Tech Hammered: Nomura Believes “Reflation Signal” Has Been Triggered

Tyler Durden

Mon, 08/10/2020 – 12:05

This morning’s price-action in the major US equity indices is unusual to say the least. A huge sudden spike in Small Caps was met with a wave of selling in Mega-Cap Tech (Nasdaq)…

As the recent run in growth/momentum relative to value has reversed dramatically in the last two days…

Why?

Nomura’s Charlie McElligott believes that the M2 money-aggregates “reflation signal” observation discussed last week is actually in the process of “triggering” real-time.

This, McElligott notes, is marking a possible inflection away from what has been (risk-aversion and savings-tied slowdown) behind the crash in U.S. money velocity at the core behind UST yield suppression and the recent “Momentum” trade in US Equities.

Indeed, the Nomura MD’s view fits with our observation last month:

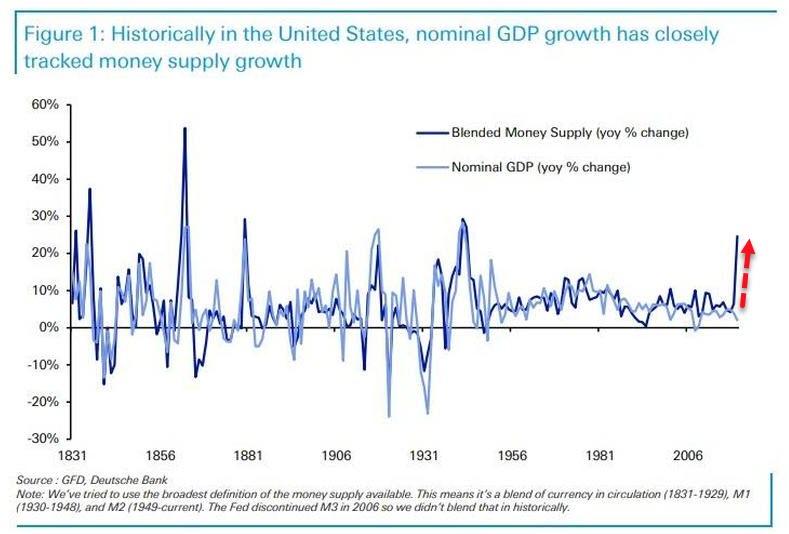

One by one the world’s legendary deflationists are taking one look at the following chart of the global money supply (as shown most recently by DB’s Jim Reid) and after seeing the clear determination of central banks to spark a global inflationary conflagration, are quietly (and not so quietly) capitulating.

As Horseman Global’s Russell Clark noted:

“the US dollar will likely weaken from here. And it is clear to me Western governments will only ever attempt fiscal austerity as a last resort, not a first. The conditions for both good and bad inflation are now in place.“

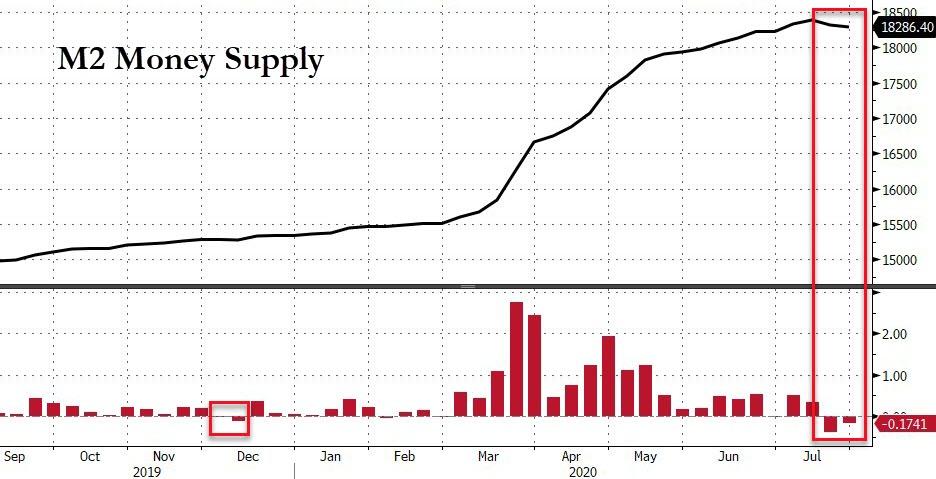

As the Nomura cross-asset-strategist explains, last Thursday’s Fed Reserve data showed a decline in the U.S. M2 measure for a second-consecutive week (marking the first two-week decline since Dec ’19) and the largest two-week aggregate decline (% chg basis) since Jan ‘10…

Recall that the view here is that it’s the actual decline in the money-supply measure which acts the reflation “tell.”

This, McElligott explains, is because it is a sign of confirmation from both corporates and individuals that that their risk-aversion and saving behavior has inflected from the peak – as opposed to the widely-held view that it is the impulse higher in M2 which leads to the inflation spillover, largely due to Fed balance-sheet largesse.

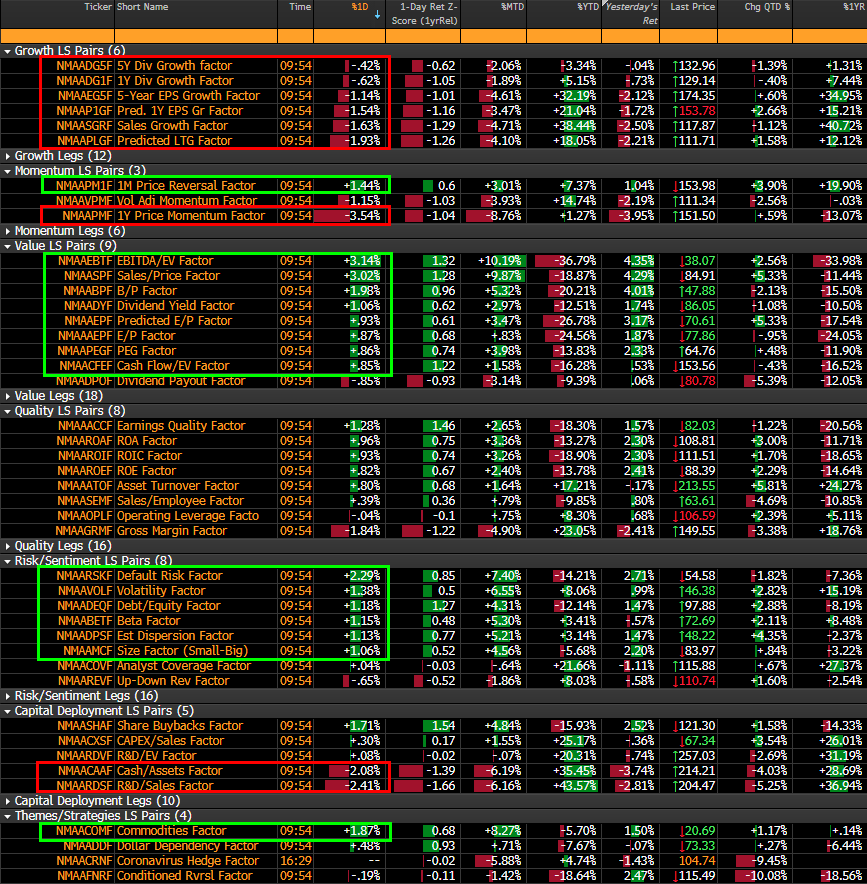

What he then finds notable was that Friday’s trade in U.S. Equities risk-premia land immediately reflected this sort of “impulse” and was remarkably pro-cyclical (“Value,” “Risk” and “Reversal” factors) despite SPX only +6bps on the day, which of course then corresponds with this macro factor “reflation” signal, coming at the cost of “Growth” and thus, “Momentum”:

Big Gainers…

-

EBITDA / EV (Value) +4.4% 1d return

-

Sales / Price +4.3%

-

B / P +4.0%

-

Predicted E / P +3.2%

-

PEG +2.3%

-

E/P +1.9%

-

Default Risk (Risk / Sentiment) +2.7%

-

Size +2.2%

-

Debt / Equity +1.5%

-

Conditioned Reversal (Reversal) +2.5%

-

1M Price Reversal (Reversal) +1.0%

Big Losers:

-

1Y Price Momentum (Momentum) -4.0%

-

Sales Growth (Growth) -2.5%

-

Predicted LTG -2.2%

-

5Y EPS Growth -2.1%

-

Predicted 1Y EPS Growth -1.7%

And this has continued again today with SPX flattish but risk factors again exploding higher at the cost of “Growth” and “Momentum” –

Here’s a factor performance snapshot after the open, with more of the same “Value / Risk” over “Growth / Momentum” and currently with Russell outperforming Nasdaq by 120bps early:

Source: Nomura

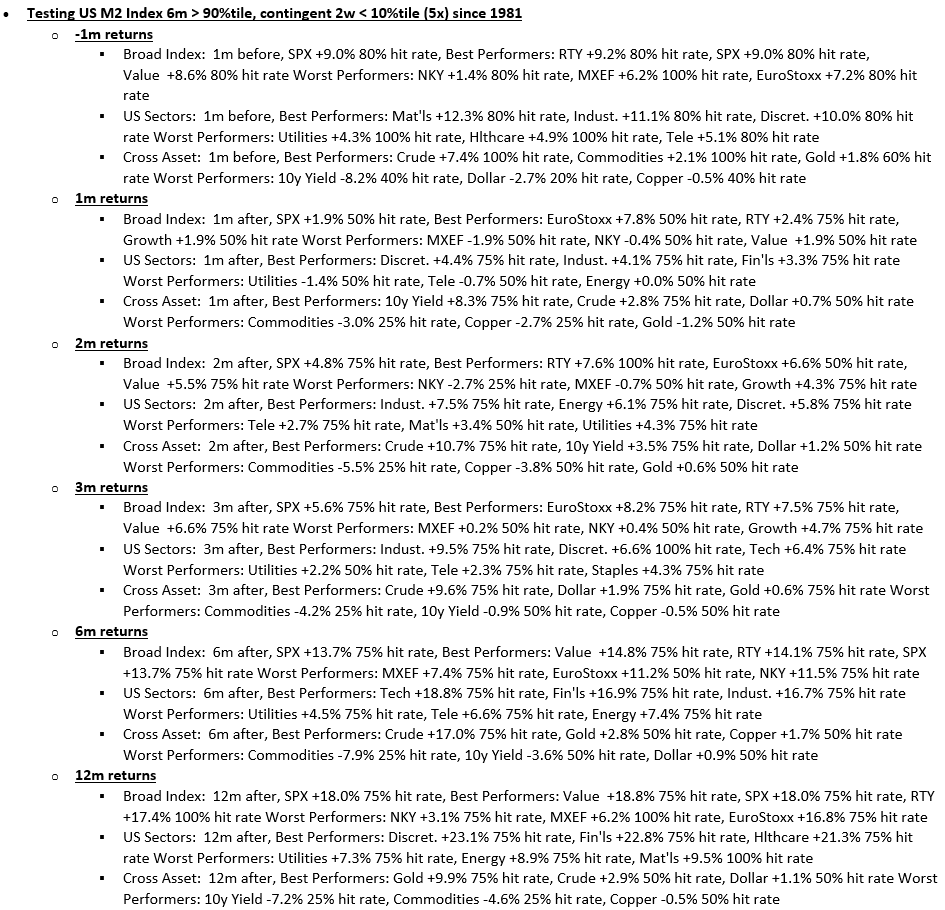

To confirm their qualitative observation, Nomura back-tested prior 6m U.S. M2 spikes (where 6m increase was over 90th %ile since 1981) which then saw a large 2w reversal lower (10%ile) thereafter – and the takeaways fit the scenario we have envisioned for this broad Aug / Sep into Q4 cross-asset thematic “reversal” into a broad risk-ON stance in returns for Equities, Factors (Value over Growth), Sectors (Cyclicals over Defensives / Bond Proxies) and Assets most acutely over the next 6-12m:

Source: Nomura

However, we remind readers that while the above historical performance is significant, this sudden reversal will be jarring to say the least. As Morgan Stanely recently warned:

To be clear, we think that overall equity and credit markets can weather a modest rise in yields, driven by better data. Risk assets have frequently been happy to trade a better growth outlook for a higher discount rate, and we saw this pattern as recently as Monday when global PMIs surprised to the upside. But the rise in duration across asset classes, at its most expensive levels on record, suggests that the transition won’t be smooth.

Whether one is active or passive, August appears to be a good time to evaluate, and be honest about, your cross-asset duration exposure.