Cryptos Crash After BitMEX Founders, Execs Face CFTC Charges

Tyler Durden

Thu, 10/01/2020 – 12:17

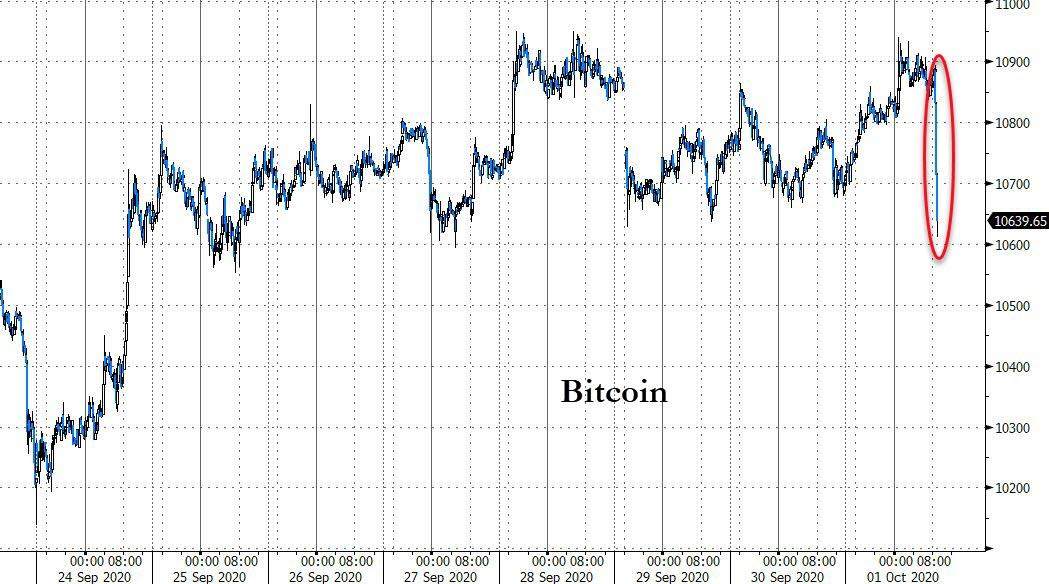

Bitcoin prices have plunged this morning after the US Commodity Futures Trading Commission (CFTC) alleged that major crypto-trading platform BitMEX facilitated unregistered trading and other violations.

Source: Bloomberg

The CFTC announced this morning that it was charging BitMEX, CEO Arthur Hayes, company owners Ben Delo and Samual Reed, and corporate entities HDR Global Trading Limited, 100x Holding Limited, ABS Global Trading Limited, Shine Effort Inc Limited and HDR Global Services (Bermuda) Limited with offering U.S. customers illicit crypto derivative trading services.

In a press release, the CFTC alleged that BitMEX received some $11 billion in bitcoin deposits and made more than $1 billion in fees, “while conducting significant aspects of its business from the U.S. and accepting orders and funds from U.S. customers.”

The uncertainty weighed on the entire crypto space…

Source: Bloomberg

BitMEX, which has reportedly been under investigation by the CFTC since at least July 2019, implemented mandatory KYC in April of this year.

“Digital assets hold great promise for our derivatives markets and for our economy,” said Chairman Heath P. Tarbert.

“For the United States to be a global leader in this space, it is imperative that we root out illegal activity like that alleged in this case. New and innovative financial products can flourish only if there is market integrity. We can’t allow bad actors that break the law to gain an advantage over exchanges that are doing the right thing by complying with our rules.”

“As the CFTC has made clear, registration requirements are a cornerstone of the regulatory framework that protects Americans and U.S. financial markets,” added Division of Enforcement Director James McDonald.

“Effective anti-money laundering procedures are among the fundamental requirements of intermediaries in the derivatives markets, whether in traditional products or in the growing digital asset market. This action shows the CFTC will continue to work vigilantly to protect the integrity of these markets.”

Case Background (from CFTC)

The complaint alleges that from at least November 2014 through the present, and at the direction of Hayes, Delo, and Reed, BitMEX has illegally offered leveraged retail commodity transactions, futures, options, and swaps on cryptocurrencies including bitcoin, ether, and litecoin, allowing traders to use leverage of up to 100 to 1 when entering into transactions on its platform. According to the complaint, BitMEX has facilitated cryptocurrency derivatives transactions with an aggregate notional value of trillions of dollars, and has earned fees of more than over $1 billion since beginning operations in 2014. Yet, as alleged in the complaint, BitMEX has failed to implement the most basic compliance procedures required of financial institutions that impact U.S. markets.

The complaint charges BitMEX with operating a facility for the trading or processing of swaps without having CFTC approval as a designated contract market or swap execution facility, and operating as a futures commission merchant by soliciting orders for and accepting bitcoin to margin digital asset derivatives transactions, and by acting as a counterparty to leveraged retail commodity transactions. The complaint further charges BitMEX with violating CFTC rules by failing to implement know-your-customer procedures, a customer information program, and anti-money laundering procedures.

As alleged in the complaint, BitMEX touts itself as the world’s largest cryptocurrency derivatives platform, with billions of dollars’ of trading volume each day. Much of this volume, and related transaction fees, derives from the operation of the platform from the U.S. and its extensive solicitation of and access to U.S. customers, the complaint alleges. Nevertheless, BitMEX has failed to register with the CFTC, and has failed to implement key safeguards required by the CEA and CFTC’s regulations designed to protect the U.S. derivatives markets and market participants.