US Manufacturing Surveys Suggests “The Outlook Has Darkened”

Tyler Durden

Thu, 10/01/2020 – 10:04

As ‘hard’ data has begun to disappoint in recent months, ‘soft’ survey data has been very mixed. On the manufacturing side of the US economy, Markit’s PMI disappointed, dropping from 53.5 preliminary to 53.2 final for August (very marginally higher MoM). ISM’s gauge of Manufacturing also disappointed, printing 55.4 vs 56.5 exp (and down from 56.0).

Source: Bloomberg

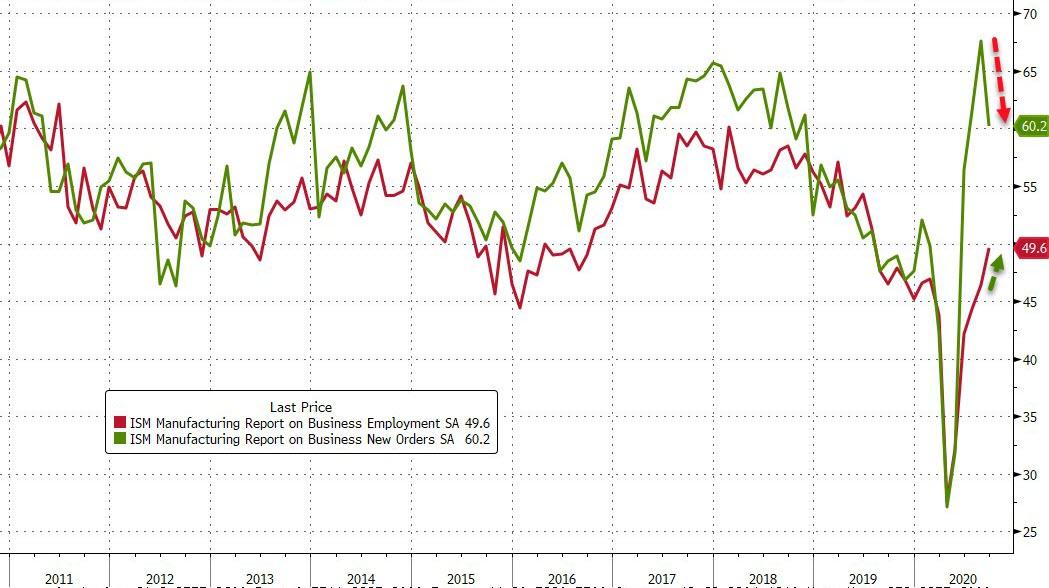

Markit notes that business confidence slowed amid election and COVID uncertainty. ISM’s Manufacturing New Orders tumbled and Employment remains in contraction (and continues to dramatically lag the exuberance in New Orders)…

Source: Bloomberg

Chris Williamson, Chief Business Economist at IHS Markit said:

“US manufacturers rounded off a solid quarter which should see the sector rebound strongly from the steep second quarter downturn.

“Encouragingly, companies reported a marked upturn in demand for plant and machinery, which suggests firms are increasing their investment spending again after expansion plans were put on hold during the spring. Similarly, fuller order books helped drive further job creation as firms continued to expand capacity.”

But it was not all good news…

“Supply shortages worsened as companies increasingly struggled to source enough inputs to meet production requirements. With demand often exceeding supply, prices rose sharply again across many types of inputs, especially metals.

“Growth of new orders for consumer goods also waned during the month, hinting at some cooling of demand from households, commonly blamed on Covid-19. Overall order book inflows consequently slowed compared to August.

“The outlook also darkened, as companies grew more concerned about the sustained economic disruption from the pandemic alongside uncertainty caused by the upcoming presidential election. The sector therefore looks to be entering the fourth quarter on a slower growth trajectory, adding to signs that fourth quarter GDP growth will wane considerably from the third quarter rebound.”