Morgan Stanley No Longer Sees A Fiscal Stimulus Deal Before The Election: What That Means For Markets

Tyler Durden

Mon, 09/14/2020 – 14:44

As recently as two weeks ago, virtually every Wall Street strategist was convinced that a new fiscal stimulus deal was inevitable, and would come somewhere in the $1.5- $2 trillion ballpark. After all, the cost of not passing such a deal was too great for both parties.

As Morgan Stanley’s Michael Wilson wrote on the first of this month, “the noise is starting to build as supplemental unemployment benefits have stopped. The recovery in certain spending may be threatened should these benefits not be restarted in a timely fashion. It’s hard to believe that Congress fails to execute on some version of this bill, given the dire consequences of failing to do so.” He concluded that “it would effectively be political suicide for any incumbent up for re-election” adding that “at the end of the day, a little more grandstanding and pressure from the markets are likely to result in the bill getting passed by mid-September and perhaps larger than currently expected – US$1.5-2 trillion is likely, but there is a growing possibility that it’s larger according to our public policy strategist, Michael Zezas.”

Well, it’s now the mid of the month, and a deal is more elusive than it was weeks ago, and the same Michael Zezas who was the biggest CARES act cheerleader is suddenly not so sure. Indeed, in a report asking tongue-in-cheek What If DC Doesn’t CARES…

… the Morgan Stanley political strategist first lays out his thinking to date, writing that since negotiations first stalled in early August, his base case on the potential for the US to enact proactive fiscal stimulus (i.e., CARES 2) has been:

- A deal remained likely, but the conviction on the potential for a deal declined substantially.

- This was driven by learning that Democrats intended to hold out for a far bigger deal than anticipated, implying a wide bid/ask between Democrats and Republicans and therefore substantial execution risk on negotiations.

- He had previously said that CARES 2, at least on a proactive basis, would become unlikely if “talks remain stalled deep into September, and reports are that Republicans and Democrats remain far apart on top-line numbers for the deal” since “the policy disagreements on stimulus may have hardened and politicians may be eager to get on the campaign trail.”

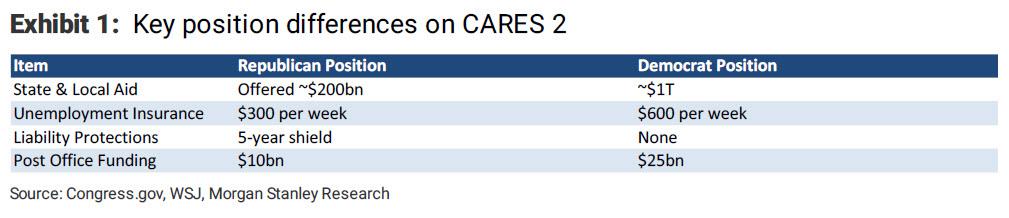

As a reminder, this is what the key position differences are between Republicans (bid) and Democrats (ask) on the CARES2 package:

In any case, Zezas admits that a glance at the calendar shows that “deep into September” is right around the corner. Hence, the bank would trash its previous expectation “if we don’t see negotiations moving toward a round of proactive fiscal stimulus (CARES 2). Consider:

- The political rationale and incentives for both parties to reach an agreement on CARES 2 remain strong, but actions ultimately matter. It’s increasingly difficult to ignore the lack of results in the negotiations.

- Any deal must likely be brokered by the White House and Democrats, as Senate Republicans appear unable to rally around a consensus negotiating position for a comprehensive stimulus.

- If it’s true that the White House and Democrats will, separate from a stimulus deal, negotiate a continuing resolution to avoid a government shutdown at month’s end, then there may be no more calendar-based incentives to reach an agreement.

- The White House and Democrats have been far apart on key issues for over a month now.

Putting all this together, Zezas concludes that “without reports showing demonstrable, gap-closing progress in the short term” which there are none so far “we can only conclude that the more likely outcome has become that no proactive stimulus deal is achievable before the election.”

So what happens next? Well that’s where things get interesting, because as a reminder, it has long been Morgan Stanley’s position that a market correction (like the one we just had and which is already largely forgotten) or full-blown crash – may be needed to get Congress to act. And while Morgan Stanley does not anticipate an imminent market shock (although Michael Wilson did correctly hint at last week’s 10% Nasdaq correction), Zezas says there are two events which could bring stimulus back into the bank’s base case, one of which predictably, is a response to a “market event”:

- A ‘reactive’ stimulus deal would remain a possibility: Weaker data and/or markets have been shown to scramble political norms and elicit fiscal responses. But this naturally would be of little consolation to investors if the goal is to avoid such adverse outcomes in the first place.

- A ‘unified government’ outcome from the US election: If either Republicans or Democrats sweep, we would expect fiscal expansion starting in 2021. Republicans would likely undertake this through fresh tax cuts. Democrats could deliver a de facto stimulus due to the practical realities of legislating to meet the needs of vulnerable moderates in their caucus: agreeing to a policy set that raises insufficient taxes relative to planned spending on healthcare and/or infrastructure.

Separately, Morgan Stanley chief economist Ellen Zentner writes that while the US economy had enjoyed a remarakble rebound in the past few months (thanks to the government’s gargantuan spending package), “should Congress fail to pass CARES 2, the loss of fiscal impulse would be sizeable and come sooner”:

Strong underlying momentum can likely carry the economy for a bit longer, but ultimately the recovery would slow. As noted, failure to act could push the timing of the economy’s return to pre-Covid-19 levels back by two quarters to 4Q21, our previous expectation. The economy has not suffered the full effects of Covid-19 because fiscal policy plugged the hole in income created by job losses. Without an extension of that support, the economy would need to align with high rates of unemployment and all they entail. What’s more, the failure of Congress to pass support for state and local governments could accelerate layoffs.

In a worst-case scenario, the acceleration in layoffs could be enough to halt improvement in the unemployment rate, and at the very least slow the pace of improvement. With the help of a stronger rebound in revenues, the hole in state and local budgets is not as large as it might otherwise have been, but states like NY, NJ, CA, and TX may have been holding off on deeper job cuts in anticipation of receiving federal aid.

So as Wall Street debates how Congress acts, and if it will be forced to respond to a market drop, millions of Americans no longer have the benefit of emergency unemployment benefits which to so many are absolutely critical for day to day lives.

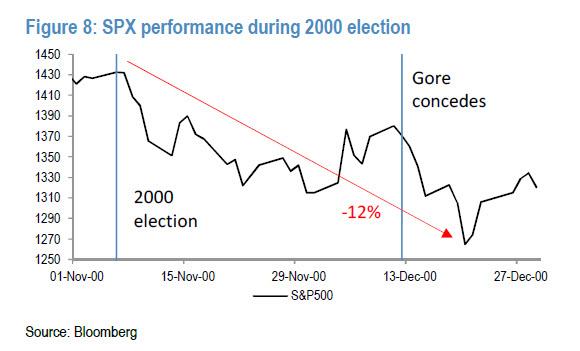

But where things get even more complicated is the growing realization that a presidential election will likely not present a clear winner on Nov 3 and instead market will have to wait for weeks (if not longer) until a clear winner is determined. In fact, as JPMorgan noted earlier, a contested election is the “worst-case scenario” for the market, if the 2000 election is any indication.

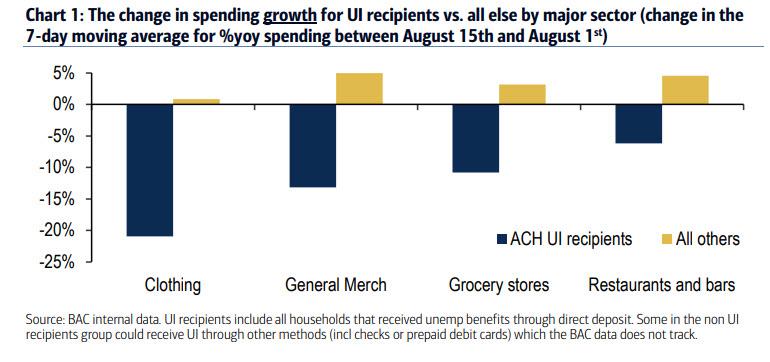

The bottom line is that all hopes about another fiscal stimulus before December – at the earliest – can be abandoned, which then prompts another question: when will the material decline in government stimulus and handouts start impacting consumer spending in the US. To be sure, we have shown that (former) recipients of UI benefits – which stopped on August 1 – have seen their consumption across key categories tumble in recent weeks.

When will this pronounced spending drop affect the broader economy, and how will markets respond. One final question: recall that former NY Fed president Bill Dudley said that the surest way to prevent a Trump re-election was to crash the market ahead of the election (he did so in a Bloomberg op-ed which prompted outrage from all those who idiotically claimed that the Fed is apolitical). One wonders if it is indeed the establishment’s intention to insure that a second Trump term does not happen, whether precisely this sequence of events won’t become the dominant narrative in October, just one month from now, culminating in a very tactical and politically-motivated market crash…