For Volatility Traders, November Election Will Be A Career “Maker Or Breaker”

Tyler Durden

Wed, 09/23/2020 – 12:06

Uncertainty surrounding the election was already maxing out amid armies of lawyers on both sides of the aisle preparing to argue over every ‘hanging chad’ they can find with a “never concede” precedent being discussed. And then the sad passing of RBG turned the risk up to ’11’ as stimulus hopes fade amid SCOTUS nominations.

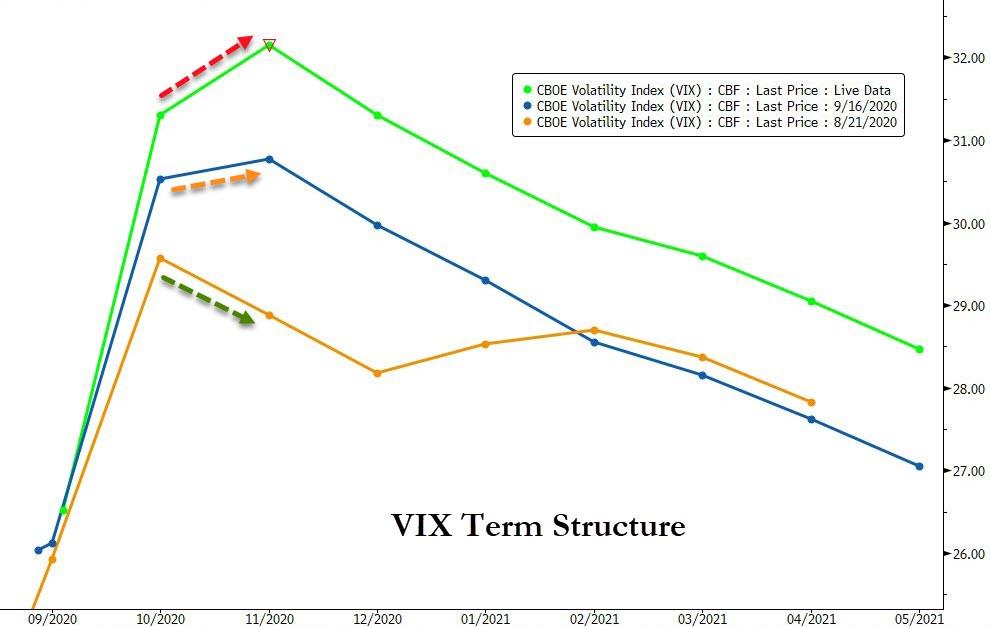

The rising uncertainty can be seen clearly in the VIX term structure which has ‘humped’ more and more over the last month…

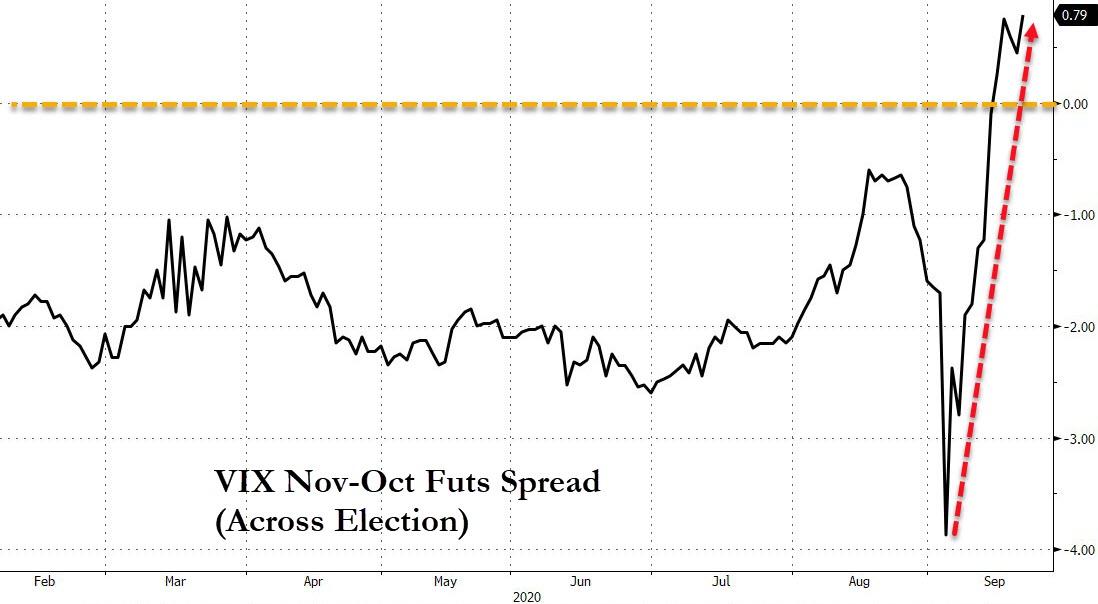

With the cross-election spread spiking to highs…

As investors price in the possibility of delayed results or contested election (via Goldman):

One consequence of the pandemic is the fraction of voting occurring via mail is likely to significantly exceed that in prior US elections. Because verification and counting of these mailed ballots does not occur until election dates in some states (including battlegrounds), and given the experience of the primaries, there is a good chance that the result may not be clear on election night.

While markets appear to have internalized this possibility, there are additional potential sources of uncertainty. In particular, there appears to be a significant bifurcation in voting method preferences between Democrats and Republicans, with a significant majority of Democrats expressing an interest in voting by mail and a majority of Republicans preferring to vote in person. This could lead to the appearance of a Trump lead on election day, but a potentially significant portion of the Biden vote still to be counted in the mail-in ballots. In a close election, such an outcome could result in claims/counter-claims of victory and/or litigation, and result in significant market volatility over an extended period.

And while the volatility market is beginning to price in this uncertainty, Nomura’s Charlie McElligott points out that the market feels like Dealers are back long vol and long downside again (we have spoken about clients “buying the dip” through selling QQQ Puts etc to Dealers), comfortably supporting a much “stickier” long-gamma market which continues to firm

“High” implied vols still screening “rich” and thus continue to compress meaningfully (providing mkt support), although skew in QQQ’s seems super cheap ahead of what implieds around- / post- Nov Election are telling you.

The SPX curve / term structure however was already steep, and yday saw election straddles “trueing up” higher again—after all, it has become consensus thinking that recounts and likely a Supreme Court decision are likely to drag the determination of the next POTUS through the end of the year.

But McElligott has an ominous warning for market participants:

This also likely means that some brave vol traders will try to take advantage as a perceived “generational” opportunity to sell this POST-NOV election “richness” (Dec / Jan) – could be a career “maker or breaker,” with the potential to see monster returns if the event were to pass and all that crash is puked back into the ether… or conversely be turned to dust into a God-forbid realization of chaos, with civil disorder, dual claims to the throne etc

These vols as I have previously stated will likely “stay rich” as no dealers / MMs will be able to go short vol / short gamma in said time buckets from a risk management perspective, while hedging demand likely continues to grow through the roof into the event risk – thus, due to this extremely likely “lack of supply”, implied vol will go even higher and more extremely optically “rich”

VIX space has now become day trading with futures “stuck” – buying UX1 when it dips 28-29 and selling it 31-32 before things get weird again on Nasdaq unwind / SCOTUS implications on NO stimulus deal / Election.

Finally, we remind readers that, while there isn’t an exactly analogous episode in history to the divisive chaos we are facing, we note that it took roughly a month for the results of the 2000 US presidential election to be settled, and over that time, the S&P500 and 10y UST yields declined by roughly 6% and 50bp respectively.

Do you think investors are ready (priced-in) for a move similar (or worse) than that? Will long high beta stocks be the new widowmaker across November 3rd?