“Hard Times Are Here”: UK Economy Suffers Record Collapse As GDP Plummets To 2003 Levels

Tyler Durden

Wed, 08/12/2020 – 10:45

The British economy shrank by a record 20.4% in the second quarter when the coronavirus lockdown was tightest, the most severe contraction reported by any major economy so far, with a wave of job losses set to hit later in 2020, according to Reuters. The (sequential) Q2 GDP slump exceeded the 12.1% drop in the euro zone and the 9.5% fall in the United States.

“Today’s figures confirm that hard times are here,” said finance minister Rishi Sunak. “Hundreds of thousands of people have already lost their jobs, and sadly in the coming months many more will.”

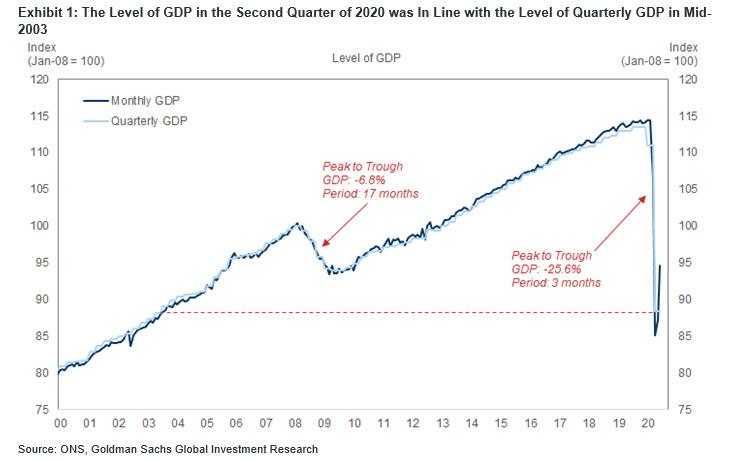

The data confirmed that the world’s sixth-biggest economy had entered a recession, with the low point coming in April when output was more than 25% below its pre-pandemic level. In recent months there has been a modest improvement as GDP rose by 8.7% M/M in June. Cumulatively through the first two quarters of 2020, GDP fell by 22%. Given the scale of that shock, the level of GDP at the end of Q2 was in line with the level of quarterly GDP in mid-2003, meaning

The monthly GDP data, however, offered a silver lining: growth restarted in May and quickened in June, when the economy expanded by a monthly 8.7% – a record single-month increase and slightly stronger than consensus expectations. From its pre-virus peak in February to its post-lockdown trough in April, GDP contracted by a cumulative 26%. As government restrictions were subsequently lifted, GDP began to recover, rising by 2.4%mom in May and 8.7%mom in June.

In the final month of Q2, services output accelerated from +1.5%mom to +7.7%mom, manufacturing output accelerated from +8.3%mom to +11.0%mom, and construction output accelerated from +7.6%mom to +23.5%mom. Within the services sector, retail returned to a level around 6% short of its pre-virus peak, while hospitality remained around 83% short. All in all, the level of aggregate GDP in June was still 17% below its pre-virus peak.

The evolution of GDP within the second quarter is encouraging, but the contraction in GDP between the first and second quarter is historic, with the sequential drop in Q2 a record 20.4% qoq. Cumulatively through the first two quarters of 2020, GDP fell by 22%. Given the scale of that shock, the level of GDP at the end of Q2 was broadly in line with the level of quarterly GDP in mid-2003.

Three features of today’s data are worth emphasizing:

- the only other comparable quarterly contraction in modern history occurred during the recession of the early 1920s (in the third quarter of 1921, GDP fell by 12%qoq non-annl.);

- the post-virus contraction in GDP through 2020 was six times faster and four times deeper than the contraction in GDP through 2008/09 (during the financial crisis, GDP fell by almost 7% from peak to trough, over the course of a year and a half);

- the cumulative hit to UK output through the first two quarters of 2020 was more acute than that experienced in other developed economies (the 22.1% decline in UK GDP compares with a 15.3% decline in the Euro area, for example, and a 10.6% decline in the US).

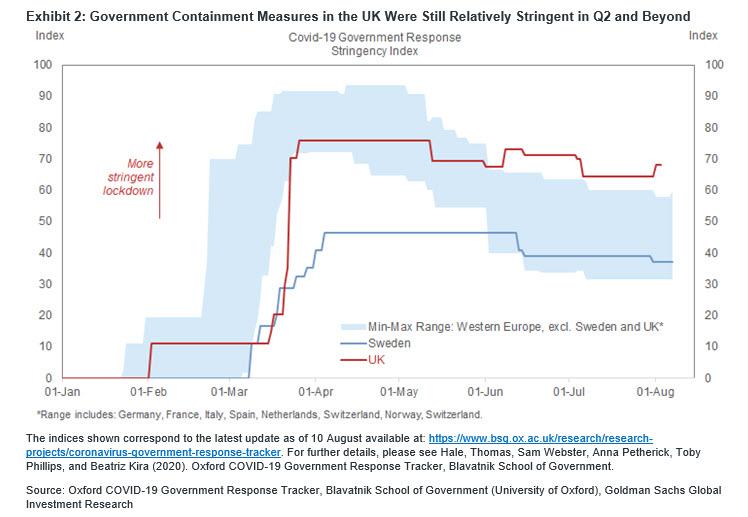

As Goldman observes, the relative severity of the UK’s post-virus contraction owes to two features of timing and structure. On timing, the relatively late imposition of the lockdown in the UK and the relatively slow unwinding of government containment measures imply that a portion of the mechanical rebound in GDP will only be registered in the third quarter. As the next chart illustrates, from a national perspective the government restrictions still in force in the UK are more stringent than those that remain in place across most of Western Europe.

On structure, the relatively large share of UK GDP derived from social activities involving face-to-face interaction implies a greater susceptibility to enforced social distancing. In the UK, consumer spending in areas such as cinemas, restaurants and live entertainment, for example, constitutes around 13% of total output, compared with around 11% in the US and around 10% in the Euro area.

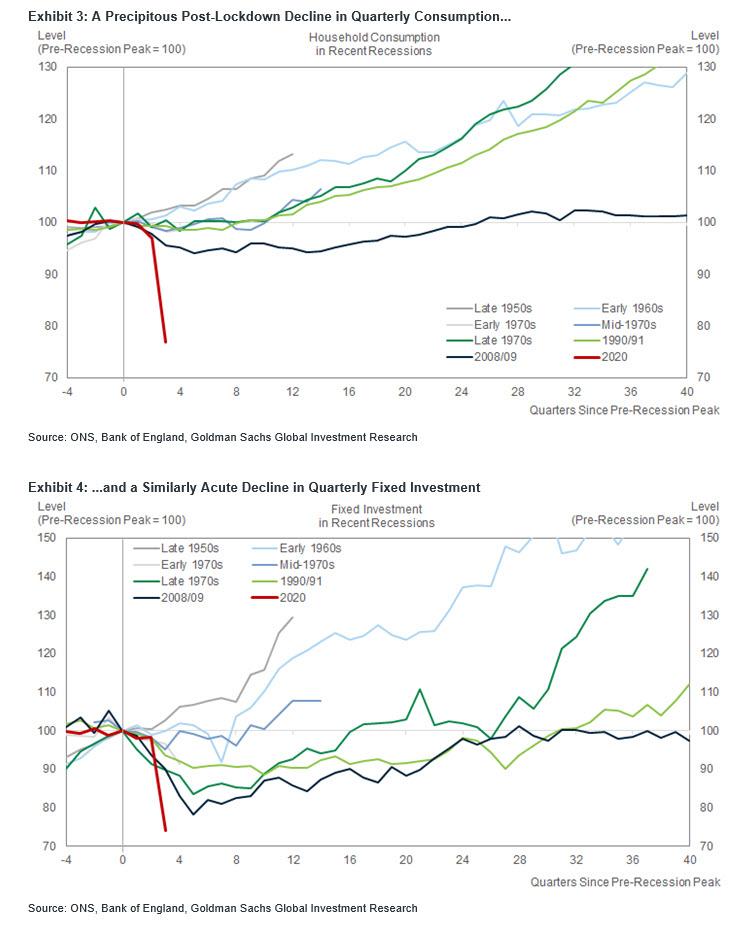

The GDP expenditure breakdown reflects the implications of sectoral susceptibility. Household consumption collapsed by 23.1%qoq non-annl. in the second quarter, accounting for more than 70% of the quarterly contraction in overall GDP (Exhibit 3). Meanwhile, fixed investment fell by 25.5% qoq non-annl., accounting for around 21% of the overall contraction in GDP (Exhibit 4). In both cases, demand in Q2 was around 22% weaker than it was, on average, at the analogous stage of the past seven UK recessions. The precipitous decline in household consumption through the first half of 2020 stands out, even relative to the experience of 2008/09.

As Reuters notes, the scale of the economic hit may also revive questions about Prime Minister Boris Johnson’s handling of the pandemic, with Britain suffering the highest death toll in Europe. More than 50,000 UK deaths have been linked to the disease.

Last week the Bank of England forecast it would take until the final quarter of 2021 for the economy to regain its previous size, and warned unemployment was likely to rise sharply. Any decision to pump more stimulus into the economy by the BoE and finance minister Sunak will hinge on the pace of growth in the coming months, and whether the worst-hit sectors such as face-to-face retail and business travel ever fully recover.

Some economists said the sharper decline partly reflected the timing of Britain’s lockdown – which fell more in the second quarter – and its dependence on domestic consumer spending. As a result, many analysts doubt the bounce-back will be sustained.

Suren Thiru, an economist with the British Chambers of Commerce, said the recent pick-up probably only reflected the release of pent-up demand rather than a sustained revival. “The prospect of a swift ‘V-shaped’ recovery remains remote,” he said.

Britain’s unemployment rate is also expected to jump when the government ends its huge job subsidy programme in October. Sunak – who told the BBC he saw some “promising signs” in GDP data for the month of June – reiterated his opposition to extending the programme. In July he cut sales tax for the hospitality sector and in August is subsidising restaurants to draw in diners.

As Reuters further notes, Britain closed restaurants, shops and other public spaces after many other European countries, meaning more of the hit was felt in the second quarter. However, the Office for National Statistics said that over the first six months of 2020, British GDP fell by 22.1%, slightly less than Spain’s 22.7% but more than double the 10.6% fall in United States.

“The larger contraction of the UK economy primarily reflects how lockdown measures have been in place for a larger part of this period in the UK,” it said. Non-essential shops in England did not reopen until June 15, and pubs and restaurants were shut until July 4.

Some more context: hotels and restaurants did just one fifth of their normal business in June, when the lockdown was still largely in force. In both Britain and Spain spending on hotels, restaurants, recreation and culture make up around 13% of the economy, compared with around 10% or less elsewhere in Europe and the United States. Although some sectors appear to have made a rapid recovery, businesses are wary about the outlook, especially as a second wave of COVID infections could lead to the reimposition of lockdowns. Employers have already shed more than 700,000 jobs since March, according to tax data.

Looking ahead, Goldman is optimistic, and said that its base case “embodies an ongoing acceleration in monthly activity, with scope for additional localised lockdowns and precautionary household behavior but no national lockdown later this year.” As such, the bank maintains the view that GDP growth is likely to rebound sharply in Q3 (it expects +10½% Q/Q print) and the level of GDP is likely to return to its pre-virus peak in early 2022.