits are hard to decipher amid the massive government transfers and pent-up (and bought-forward) demand of various items – with spending plummeting and incomes soaring – and June pushed that even further with incomes falling 1.1% MoM, worse than the expected 0.6% drop; and spending rising 5.6% MoM (better than expected 5.2% and off a revised higher May).

Source: Bloomberg

On a year-over-year basis, incomes remain higher (government transfers) and spending lower…

Source: Bloomberg

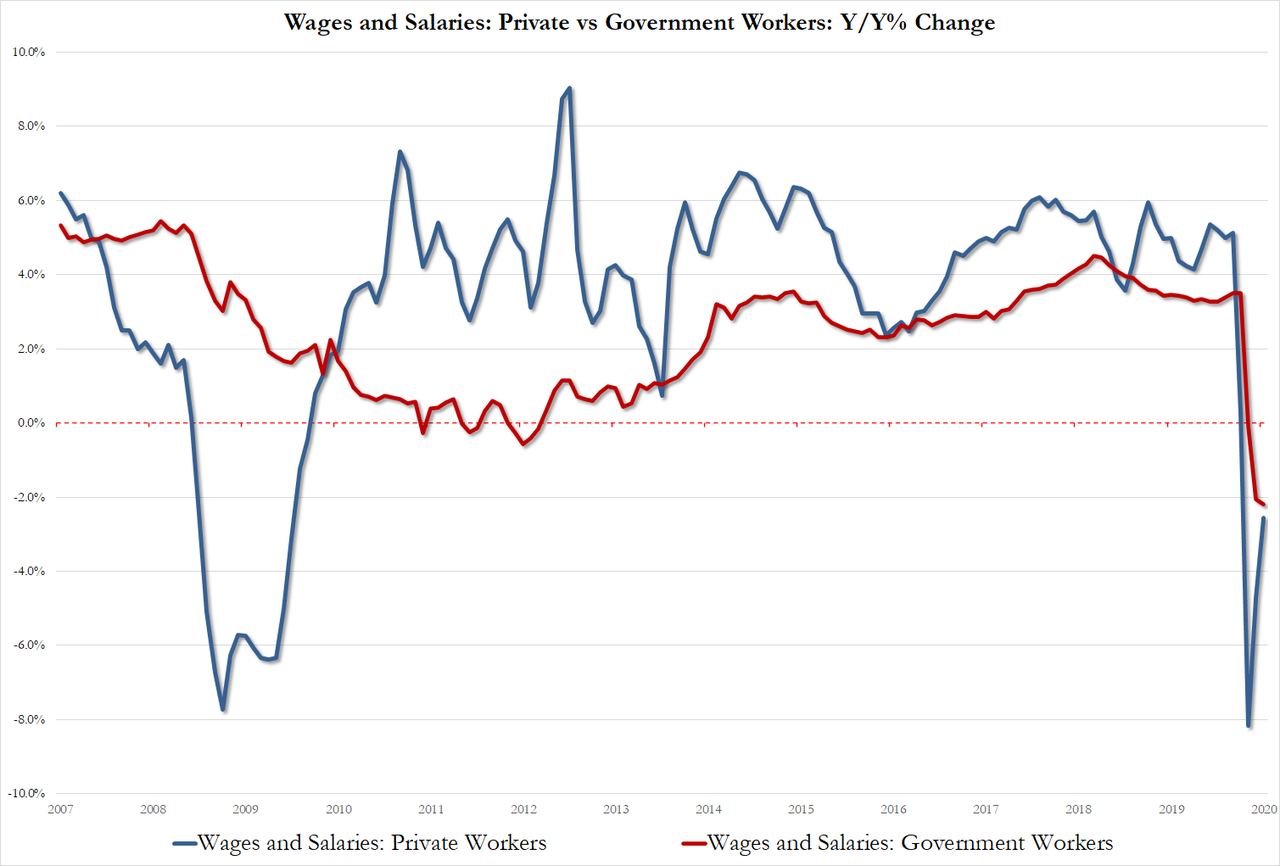

Government workers saw income losses accelerate as private sector workers saw their income losses rebound somewhat – both still down hard YoY…

How long will this last as the $600 government handouts to stay home evaporate?

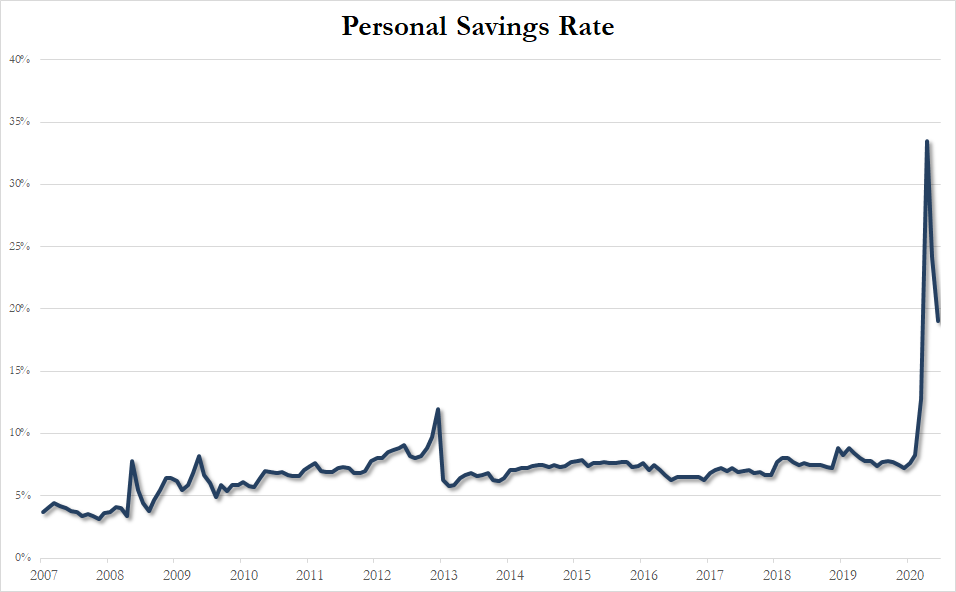

The brief ‘forced’ savings is starting to disappear…

Finally, The Fed’s favorite inflation indicator – the Core PCE Deflator – rose by a smaller than expected 0.9% YoY, stuck at its weakest since 2010.