“Equities Go Parabolic”: The Fed Has Put The Market Into A Positive Inflationary Feedback Loop

Tyler Durden

Fri, 08/14/2020 – 12:10

By Mark Orsley, head of macro strategy at PrismFP

For the past week, we have discussed the emergence of inflation risks which stands to be a major regime shift for 2H. The rates complex has awoken (EDH4 +11bps, 30yr yields +20bps, 2s10s +13bps).

The idea has been the handoff from financial asset reflation driven by Fed policies which caused a precipitous drop in real yields, over to a pure economic reflation driven by “peak COVID” into another round of fiscal stimulus. Fiscal no longer means just stabilization, it now means absolute economic stimulus.

* * *

The macro drivers of inflation have shifted aggressively in favor of reflation:

Dollar has depreciated and is technically set for at least one more leg down DXY still has a 5th wave down coming in the next month or so…

Metal prices have risen substantially (often the best predictor of growth): iron ore, steel, copper, and silver

WTI has recovered from the May contract debacle (though lagging metals) – forward outlook extremely positive as the thesis pivots from oversupply to undersupply – oil now a cheap reflation play

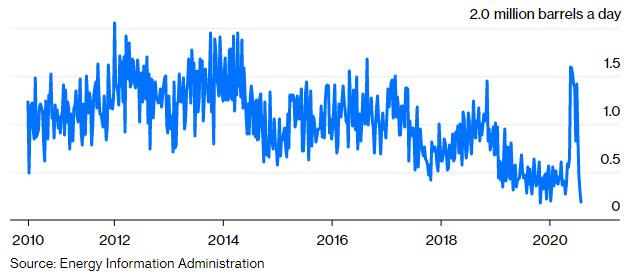

1) Saudis have sharply cut exports to the US to lift prices. US imports of Saudi crude…

2) At this level of US + OPEC production (blue line), WTI average > $60 in 2006, and > $75 in 2010…

US housing boom lifting home prices, housing materials, and home improvement. New home sales (black), Lumber (red), Home Depot (green), Sherwin Williams (purple) all “V’ shape…

Food inflation turning? After derecho winds flattened 10m acres of corn farms in Iowa, which is ~50% of the state’s crop, prices are starting to rise. Corn will eventually break this descending triangle to add another inflationary impulse…

Financial assets have obviously “V” shaped – no chart necessary

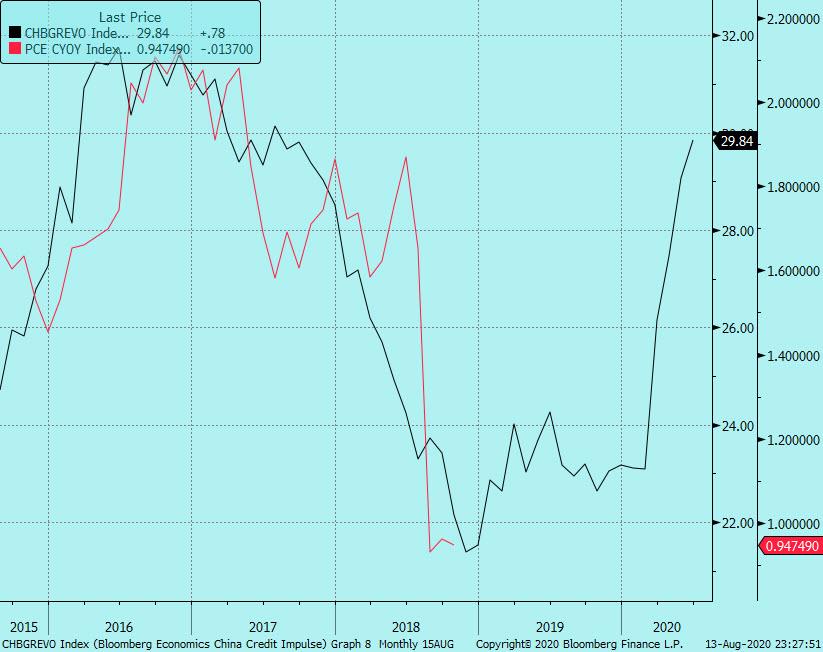

China credit impulse (black) surging – US Core PCE (lagged in red) eventually follows:

* * *

There are future macroeconomic drivers of inflation developing as well:

A housing boom means a coming auto boom

- Urban dwellers (non-car owners) become suburbanites (cars necessary)

- Pent up demand from COVID lockdown

- High savings rate

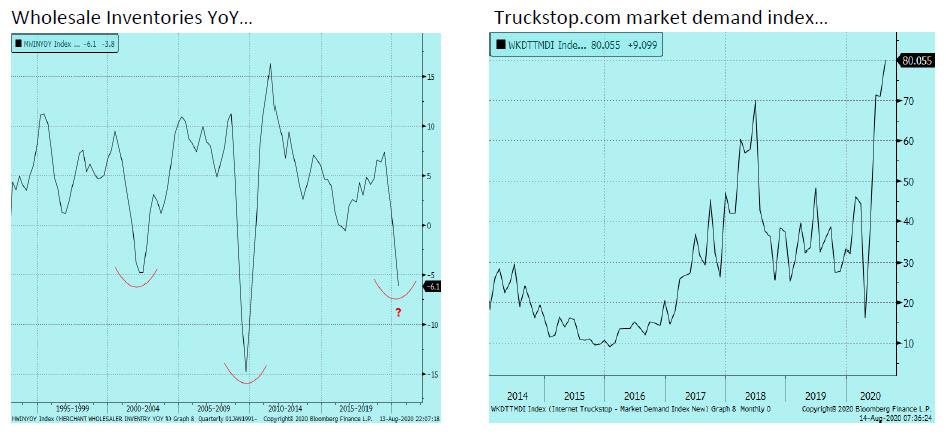

Recall our theme from the turn of the year/pre-COVID of the green shoot potential for manufacturing as inventories rebuild from now even more depressed levels. Trucking demand is surging which is indicative of a manufacturing green shoots to replenish lean inventories…

Supply chains moving out of China means higher costs

“No matter if it’s India, Southeast Asia or the Americas, there will be a manufacturing ecosystem in each,” Chairman Young Liu told investors, saying that while China will still play a key role in Foxconn’s manufacturing empire, China’s “days as the world’s factory are done.”

* * *

The potential negative questions for inflation will be:

- What happens to rental prices as people move out of cities?

- Will drug prices fall as Trump works to compress prices via executive orders?

The inflation impulse doesn’t end there. The policy response will only embolden inflation.

We all know the Fed is on hold and will let inflation overshoot for a time. Something emboldened by the SF Fed white paper released on Monday which foreshadows a coming policy shift from the Fed towards the Average Inflation Targeting (AIT) framework. September odds of AIT introduction just increased markedly.

Additionally, the Fed must remain accommodative for the 15MM claimants of unemployment benefits. The Fed, who is now “socioeconomically conscious”, will continuing easing in the face of 10% unemployment, even if those being economically left behind are not significant drivers of US growth.

Thus, “red” Eurodollars (1yr forwards) are not participating in the sell off as much as “blues” (3yr forwards) – aka the spread is steepening.

In other words, the market is rightfully placing increasing odds that the Fed may not be tightening by 2022, but there needs to be rising probabilities of rate hikes by 2024. In fact, the Fed should rarely be taken at their word and will likely have to tame inflation well before 2024, but for now, shorting blues is optimal.

EDH2/EDH4 spread broke out of its downtrend, retested it, and held confirming the breakout pattern…

From previous discussions, we also know due to the massive debt overhang, nominals yields can never substantially increase. The debt burden moves to unsustainable levels so the Fed must work to compress yields in order to fund the fiscal deficits.

Therefore, although nominal yields can lead the selloff on this initial inflation impulse, eventually Fed policy will be enacted to dampen the yield spike (think YCC, yields caps, etc). That means play the nominal yield rise now, and the continued compression in real yields later (probably around the time AIT is introduced formally).

5yr real yields undergoing an ABC correction before the next wave down – recall we are looking for much deeper negative real yields…

IMPORTANT POINT -> Further to the idea Fed policy will drive even more inflation, in normal reflationary cycles, we typically see:

Dollar depreciates -> commodities rise -> equities rally -> rates increase -> Fed tightens until the cycle ends

However, in the post-COVID/extreme debt burden world, the new reflation cycle will now be as follows:

Dollar depreciates -> commodities rise -> equities rally -> rates increase -> Fed employs measures to dampen yields -> real yields plummet -> dollar depreciates even more -> commodities rise even higher -> equities go parabolic

Essentially the Fed is putting the market into a positive inflationary feedback loop. After all, if we brush off our Econ 101 textbooks, inflating is one way out of a debt bubble.