“Skinny” Or “Supersized”: What Happens To The Treasury Market When The Next Stimulus Bill Passes

Tyler Durden

Sat, 10/03/2020 – 18:00

While Congress remains gridlocked over the fifth covid stimulus bill (demanded by 90% of all Americans), rcent headlines suggested on-going discussions for a stimulus breakthrough between Democrats and Senate Republicans prior to the election. And while chances for a deal finalized prior to the November election are slim to nil, Bank of America acknowledges that the chances have improved from near zero at the start of the week. To be sure, timing is critical since the Congressional recess through the election starts on Oct 2 for the House & Oct 9 for the Senate (while Congress can always be called back for a vote but a pre-election deal seems most likely to happen in the next few days if it happens at all).

Yet while the political and calendar dynamics of any new stimulus deal have been widely discussed, one aspect that remains an open question are the market implications of said deal: just how will the Treasury fund the proposed stimulus and what will its impact be on Treasury spreads, either before or after the election.

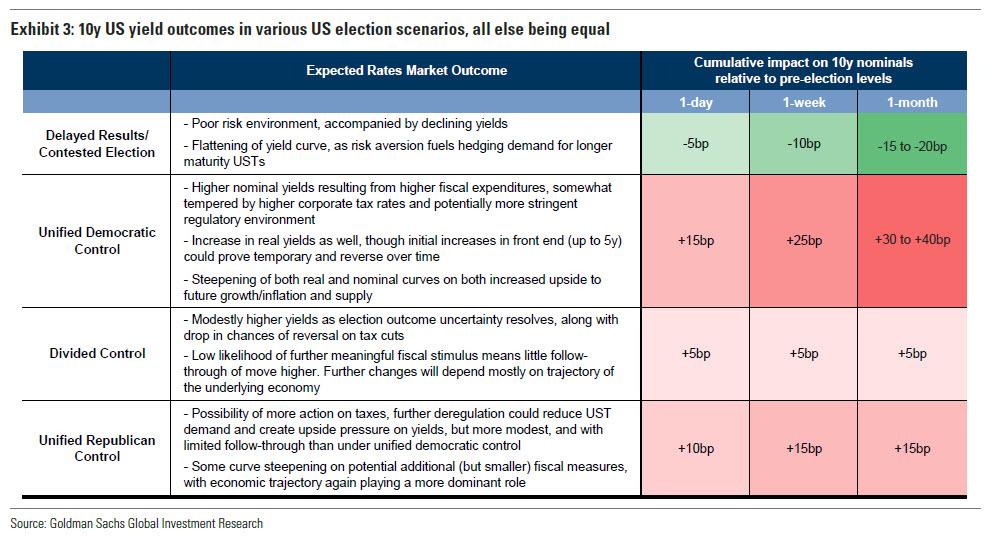

In a recent analysis of just this issue, Bank of America concludes that most scenarios will see little change to coupon or bill sizes unless there is a “supersized” stimulus plan following a Democratic sweep, the same scenario that prompted Goldman to expect a surge in yields.

As BofA’s Mark Cabana writes, “the limited supply impact is due to the very large existing UST cash balance and recent coupon supply increases that generate sizeable net cash raises each month ($200bn / month thru end ‘21).” And, for those curious where on the curve is the fulcrum point for new stimulus, Cabana expects “most of the supply impact from stimulus will be concentrated at the front-end of the UST curve.”

Before we get into the specifics, we fast forward to the bank’s conclusions which, similar to Goldman’s recent thoughts on the matter, find that “any sizeable stimulus would support higher back end UST rates & a steeper curve due to improved growth expectations & higher longer-run deficits.” At the same time, front end rates will continue grinding lower in most scenarios since bill supply will be limited and Treasury is sitting on $1.65+tn of cash which will likely be used to fund new stimulus: “A paydown of this cash results in more money in the banking system which will offset bill supply.”

* * *

With that in mind, we focus on the scenario matrix proposed by Cabana, which breaks down roughly as follows – now vs later, supersize vs skinny.

The BofA rates strategist considers 5 potential scenarios for his supply analysis:

- no stimulus

- a near-term $1.5tn package agreed to prior to the election

- a $500bn “skinny” package post inauguration

- a $1.5tn package post inauguration

- a $3.5tn “supersized” package post inauguration.

With the Treasury having already increased coupon sizes substantially this year, only in the “supersized” stimulus package post-inauguration does BofA see a compelling case for higher coupon sizes, although another small coupon supply increase at the Nov refunding is not ruled out if stimulus is passed pre-election; In either scenario, any coupon increase will be relatively small and is unlikely to have a large impact on markets. Bill supply outcomes are more varied across the proposed scenarios. In most cases the bill need should be relatively small and are unlikely to offset the impact from a lower Treasury cash balance & ongoing Fed UST purchases.

Going back to the three key post-stimulus scenarios, Cabana writes that he expects Congress to “eventually” address the need for more fiscal stimulus. If the stimulus does pass before the election, BofA expects it to be around $1.6TN, which would suggest Democrats concede on their demand for state and local bailouts (i.e., a taxpayer bailout of underwater pensions).

Here it is worth noting a brief report in Saturday’s Politico Playbook, according to which “PELOSI and Treasury Secretary STEVEN MNUCHIN are expected to work through this weekend. Everyone understands that one of the main issues is funding for state and local governments. The last offers traded were Dems offering $436 billion, and Republicans countering at $250 billion. ON THURSDAY, PELOSI and MNUCHIN held a private phone call with Fed Chair JAY POWELL to discuss state and local funding, and municipal lending. This call has not yet been reported, and underscored the lengths to which the two principals are going to try to get a deal.“

As such, the odds of a deal where the Fed comes up with some “inert” source of funds to placate Senate Republicans suddenly looks quite real.

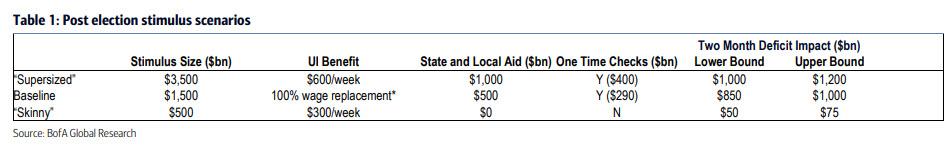

Alternatively, if the stimulus is delayed until after the election, there are 3 most likely sizes as shown in the table below; the BofA base case is a $1.5tn stimulus package after the election but there is a great deal of uncertainty over the size, timing and makeup of any bill.

- “Supersized” ($3.5tn): This scenario assumes the Democrats sweep the November elections and pass a bill that closely resembles the $3.4tn Heroes act passed by the House Democrats in May. The bill would include a second round of stimulus checks, $1tn in State and Local aid paid out in two installments and an extension of the $600/week additional unemployment. Even under a Democratic sweep, the likelihood of a bill of this magnitude passing is low given that the economic recovery has been much faster than what was anticipated in May.

- “Baseline” ($1.5tn): This is our current assumption and assumes that Biden wins the presidential election and Congress control remains split. Similar to the extreme scenario, the bill is expected to include another round of stimulus checks, $500bn in aid for state and local governments and an extension of the additional unemployment benefits but at a lower rate. Expect a similar sized bill if Trump were to be reelected and Congress control remains split.

- “Skinny” ($0.5tn): This scenario assumes a Republican sweep of the elections, Under this scenario, the Republicans would move forward quickly with a skinny deal targeted primarily at money for the PPP program and unemployment insurance. Expect an earlier passage than the other two scenarios even though Democrats would still hold the House until January.

According to the Cabana, the two “extreme scenarios” are more illustrative than anything else as they underscore the differences in stimulus approach between the two parties.

However, they are useful for our discussion around the deficit and Treasury supply issuance. For each of the above scenarios, we have included a lower bound and upper bound estimate of the two month deficit impact following the passage of the bill. The key difference between the two is that in the upper bound scenario we assume that the added UI benefit is retroactive to October 1.

As shown in Table 1, whether or not this provision is retroactive could be a significant swing factor for the deficit, which could amplify or compress depending on the pace of the labor market recovery over the coming months.

Another important swing factor is the tax filing deadline. As a reminder, in 2020 the deadline was shifted from April 15 to July 15, which shifted around $250bn in revenue from April to July. If the deadline is again moved to July, then one should anticipate another revenue shift of a little under $250bn from April to July. BofA’s Treasury financing projections currently assume the tax date is kept in April which reduces UST financing need in 1H ’21.

In sum, Cabana – a former NY Fed Markets Group staffer – “easily” sees a bill that increases the near-term deficit by over $1tn following its passage. And while he is rather bizarrely optimistic, saying that “in the long-run”, he expects the deficit to decline “significantly” in 2022 (good luck with that), he concedes that the deficit will be very elevated compared to the pre-virus levels as the government deals with the lingering scars of the virus.

* * *

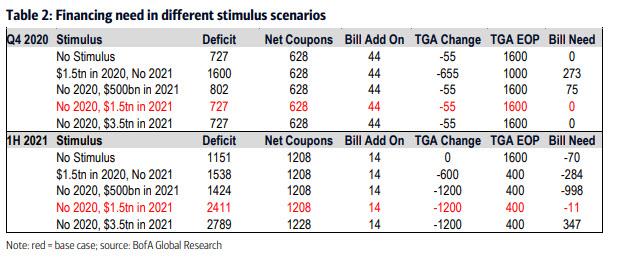

What about the stimulus bill impact on rates markets and financing needs? In Table 2, BofA outlines the impact of these stimulus scenarios on Treasury financing needs.

Coupons: As noted above, the Treasury has already increased coupon sizes substantially this year to all time highs and most scenarios should see little change to coupon sizes unless there is a “supersized” stimulus plan following a Democratic sweep. Additionally, a $1.5tn stimulus bill passed pre-election could see Treasury pursue one last modest round of coupon size increases at the November refunding but it’s probably unnecessary. Any coupon size increase after a “supersized” or pre-election deal would likely include $1bn/month growth for 2/3/5/7Y notes and $1bn increase in 10/20/30Y offerings for new issue & reopening auctions; any coupon growth would only last for one quarterly refunding cycle.

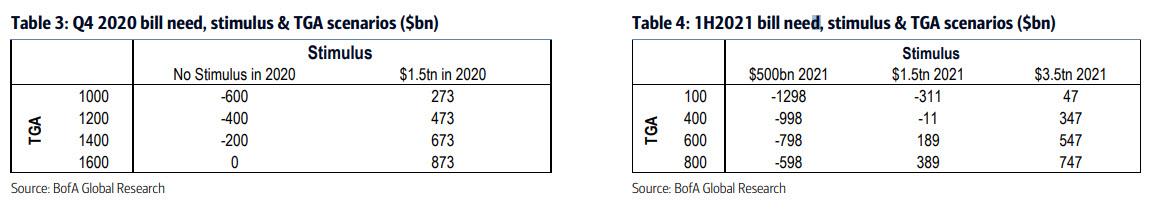

Bills: there is a range of bill supply outcomes between now & 1H ’21 as shown in Table 2. Much of the bill supply impact will be a function of the Treasury cash balance level, which remains near record levels. The implications of a few bill supply scenarios are listed below:

- Pre-election stimulus: In Q4 ’20 bill supply would likely total $250-$300bn. The Treasury will drop their cash balance to $1tn, which would add ~$600bn of cash into the banking system. The expected increase in banking system cash would likely overwhelm bill supply & keep front end rates stable to lower.

- Base case (no stimulus pre-election, $1.5tn post inauguration): In Q4 ’20 bill supply will likely be flat or slightly negative with a Treasury cash balance at year-end of $1.6tn. This is lower vs prior forecasts due to a downward revision in deficit estimates and the TGA ending September higher than BofA had previously anticipated. In 1H ’21 bill supply will also likely be flat on net but there may be one notable variation; Cabana “might anticipate” $200-$300bn bill supply after stimulus is passed in Feb or March but expect this would be paid down after the April tax date. The decline in Treasury cash balance will limit the need for elevated bill supply.

- Extreme scenarios: in 1H ’21 a “supersized” or “skinny” deal could see bill supply range from positive $350-$400bn to negative $1tn. In a “supersized” scenario the bill supply increase would likely be greatest after a bill is passed in Feb or March ’21. In a “skinny” deal the risk of sharply negative bill supply stems from a potential “forced” reduction of the Treasury cash balance.

When considering Treasury supply scenarios, one must also consider 2 wildcards: (1) Treasury cash balance (2) PPP forgiveness options. A few details on each:

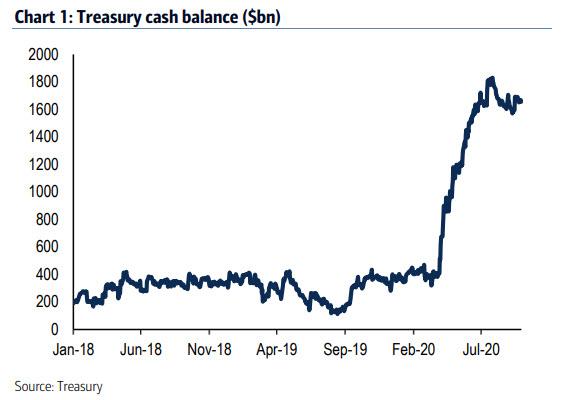

Treasury cash balance: As we have shown previously, the Treasury currently sits on $1.65trillion of cash, well above historical norms and near a record high.

These funds will likely be used to pay for a large portion of any fiscal stimulus plan and the Treasury will ultimately target a $400bn cash balance after stimulus needs are met & PPP loan forgiveness is complete, suggesting a $1 2 trillion drawdown from current levels. Treasury will face material pressure to get their cash balance down by the summer of next year. Specifically, as BofA notes, Treasury will need to lower their cash balance to $133bn by end July ’21 to be in compliance with the existing debt limit law (the 2019 Bi-Partisan Budget Act suspends the debt limit through end July ’21 but when the debt limit is reinstated UST needs to hold no more cash on hand vs when the bill was originally signed into law which is $133bn). If a new debt ceiling is not instituted before end July ’21 it could imply less financing need from bills, all else equal. The impact of different TGA levels on expected Q420 and 1H21 net bill supply in tables 3 and 4.

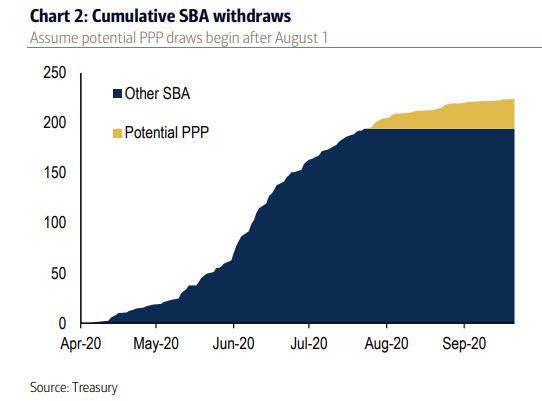

PPP loan forgiveness: a sizeable amount of the Treasury cash balance is being held for PPP loan forgiveness. Recall, the PPP approved $525bn of loans for which the largest Treasury financing draw does not occur until the loans are forgiven. According to BofA estimates, a maximum of $30bn in PPP loans has already been forgiven since most large banks did not start accepting PPP loan forgiveness applications until August and there have only been $30bn of additional Small Business Administration withdraws from Treasury since then. As such, one can assume another $100bn in PPP loan forgiveness + UST outflows in Q4 ’20 and $400bn of PPP loan forgiveness + UST outflows in 1H ’21.

Wildcard bottom line: the base case of $400bn standard TGA operating balance + $500bn of PPP loan forgiveness needs leaves UST with roughly $700-$800bn of “unencumbered cash” at present to fund the next round of stimulus

* * *

Putting all of the above together, Cabana writes that “the most striking takeaway” from his simulations is “the relatively limited impact stimulus has on Treasury’s expected near-term debt issuance, even under the “supersized” supply scenario.” This is due to prior coupon auction size increases & available financing from the Treasury cash balance. “These scenarios also offer limited hope for a supply driven increase in front-end UST rates” which means that any action – assuming there is one – will be entirely in the long-end.

One final – and interesting – note raised by Cabana is his claim that the choice of who is the next US Treasury Secretary after the election “matters for debt management policy.” According to the BOfA strategist, “debt management practices under Treasury Secretary Mnuchin have been “regularly unpredicatable” in contrast to Treasury’s more typical practice of ‘regular & predictable’.” This view was formed by the unusual means by which the 20Y UST issue was introduced & the post-COVID larger-than-expected long-dated coupon sizes vs market & TBAC guidance

According to Cabana, “debt management decisions made under Mnuchin are likely to favor long-end issuance while a new Treasury Secretary would likely favor issuance more concentrated towards the belly of the UST curve. If President Trump wins re-election we expect that Mnuchin will remain Treasury Secretary based on some of the Treasury Secretary’s prior

comments. If former Vice President Biden wins we expect a new Treasury Secretary and one that would likely follow more “orthodox” debt management practices. We think a new Treasury Secretary would likely favor TBAC’s recommended strategy of concentrating issuance at the belly of the curve to minimize interest cost and interest rate variability. A focus on issuance towards the belly would also be easier since the weighted average maturity of Treasury debt is expected to normalize or exceed pre-COVID levels by the end of FY ’22 under the existing coupon trajectory.”

The reason why this is important is that it partially offsets the adverse consequences for long-end prices in the scenario presented by Goldman at the end of September, as such a shift in debt management strategy might lessen the extent of UST cheapening at the long end of the curve and concentrate the impact of any coupon increases at the belly of the curve. Those who wish to trade, or hedge, a change in Treasury Secretary, are advised to “consider” 5s30s swap spread steepeners “or greater tightening potential concentrated at the 5Y part of the curve as a part of any trade to position for a potential Democratic sweep.”