Stocks Pump’n’Dump As Stimulus Hopes (& The Dollar) Slump

Tyler Durden

Thu, 09/24/2020 – 16:01

The Dollar tumbled intraday, ending the 4-day win streak and biggest surge since March…

Source: Bloomberg

Stocks hit session highs on speculation that talks about a new round of economic stimulus will resume amid growing concern over a resurgence in coronavirus cases around the world. Then reversed on reports that “no talks” were scheduled between Mnuchin and Pelosi. A record daily surge in COVID cases in France didn’t help…

Or visualized a different way…

Shortly on today‘s trading session pic.twitter.com/vtkJVvCuaE

— Russian Market (@russian_market) September 24, 2020

Small Caps bounced off 200DMA (but then retraced back below it), Dow bounced off 100DMA at the open…

The S&P 500 broke down into the red for 2020 today (below 3230.78) but the machines made sure it closed above it…

Election uncertainty pushed higher once again…

Source: Bloomberg

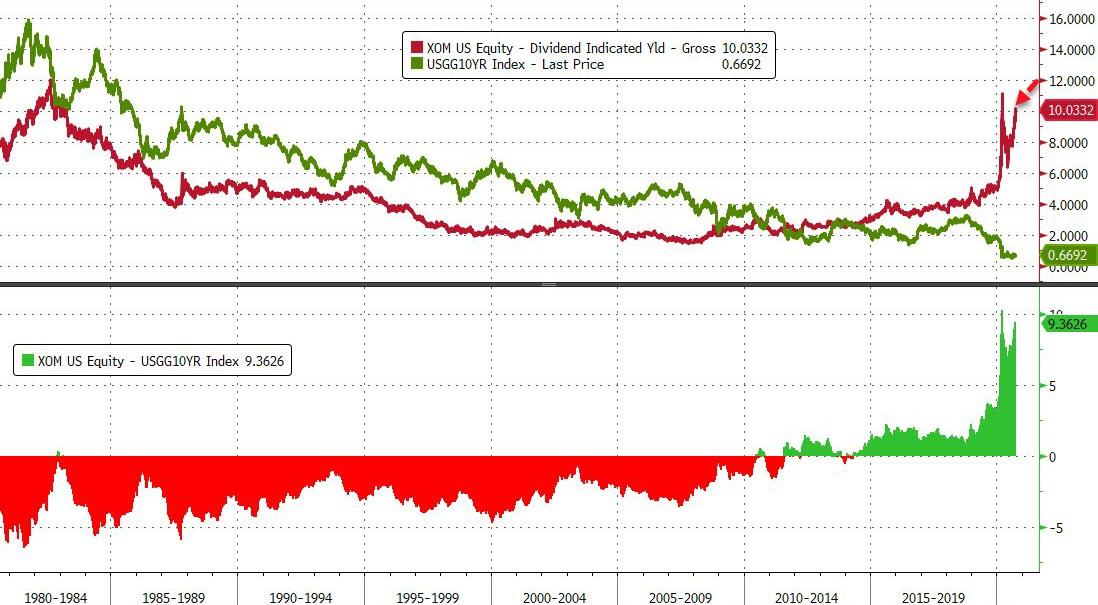

Despite Oil’s modest gains, XOM slipped lower, pushing its dividend yield above 10% once again!…

Source: Bloomberg

As Bloomberg notes, the world’s second-biggest oil explorer by market value has pledged to defend the payout, which has increased for 37 consecutive years, but stubbornly low crude prices have meant a reliance on borrowed money to fund it.

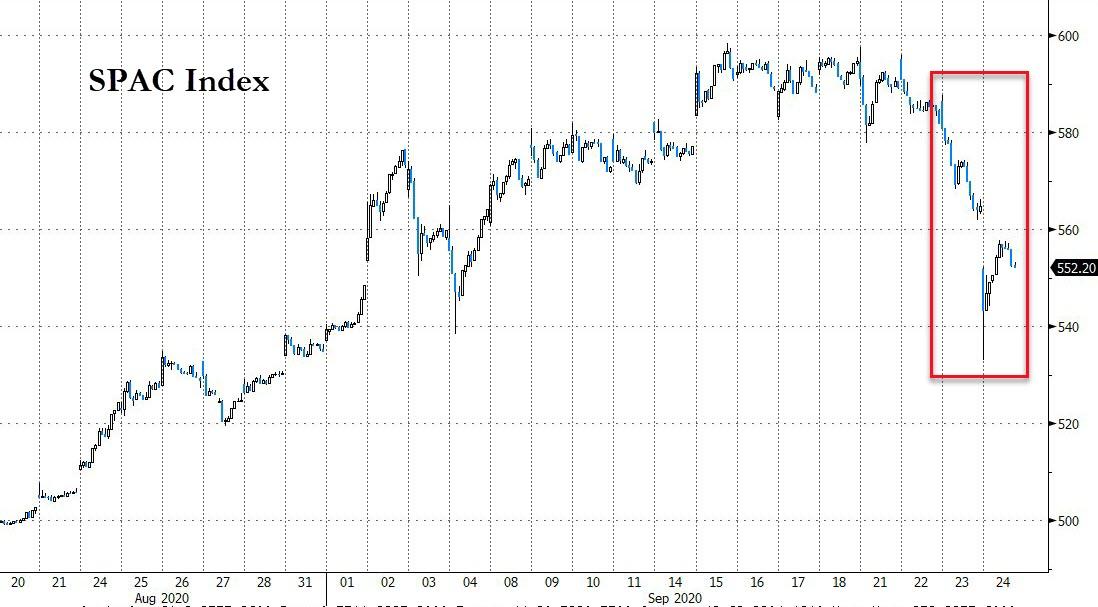

SPACs were spanked (after SEC concerns)…

Source: Bloomberg

Or visualized a different way…

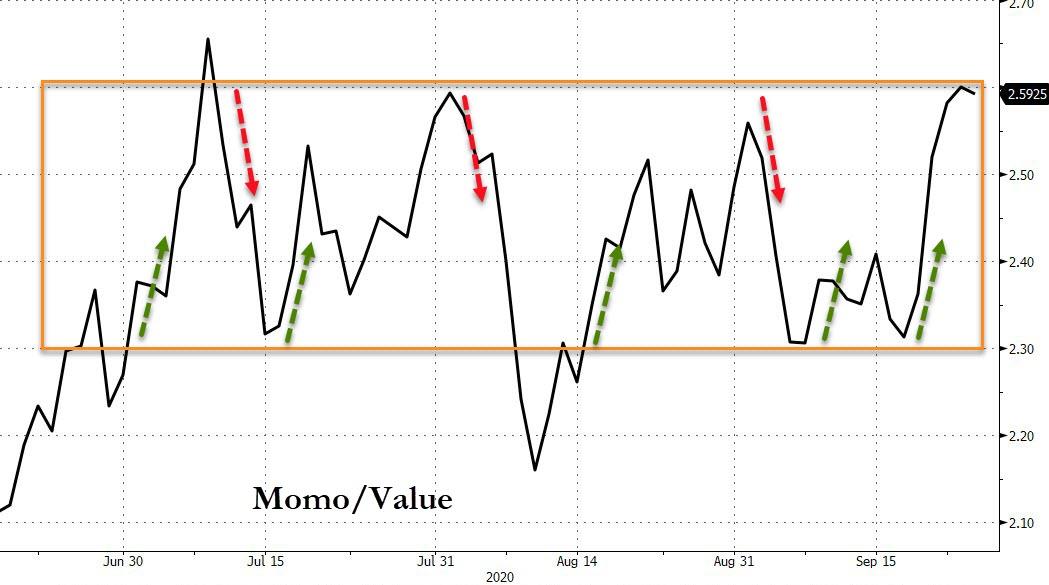

Momo’s short-term run against value appears to have its upper limit once again…

Source: Bloomberg

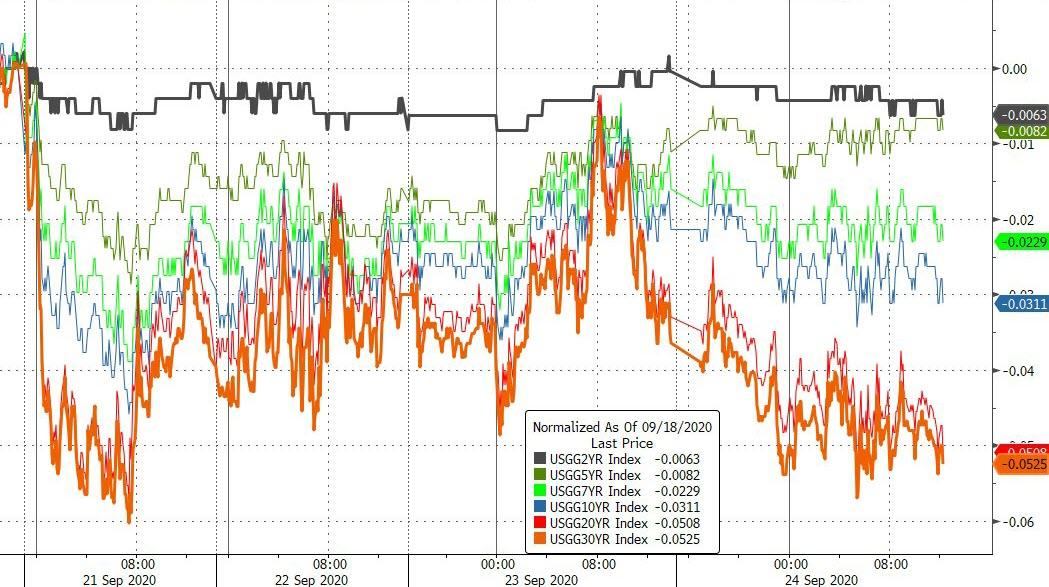

Treasury yields remained in an insanely narrow range once again (10Y yields traded inside a 2bps range today). On the week, 30Y is down around 5bps, 2Y unch…

Source: Bloomberg

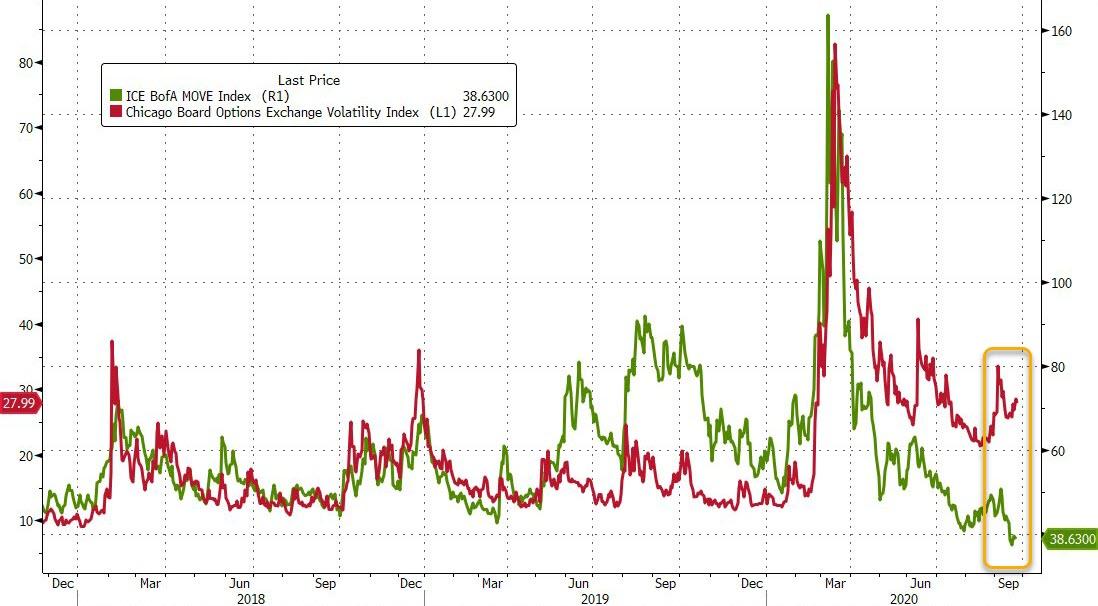

Driving Bond vol (MOVE) back down to record lows (the biggest divergence from VIX in over 30 years)…

Source: Bloomberg

Real yields pushed higher again…

Source: Bloomberg

Turkish Lira screamed higher on the back a surprise rate hike (first since 2018)…

Source: Bloomberg

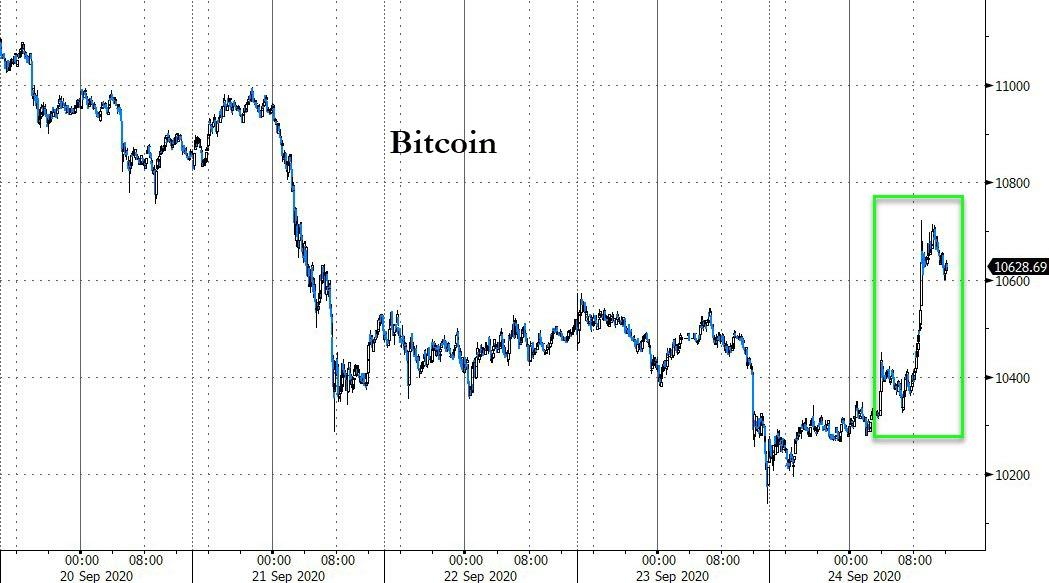

Bitcoin managed some decent gains as the dollar sank today…

Source: Bloomberg

Silver rebounded during the US day session, getting back above $23…

WTI pushed back above $40 as the dollar weakened…

Gold/Silver reversed lower today (after a notable spike in the last few days)…

Source: Bloomberg

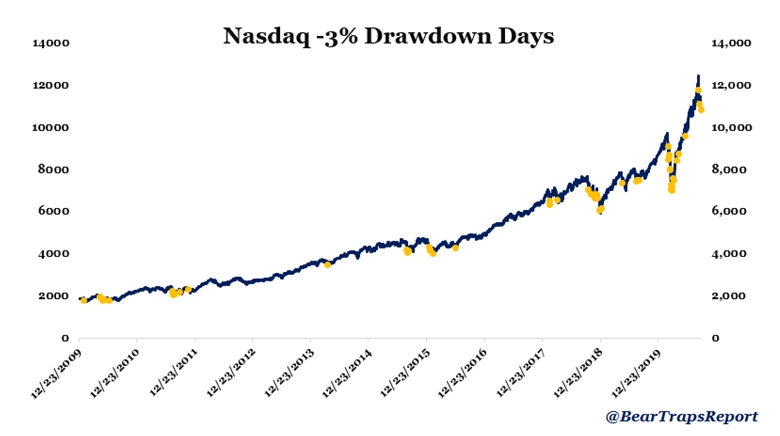

Finally, in case you were wondering if it’s over yet? @BearTrapsReport notes that one rule of thumb we learned years ago – when you see a 3% drawdown, they only rarely happen alone, they often come as a cluster. The Nasdaq fell -3.1% on Wednesday, underperforming the other major US indices.

Looking at all of the -3% Nasdaq drawdowns over the past decade, a trend is clear… Large drawdowns come in clusters, they are rarely isolated events. With every big drawdown we see, there is an increased probability we see another one.

Source: Bloomberg

Trade accordingly.