By Tyler Durden

By Tyler Durden

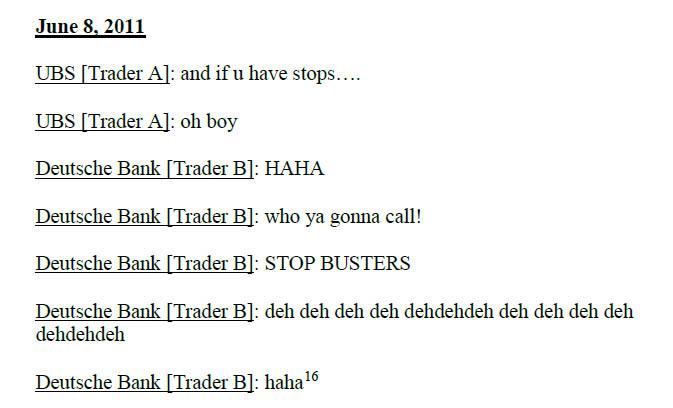

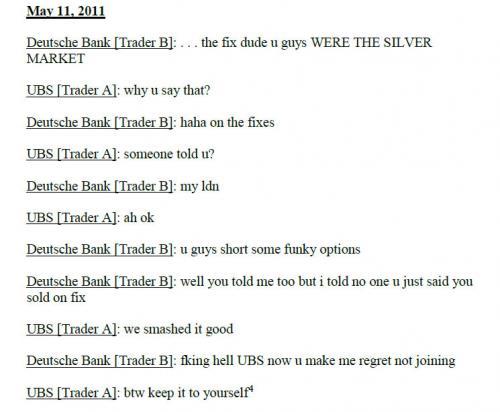

We first brought you the fascinating story of Deutsche Bank’s gold spoofer David Liew back in June 2017, when we revealed that the former precious metals-trader turned government star informant was responsible for busting a massive ring of gold manipulators that resulted in numerous arrests and multi-million penalties paid by banks including Deutsche Bank, UBS and HSBC. For those who need a refresher read “Deutsche Bank Trader Admits To Rigging Precious Metals Markets” in which we showed such internal chat board excerpts as the following:

And of course this:

Fast forward to today, when the Former Deutsche Bank analyst David Liew told a Chicago jury he learned how to manipulate gold and silver prices from the two successful senior traders he admired and worked with for about three years. As Bloomberg reports, Liew “said he wanted to be a team player and make money after joining the bank’s Singapore office, so he began doing “spoof” trades the way he was taught by Cedric Chanu and James Vorley” two other Deutsche Bank gold traders who were perp walked in January 2018 as the crackdown on spoofers hit.

According to Liew, “the senior traders often placed buy and sell orders they never intended to execute, a strategy intended to influence prices so they could reap illegal profits.”

“I saw Mr. Vorley and Mr. Chanu do it,” Liew, the prosecution’s star witness, said Wednesday in federal court. Liew, who has already pleaded guilty to spoofing charges and is cooperating with the government, said he sat next to Chanu in Singapore from 2009 to 2012 and communicated daily on a live video chat with Vorley in London.

And the punchline: while Liew knew manipulating prices was wrong, he said spoofing trades were “so commonplace” in the market and among his co-workers that he figured it was OK.

Indeed it was, and it’s why so many precious metals traders would fume at the irregular price action in precious metals in the 2008-2013 period when the above-mentioned banks had honed their manipulation to an art.

As a reminder, Vorley and Chanu are on trial for fraud and conspiracy, accused of issuing multiple bogus trade orders between 2008 and 2013. The case is the latest prosecution of “spoofing” trades brought by the U.S., which has been cracking down on the practice since the so-called “flash crash” a decade ago, according to Bloomberg

Liew described one of the countless trades in which he worked with Vorley to manipulate the gold price:

On Aug. 26, 2010, Liew said he put in an order to sell 15 futures contracts, valued at around $1.8 million based on prices at the time, while Vorley placed an order to buy 80 contracts, which would have been worth about $9.9 million. When prices rose, Vorley canceled his buy order and Liew executed his sell order, Liew said adding that Vorley and Chanu would often help Liew with his spam trades.

If they saw he had an open sell order, they would put in a buy order to help him get a better price, exhibits presented at the trial show. Such coordinated spoofing could also be done by a lone trader placing orders on each side of the market.

It gets better: Liew said he became so familiar with spamming that he could tell when his colleagues were doing it. One day, he noticed Chanu was making such a trade, and Liew sent him a message saying, “be careful … don’t let the buy orders get into the market,” according to a chat log and Liew’s testimony.

In their defense, Vorley and Chanu claim their actions were legal, and that canceling orders is an accepted bluffing strategy in the competitive world of high-frequency trading, where computers use algorithms to execute massive trades in milliseconds. Of course, that’s a lie, but it’s just yet another inadvertent confirmation that the entire edifice of high frequency trading is built on manipulation. The defense lawyers also argued that none of the traders’ actions were flagged by Duetsche Bank’s compliance department. Which speaks volumes about just how rampant and accepted gold manipulation was on Wall Street – even legal departments turned a blind eye.

Another argument used by the defense lawyers was their attempt to discredit the claim that Chanu and Vorley intentionally canceled trades. Liew acknowledged that there might be all sorts of situations that would result in a cancellation, including if the trader goes to lunch or the bathroom. “There’s no button that says what intent is,” defense lawyer Matthew Mazur said while questioning Liew. Of course, that particular line of defense would not fly with spoofing HFT algos which, last time we checked, don’t have bathroom breaks.

In another bizarre defense tactic, Mazure said that Liew must have been aware that his own price-manipulating strategies weren’t legal. In an Aug. 8, 2010, chat message to Chanu, Liew wrote: “Cause Dodd Frank gonna get me fired, Ha Ha,” according to a transcript of the conversation shown to jurors. Well, yes, and that’s why Liew is now a star cooperating witness for the prosecution.

Source: Zerohedge

Subscribe to Activist Post for truth, peace, and freedom news. Send resources to the front lines of peace and freedom HERE! Follow us on SoMee, HIVE, Parler, Flote, Minds, and Twitter.

Provide, Protect and Profit from what’s coming! Get a free issue of Counter Markets today.

Deutsche Bank Gold Manipulator: “Spoofing Was So Commonplace I Figured It Was OK”