Amid The Rout, Morgan Stanley Explains Why There’s No Panic Selling (Yet)

Tyler Durden

Thu, 09/24/2020 – 11:55

By Morgan Stanley’s Rob Cronin, Ross Montgomery, Mathieu Renault

Post September expiry, clients appear well hedged into year-end and bar US election/covid headline agitation there is no clear SX5E technical that can drive spot in either direction near-term. The net futures short has rebuilt to levels last seen in June, ownership of downside is higher than normal and HF gross/net exposure is concentrated in market segments where drawdowns are low. HF P&L volatility is extremely low and returns are, in aggregate, mid-single digits now (vs. -8% at its worst). Breakouts on the upside, flow wise, have so far been met with stern resistance and the new SX5E composition makes sharp breakouts more difficult. There is some evidence (in cash & options) that the focus is shifting to single names.

Since the start of August, clients have re-hedged, increasing their net short in SX5E futures by -$13bn, taking the total net to -$19bn (vs. YTD trough of -$50bn). About $2bn more of the long book was left to expire in Sep roll vs. the short book, but the rest was flow. There isn’t a lot of longs to unwind – the client long book is $51bn (vs. 5Y average of $74bn) and except for the a drop to $42bn post the Mar20 expiry, this is the joint-lowest it has been since 2013. The short book is $71bn, in line with the 5Y average.

We estimate clients are net long SX5E puts in ~$6bn of delta between now and Dec. For options expiring within 3m, this amount is in its 65th %-ile vs. 2015. The appearance of a lot of short puts for strikes between 2800-3000 indicates a lot of these are likely spread trades.

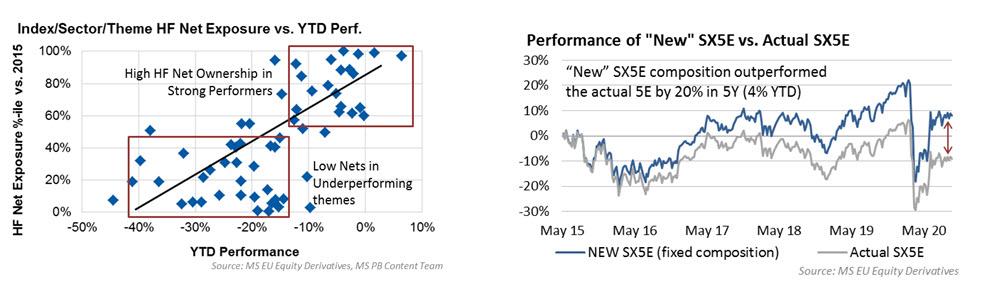

Panicky HF flow is also limited as the “crowded” HF trades, where gross and net leverage is high, are working. Crowding is concentrated in high quality Cyclicals and Defensives but the common themes are secular growth winners with low EPS volatility – performance has been very strong in these areas (left chart below). In areas where HF nets are low or outright short, performance is bad. As a result of this dynamic HF P&L volatility is low and it has been persistently sub 4v on a 20d rolling basis since July – even hit 2.7v in early Sep, lowest recorded YTD. For comparison HF P&L vol was 5v in Jan/Feb, 21v at its peak in March. SX5E 20d realized vol is trading well above Jan/Feb levels (21v now vs. ~15v then).

Sharp SX5E breakouts to the upside are likely to be curbed further as a result of the largest SX5E rebalance last week (5 stock changes, 7% weight). The new stocks have massively outperformed such that the NEW composition, on a fixed weight basis, would be 20% higher than the ACTUAL SX5E over the last 5Y (right chart below). YTD it would be 5% higher than ACTUAL SX5E and 4% closer to its own YTD high. Be careful when looking at SX5E at 3150, the NEW basket of underlying stocks has performed better than SX5E levels suggest.

The ratio of notional traded in all EU single name options vs. SX5E index options has hit an 8Y high. Both are low vs. history but SNO activity has bounced back quicker than index in Sep (single names traded $4bn on average per day over last month vs. $30bn for SX5E index). Big gaps in stock performance YTD and stickiness of SX5E is likely driving this.

We see more urgent trading in SX5E single names in cash too. Since the start of Sep, we have seen more volume traded net at the offer vs. bid in SX5E names than at any point since the March rally.

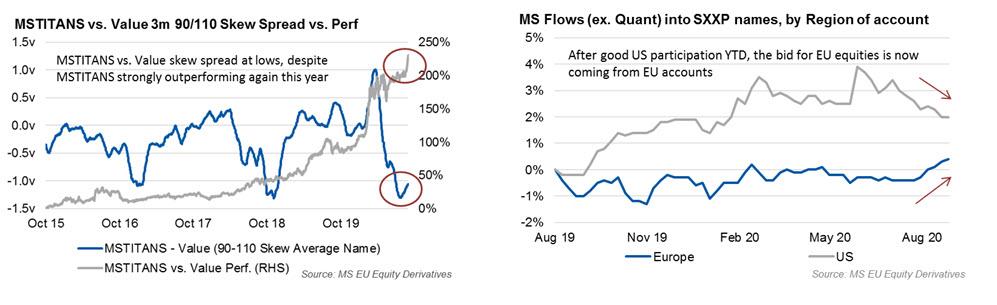

One representation of HF crowding is MSTITANS (custom basket of 10 of EU’s highest quality, secular growth winners) where HF Gross and Net exposures are at record highs. YTD, the basket is now +16%, has outperformed Value by 50% and is at a YTD high. Despite that outperformance, 3m 90/110 option skew spread for MSTITANS vs. Value (MSQQEVLL) is close to 5Y lows. Despite the massive outperformance, the options market has little concern about potential downside for the MSTITANS group.

One area of concern for EU equities is an emerging over-reliance on EU based accounts. Net buying of SXXP names by US based accounts had been strong in 2020 but they have flipped to being net sellers over the last 10w with EU based account bidding for that supply.

Source for charts: Morgan Stanley European Derivatives Desk, Eurex, MS PB Content Team