Hotel Bailouts At Taxpayer Expense Coming Right Up

Tyler Durden

Wed, 08/12/2020 – 13:20

Authored by Mike Shedlock via MishTalk,

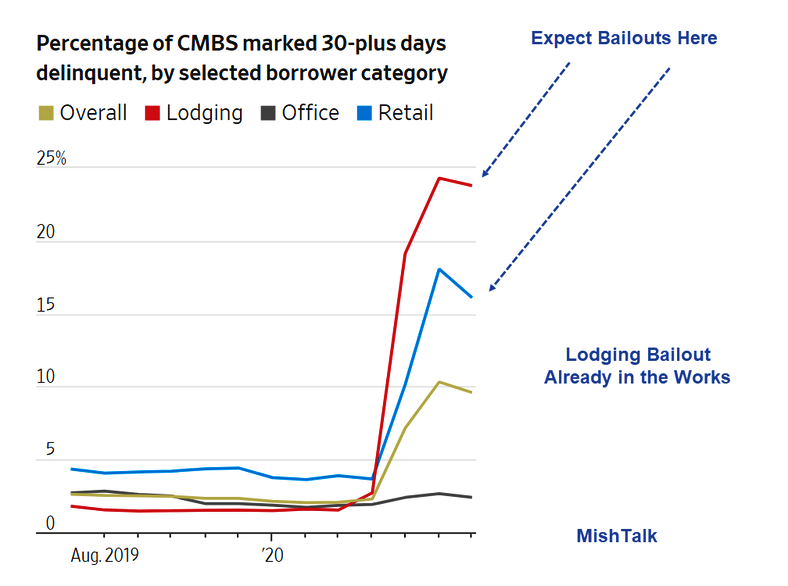

Commercial Real Estate delinquencies have soared led by lodging.

Trepp research shows CMBS Delinquency Rate Surges for the Third Month; Nears All-Time High.

That was for June.

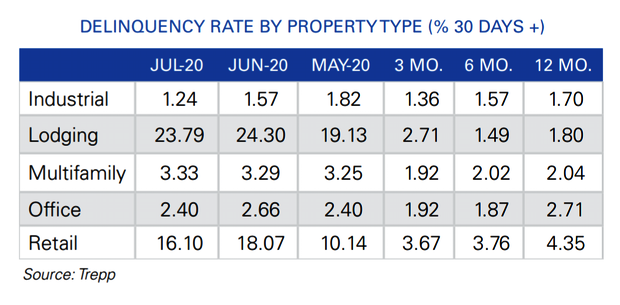

July Delinquency Rates by Property Type

For July, Trepp reported CMBS Delinquency Rate Sees Biggest Drop in More Than Four Years but even with the decline, delinquencies are near record levels.

The notable change in the overall delinquency rate was the result of having more than $8 billion in loans “cured” – which means the loan was delinquent in June but reverted to “current” or grace/beyond grace period status in July.

As we reported in TreppWire in mid-July, some of the improvements came via loan modifications such as a maturity extension. Additional benefit came via reserve relief, whereby borrowers were permitted to use reserves to keep the loan current. (This was confirmed by special servicer or watchlist comments in July.)

The above paragraphs show that it is not clear how much of the alleged improvement is due to extend-and-pretend maneuvers vs. real improvement.

How Long Will Hotels Stay Empty?

That is the key issue.

Trepp discussed that question on June 18.

The report is now a bit out of date, but the observations are still worth a look.

At the beginning of this year, one of the biggest headlines in the hotel sector was a measly growth in revenue per available room (RevPAR) in 2019. According to STR, the hotel industry recorded a 0.9% increase in RevPAR in 2019 – the lowest annual increase since 2009. At the time, STR had predicted that in 2020, overall RevPAR will only grow by 0.5% as an increase in supply would outpace growth in demand.

Little did we know that any forecast – no matter how conservative – would not be applicable in the next few months. With the sudden COVID-19 outbreak spreading at a rapid pace, the hotel and tourism industries across the world faced a devastating halt.

STR’s US hotel performance data has shown week-over-week increases in occupancy recently. From above 60% in late-February, the occupancy dropped sharply to only a third at 22% in early-April. It has since inched up slowly every week, coming in at 41.7% for the week ending June 13th. Going forward, CBRE expects that the hotel demand will return to pre-crisis levels in the third quarter of 2022. In this context, roughly $16.9 billion and $14.7 billion worth of hotel CMBS loans are set to mature in 2020 and 2021 respectively according to Trepp data. Over half of the balance of these maturing loans is backed by full-service hotels.

Expect Some Hiccups

The answer in June was the third quarter in 2022.

Trepp comments “Given the expected timeline of recovery and a significantly lower forecasted demand, especially for high-end luxury hotels, the hotel industry is likely to face some hiccups in the next two years.”

What About Loan Quality?

A University of Austin report by John M. Griffin and Alex Priest show Property Income is Significantly Overstated.

The report is 74 pages long but shows considerable issues.

Many borrowers are now struggling because of coronavirus, though study finds income often fell short of underwritten amount before the pandemic

The WSJ discussed the setup in Commercial Properties’ Ability to Repay Mortgages Was Overstated.

Actual net income trails underwritten net income by 5% or more in 28% of the loans, according to the study of nearly 40,000 loans by two finance academics at the University of Texas at Austin.

The study shows risks in the $1.4 trillion market for commercial mortgage-backed securities, or CMBS, where loans on malls, apartment buildings, hotels and the like get packaged into bonds bought by investors, often with guarantees from the government. The findings suggest that loans sold to investors before the pandemic frequently featured overstated income and could have more trouble staying current in case of a downturn.

The findings corroborate a complaint received last year by the Securities and Exchange Commission stating that commercial mortgage loans frequently feature inflated financials. They also come at a sensitive time for the commercial-mortgage-backed securities industry, which has been seeking a lifeline since the spring, when the Federal Reserve left out swaths of the market from its $2.3 trillion economic-rescue package.

Income was overstated by more than 5% in more than 40% of loans originated by UBS, Starwood Property Trust and Goldman Sachs Inc., the study said. Loans from these originators were among those most likely to be on a watch list, Mr. Griffin found.

“This is a direct function of the aggressive underwriting,” Mr. Griffin said. He disclosed in his paper that he owns a fraud-consulting firm, Integra FEC LLC, which could benefit if the government or investors acted against the bond issuers.

Share of Loans Identified with Inflated Values

Bailout Coming?

Of course! You knew that, didn’t you?

A bill in Congress would create a funding vehicle to help CMBS borrowers make their mortgage payments.

Please consider New Legislation Would Aid Cash-Strapped Commercial-Property Owners

The bill would set up a government-backed funding vehicle that businesses could tap to stay current on their mortgages. It is meant in particular to help those who borrowed in the $550 billion market for mortgages that are packaged into bonds and sold to Wall Street.

“The numbers are getting more dire, and the projections are getting more stern,” said Rep. Van Taylor (R., Texas), who is sponsoring the bill alongside Rep. Al Lawson (D., Fla.)

Get the Fed Involved?

Hey why not?

No stone can possibly be left unturned when it comes to bailouts at taxpayer expense.

Rep. Taylor led a bipartisan group of more than 100 lawmakers who last month signed a letter asking the Federal Reserve and the Treasury Department to come up with a solution for the CMBS issues.

Why?

To protect Goldman Sachs and the rest of the originators from fraud clawbacks due to inflated valuations as mentioned by John M. Griffin.

This has nothing at all to do with jobs as suggested by Rep. Van Taylor (R., Texas) and Rep. Al Lawson (D., Fla.).

Government-Backed?

No!

Whenever you see that term, it’s important to understand the true meaning.

Government-Backed = Taxpayer-Backed.

God’s Work

Taxpayers, not the government, take the risk.

We need to do this to protect “God’s Work” by Goldman Sachs and others.