“These Are Staggering Numbers”: Spending By Unemployed Americans Plunges As Fiscal Stimulus Ends

Tyler Durden

Fri, 08/21/2020 – 18:40

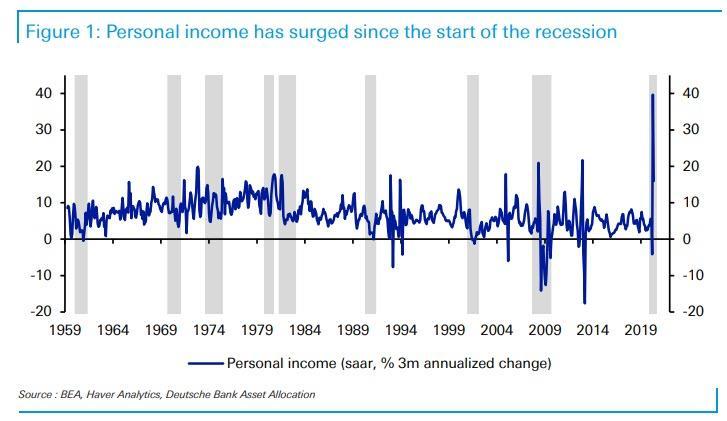

One month ago, with millions of newly unemployed Americans fearful about their future in an economy transformed by the covid pandemic, Deutsche Bank’s Jim Reid made a remarkable observation: “Recessions don’t usually result in personal income soaring, but this one has thanks to government support around the world.” This was shown in the following chart:

This was not a surprise: as Bank of America writes, one of the regular features of US recessions since the 1950s is that they always trigger, with a bit of a lag, an expansion of unemployment benefits. In normal times, benefits in the US are lower than for most other developed market economies, but there is an attempt to close some of the gap during the recession. In recent recessions the additional benefits have tended to be earlier, bigger and last longer. Thus benefits weren’t enhanced until the end of the 2001 recession and provided 13 weeks of additional benefits through Mar 2004. However, for the Great Recession of 2008-9 enhanced benefits were enacted on July 2008, a year before the end of the recession, lasting through December 2013, with the unemployment rate down to 6.7%.

Initially the response to this crisis continued the trend toward stronger responses. Facing a much deeper and faster recession, enhanced benefits were almost immediately implemented and included a large bonus benefit of $600/week. Unfortunately, 4 months later and policy has taken a 180 degree turn: the benefit has been allowed to expire with an unemployment rate still north of 10%. Needless to say, it seems a bit early to declare mission accomplished.

That said, the US is now caught in an unprecedented dilemma – as BofA also notes, “Absent government support disposable income would have fallen the most in history; with that support it has risen the most in history.”

So what’s Congress – and the President – to do?

Well, while the full impact of this economic transformation has yet to be felt across the country, at least for some the government support ended on July 31 when the infamous “fiscal cliff” hit and has yet to be renewed by Congress (executive orders signed by Trump two weeks ago have offset only a modest portion of the stimulus). The group most directly affected are recipients of unemployment insurance (UI) who have seen a notable reduction in income.

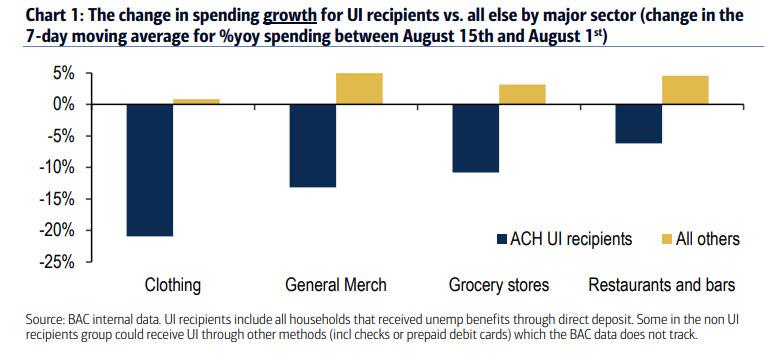

To quantify the impact, Bank of America examined spending trends of the population of card holders who receive UI through ACH

(direct deposit) and compared to all other households. What it found was a dramatic divergence as the YOY rate of growth for UI recipients slowed dramatically but increased for the broader population since Aug 1st.

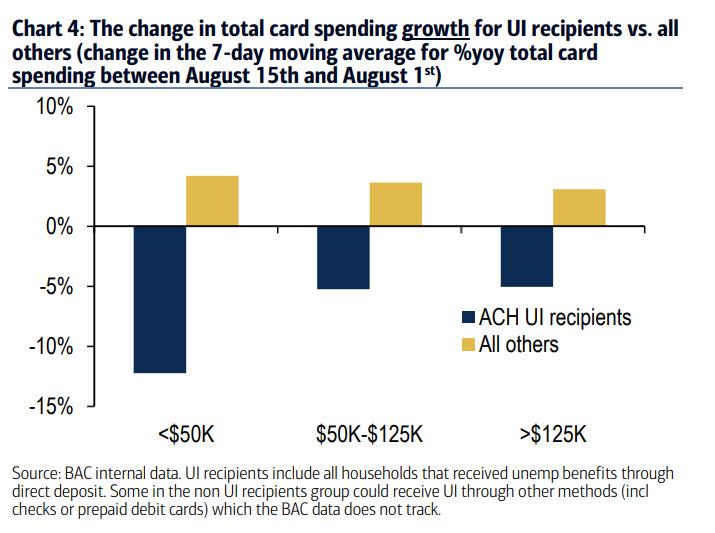

By income, over the past two weeks, the YOY growth rate slowed by 12% for the unemployed cohort (formerly) earning under $50K vs. a roughly 5% drop for the middle and upper income cohorts.

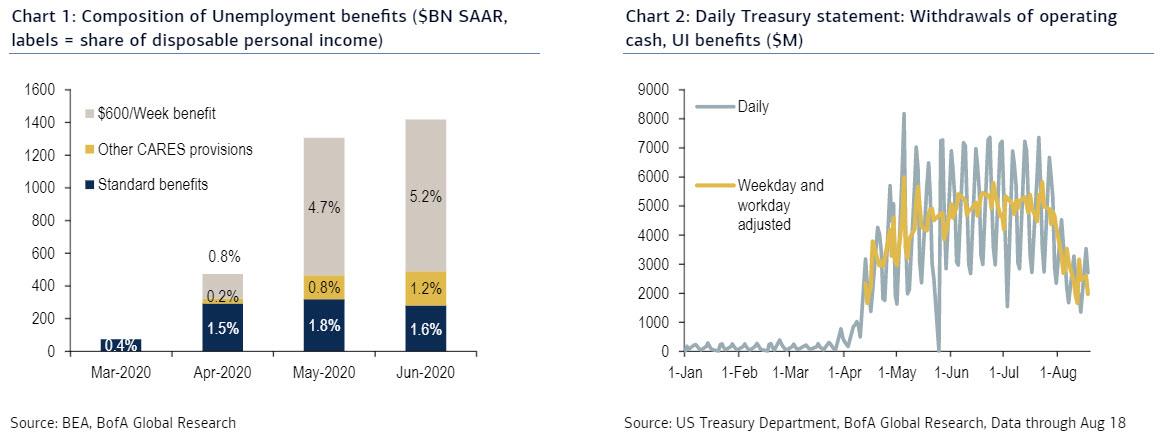

Some more math: a closeer look at the US household income statement underscores the resulting hole in household income as a result of the lapsing of the fiscal stimulu. The $600/week benefit was not a small support to the unemployed, it accounted for more than 60% of unemployment benefits in June (Chart 1). As the numbers on the chart indicate, that means a payment equivalent to about 5% of household income just disappeared. We don’t have data yet for July and August, but the daily treasury statement confirms the collapse in payments (Chart 2). In July the average daily outlay was $4.8bn, in the past five working days it has collapsed to $2.3bn, or a drop of more than half from the peak stimulus period.

These charts show just how reliant on the government much of America has become.

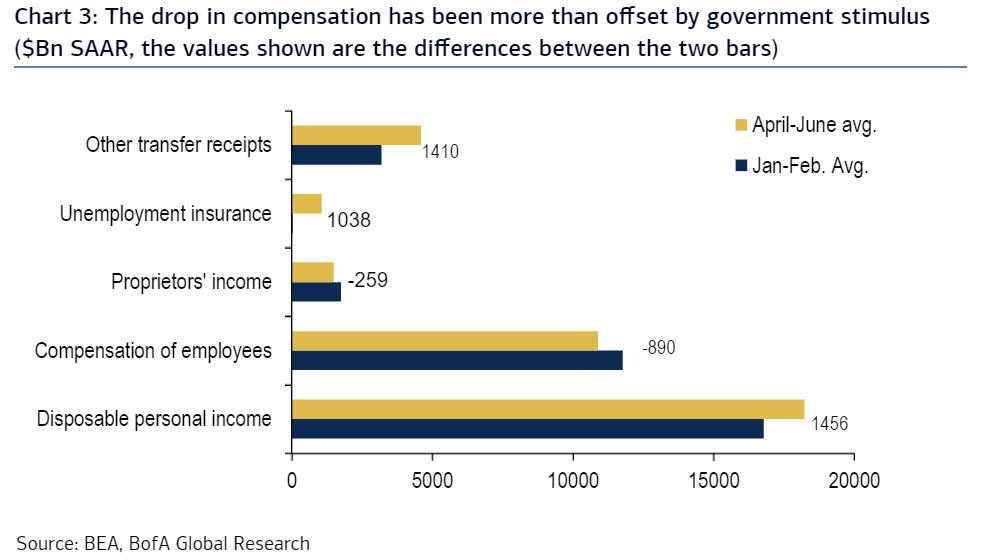

To be sure, much has been made about the resilience of the consumer so far in this crisis. Indeed, while services spending remains depressed, retail sales have fully recovered. However, as shown above, this recovery is deeply dependent on fiscal support. The next chart decomposes the various sources of income in recent months-unemployment benefits, other tax and transfer benefits, labor income, proprietors income and other income.

And here is BofA’s remarkable observation: “Absent government support disposable income would have fallen the most in history; with that support it has risen the most in history.” Note that the role of government stimulus is even bigger because the surge in proprietors income was due to another (now fading) federal program-the Paycheck Protection Program.

So just how much of a hit to consumption – which represents 70% of US GDP – is coming?

Well besides the already noted slump in spending by unemployed Americans, it will take time to see the full effect of the lost payments on consumer spending since presumably some recipients have savings or can postpone rent, credit card and other bills. The early evidence suggests “a moderate shock” according to BofA which again notes – see chart 4 above – that among the unemployed, lower income groups were among the hardest hit, with the YOY growth rate slowing by 12% for the cohort earning under $50K vs. a roughly 5pp drop for the middle and upper income cohorts.

While the bank has not done a formal simulation of the impact of the lost fiscal stimulus, a simple illustrative example from the Petersen Institute can give a sense of the magnitude. First, they assume that 20MM people were unemployed at the end of July and that the $600 benefit has a fiscal multiplier of 1.5 (around the midpoint of the CBO’s range of estimates). The expiration of the $600/weekly benefit would therefore remove about $50bn in income from the economy per month. By their estimate, this would result in about a 2.5% decline in GDP, 2MM less jobs over the next year and a 1.2pp increase in the unemployment rate.

As BofA summarizes “while illustrative, these are staggering numbers.” Moreover, based on the latest claims data there were around 15MM people on standard unemployment benefits as of the week ending August 8 with millions more in other programs such as Pandemic Unemployment Assistance (PUA). Thus, the full impact will likely be even more acute than modeled by BofA.

The final question is whether President Trump’s executive orders can offset the shock to incomes.

Let’s look first at the unemployment benefits and then at executive orders as a group. The executive order earmarks the $44bn in remaining FEMA funds for unemployment benefits of $300/week. In addition, initially it required states to provide $100/week in matching funds, but that requirement was dropped as it became clear that it would deter cash-strapped states from participating. Since the program is new it will take time for states to set up the new system, and indeed as we pointed out earlier this week, only 7 states have so far signed up for the $300 unemployment stimulus plan. Hopefully a number of states will have the program up and running by the September 1 launch date. While this new payment cuts the income shock in half, the funds are likely to only be enough to cover a month or so or into early October, one month ahead of the elections. Moreover, the order is backdated to start on Aug 1. So in practice, the funds may be disbursed quickly after states have set up their programs.

The other major executive order is the deferral in the employee component of the payroll tax from September 1 until December 31. Objectively, this will provide very little support to consumer spending, and as we also noted earlier, business lobbies are already complaining that the program is “unworkable” – a letter co-signed by a number of groups including the US Chamber of Commerce, the National Retail Federation, the National Association of Manufactures and others argued that (1) the order would result in a significant tax bill in 2021 for employees, (2) the implementation of the order is unworkable and (3) many members expect to decline to actually adopt the deferral.

Even for workers at firms that do implement the deferral the impact on spending will likely be very small. Households that are not in financial distress will save most of the tax cut in anticipation of a big bill at tax year end. Of course, workers that are in distress due to unemployment will not benefit from cutting a tax they are not paying. That leaves a relatively small group of households that remain cash strapped even though they are still employed. Presumably they will spend a good part of the tax cut.

What happens next?

As we have reported almost every day for the past three weeks, Congressional negotiations seem hopelessly bogged down and furthermore, Congress is currently on recess with funding the post office has become a major distraction. Both parties are having their conventions. Both parties are watching to see if the executive orders work. And an election looms.

As BofA’s economists concludes, while they had hoped for a deal this month, “increasingly it looks like one only comes after Labor Day and after demonstrable pain in the economy.” Unfortunately, in a world in which the market no longer reflects the economy, it is unclear just what signal US politicians will seek to determine that the economy is “in pain.” Ironically this will make the disconnect between the soaring market which just hit a fresh all time high and the economy which is about to double dip, even more grotesque.