Hedge Funds Start Piling Into “The Big Short 3.0”

Tyler Durden

Fri, 08/28/2020 – 22:56

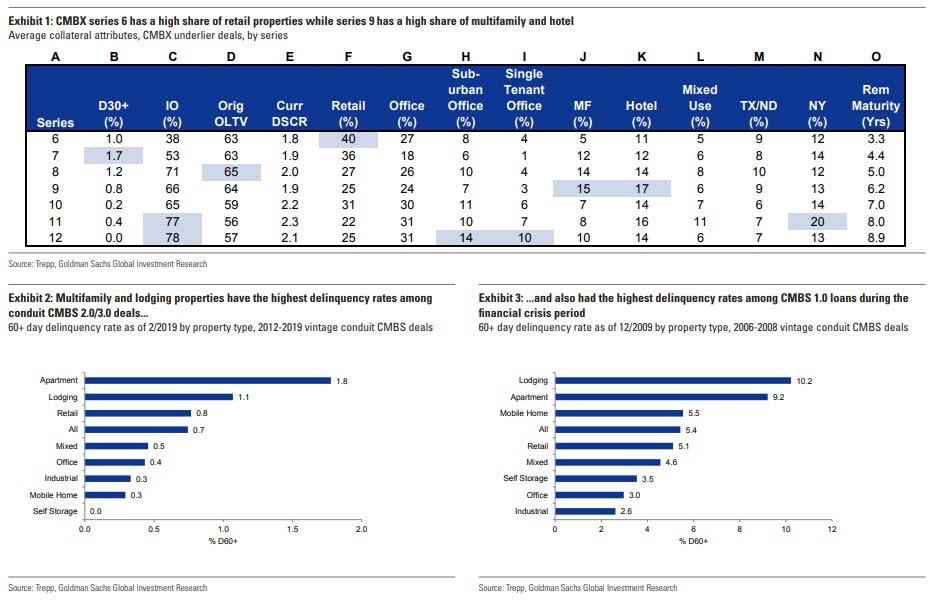

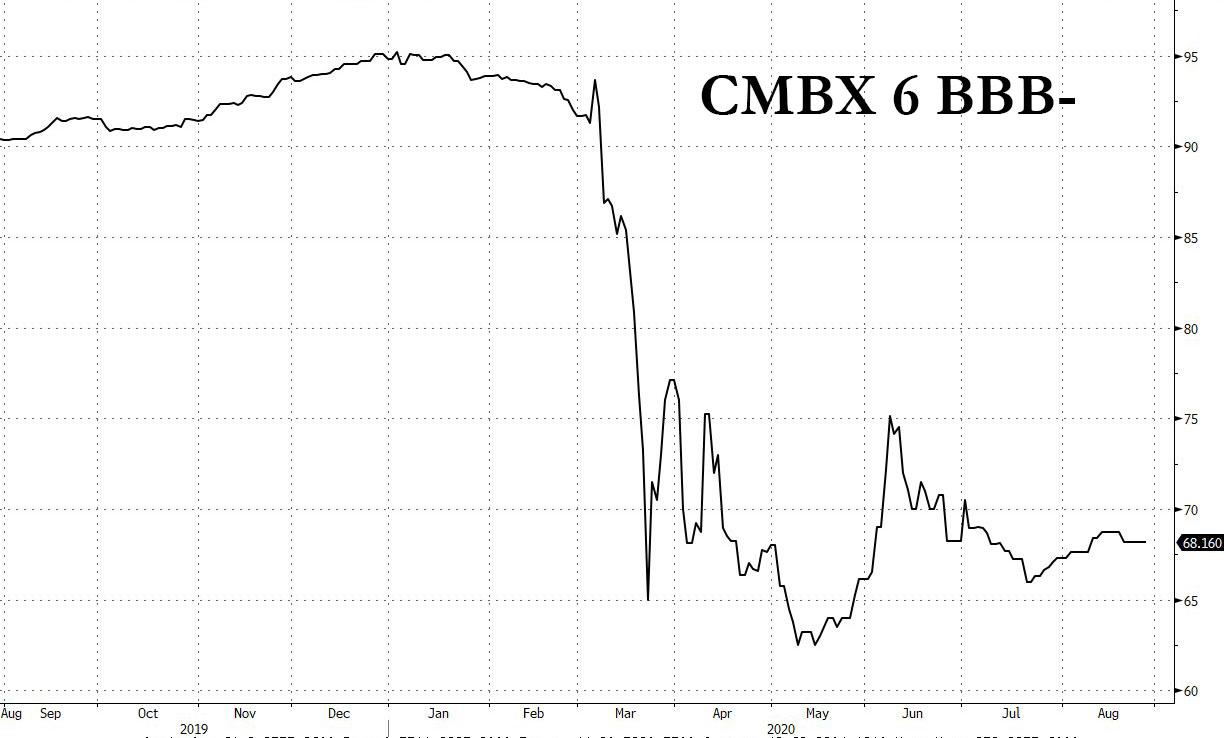

Back in June we said that as we had reported previously, with commercial real estate failing to benefit from the record rebound in overall risk since the March lows as a result of a tidal wave of retail bankruptcies, CMBX Series 6 which back in March 2017 was dubbed the “Big Short 2.0” trade due to its substantial exposure to malls which were hurting long before the arrival of the pandemic…

… and especially the BBB- tranche, has been stuck in purgatory, and after surging to 75, is back to where it was in mid-April as investors signal that the worst is yet to come for commercial real estate.

Of course, all of this is well-known by now, and it is safe to say that the riskier tranches of CMBX S6 are now fairly priced for even a downside scenario among retail outlets. But what about other CMBX issues, and is there another “Big Short” lurking among the various tranches, especially in the aftermath of the coronavirus shutdowns which will cripple not just retail outlets but everything from restaurants, to multi-family housing (as city renters flee for the suburbs), to offices and hotels.

As we said all the way back in May, the answer to all those seeking the next Big Short, or Big Short 3.0, is CMBX 9. This is what we wrote:

… with CMBX 6 now done, keep a close eye on CMBX 9. With its outlier exposure to hotels which have quickly emerged as the most impacted sector from the pandemic, this may well be the next big short.

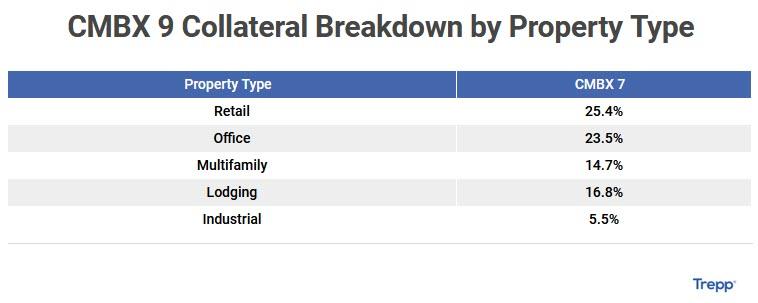

A few weeks later commercial real estate analytics specialist Treppagreed with us. As Trepp’s Manus Clancy wrote in a blog post, “the COVID-related volatility over the last three months has resulted in growing interest over CMBX as a way to take positions on US commercial real estate. This week we are back to hone in on CMBX 9.“

Below are some of the reasons why CMBX 9 – which so far is off-limits to the Fed’s blatant bailouts of most, but not all, asset classes – may be the cleanest and safest way to bet on the devastation resulting from the coronavirus pandemic. Courtesy of Trepp:

What Makes CMBX 9 Unique?

For one, it’s the only CMBX index backed by 2015 deals. Before the COVID-19 crisis began, the last meaningful hiccup in CMBS lending came in early 2016. In late 2015, volatility in the US equity markets picked up considerably and oil prices fell to under $30 a barrel. The sharp price decline in black gold led investors to fear a wave of forthcoming bankruptcies from energy companies.

That fear led to a sharp repricing of credit in the leveraged loan market and that widening had a gravitational pull on CMBS, dragging spreads wider over the course of two months. That widening in CMBS led to an abrupt pause to CMBS lending leading to a standstill in issuance in Q1 2016.

The 2015 CMBX 9 reference obligations consist of deals issued before any of that drama emerged. (The 2016 oil downturn in CMBS also led to several defaults of hotel and multifamily loans backed by “man-camps” in the shale regions of North Dakota and elsewhere.)

Other Attributes of CMBX 9?

It has the highest concentration of multifamily loans of any CMBX series with 14.7%. (The only other series that is close is CMBX 13 with 14.1%.)

CMBX 9 also has the highest concentration of hotel loans with 16.7%. (CMBX 11 is next with 13.8%.) In terms of protection premiums, CMBX 9 BBB- costs about 725 basis points to insure. That’s well inside of the 925 basis points for CMBX 8 BBB- but wider than the 675 for CMBX 10 BBB-. (Those spread levels are from IHS Markit).

For comparison purposes, CMBX 9 BBB- ended 2019 with a spread of 310 basis points. So there has been about 400 basis points of widening since the beginning of the year.

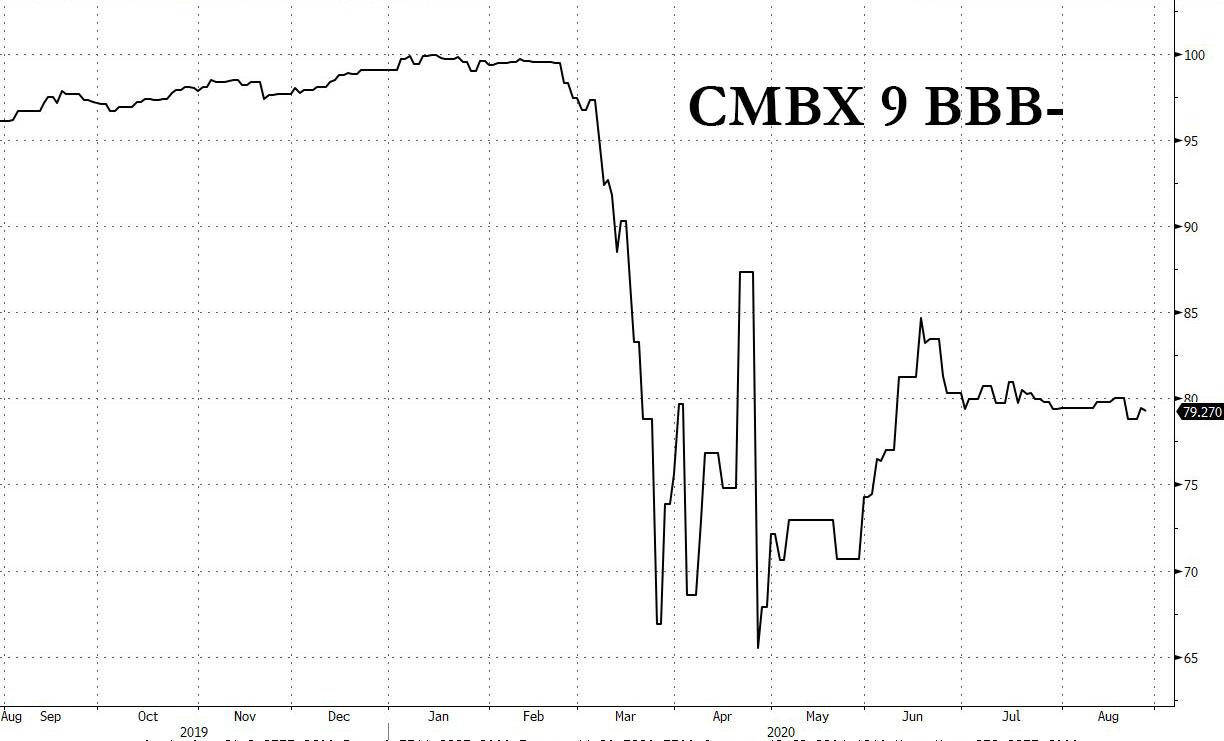

Furthermore, as we most recently showed in late June, there was a lot of potential downside for CMBX Series 9 BBB-. In fact, if the hotel world suffers a perfect storm of pent up defaults coupled with waves of covid-related shutdowns which send the hotel industry into another tailspin, the potential downside here could be even greater than for Series 6.

Today, Bloomberg has caught up and writes – three months after us – that hedge funds are “beginning to set their sights on a U.S. credit-derivatives index with outsized exposure to hotel debt as the pandemic sinks the hospitality industry into distress.” Actually, they “began” to set their sights in May but who’s counting.

The funds, the report goes on, are starting to build up wagers against the synthetic index, known as CMBX 9, “shifting attention from a high-profile bet against America’s challenged malls” i.e., the popular CMBX 6 short first profiled here in 2017 as “The Big Short 2.0” and which made traders such as Carl Icahn $1.3 billion in profit.

The shift, which market participants say is beginning to show up in some trading flows, comes as delinquencies on hospitality property loans surge and even begin to exceed those in retail.

Bloomberg quoted Dan McNamara, a principal at MP Securitized Credit Partners, a hedge fund focused on shorting commercial mortgage bonds and which also made a killing on shorting CMBX 6 (unlike his nemesis Brian Phillips of AllianceBernstein, a famous CMBX 6 bull, who in June lost his job) who said that “in the last month there has been more selling pressure on the CMBX 9 than any of the other CMBS indices. That’s because some hedge funds are actively looking to play the short side on the Series 9 index due to its significant hotel exposure.”

Well, seek and ye shall find, as we reported first in May in then and again in June in “Is This The Next Big Short?”

Meanwhile, “funds have been coming out of the CMBX 6 and moving onto the CMBX 9,” said Christopher Sullivan, chief investment officer of United Nations Federal Credit Union. “The CMBX 6 trade has gone a bit long in the tooth and is now more fairly priced given the likely pandemic effects. We can see this series becoming the favorite option now.” This is precisely what we said in June.

The question now is how long before CMBX 9 BBB-, which has shown remarkable resilience in recent months, snaps lower. Something tells us it won’t be too long: nearly 25% of hotel loans in CMBS are now delinquent, according to Cantor Fitzgerald, compared to about 20% for anchored retail loans. Across the broader CMBS universe, about 10% of hotel loans securitized in bonds are now more than 90 days overdue, compared to only 3.7% for retail loans, Darrell Wheeler, head of research at the New York-based firm, told Bloomberg.

As shown in the chart above above, the fulcrum BBB- tranche of the CMBX 9 series fell to 65.5 cents on the dollar by late April from almost par in early March. It’s since gradually fallen in price to 79 cents on the dollar Thursday from its mid-June peak of about 85 cents.

UNFCU’s Sullivan said CMBX 9 trading volume has been increasing for well over a month, and was among the most actively traded across CMBS indexes for several days in July and August, according to aggregated swap depository data compiled by Bloomberg. Total cumulative trading volume for all tranches of the CMBX 9 increased to $258.5 million on Aug. 26 from $30.2 million on July 28, the data show.

To be sure, the shorts are quietly piling in: for the week ending Aug. 21, the BB tranche of CMBX 9 had $95 million of CDS contracts trading in the market, the highest of any series’ BB tier, according to JPMorgan Chase & Co. data. CMBX 6 had the next greatest amount trading, at $35 million, but that number is declining.

That said, there is always the risk of holding on to a negative carry position for too long before the target “catalyst” – i.e., a price crash – occurs. That’s what happened to some of the earliest proponents of the CMBX 6 short trade such as hedge fund Alder Hill Management, which had been short the CMBX 6 since at least early 2017, and was forced to shutter last year as losses on the wager piled up.

One final note which Bloomberg points out: the CMBX 9 trade doesn’t mature until 2025, while CMBX 6 shorts can get their payouts in 2022. And for short sellers, “CMBX 9 is not as clear cut as CMBX 6, where we expected several BBB- bond classes to take full losses,” Cantor’s Wheeler said.

Liquidity could also be a concern: “It’s not clear whether there will be enough two-way volume in the CMBX 9 index to sustain large bets, said Matt Weinstein, a partner at Axonic Capital, a hedge fund specializing in structured products and commercial real estate. But the thesis makes sense, he said. With one in four hotels in CMBS already in default and revenue per available room still down nearly 50% year-over-year, defaults are likely to pile up as forbearance agreements with lenders roll off.”

“From a thematic viewpoint, it makes sense to short hotels,” he said.