In Illinois, The Ultimate “Fair Tax” Treachery Is The Ballot Itself

Tyler Durden

Mon, 10/05/2020 – 14:19

Authored by Mark Glennon via Wirepoints.org,

Illinoisans voting on the “Fair Tax” constitutional amendment who have not already studied it probably will be duped into the wrong choice because the ballot is deceitful and incomplete.

Moreover, it is not separate from a ballot for other matters as clearly required by the Illinois Constitution.

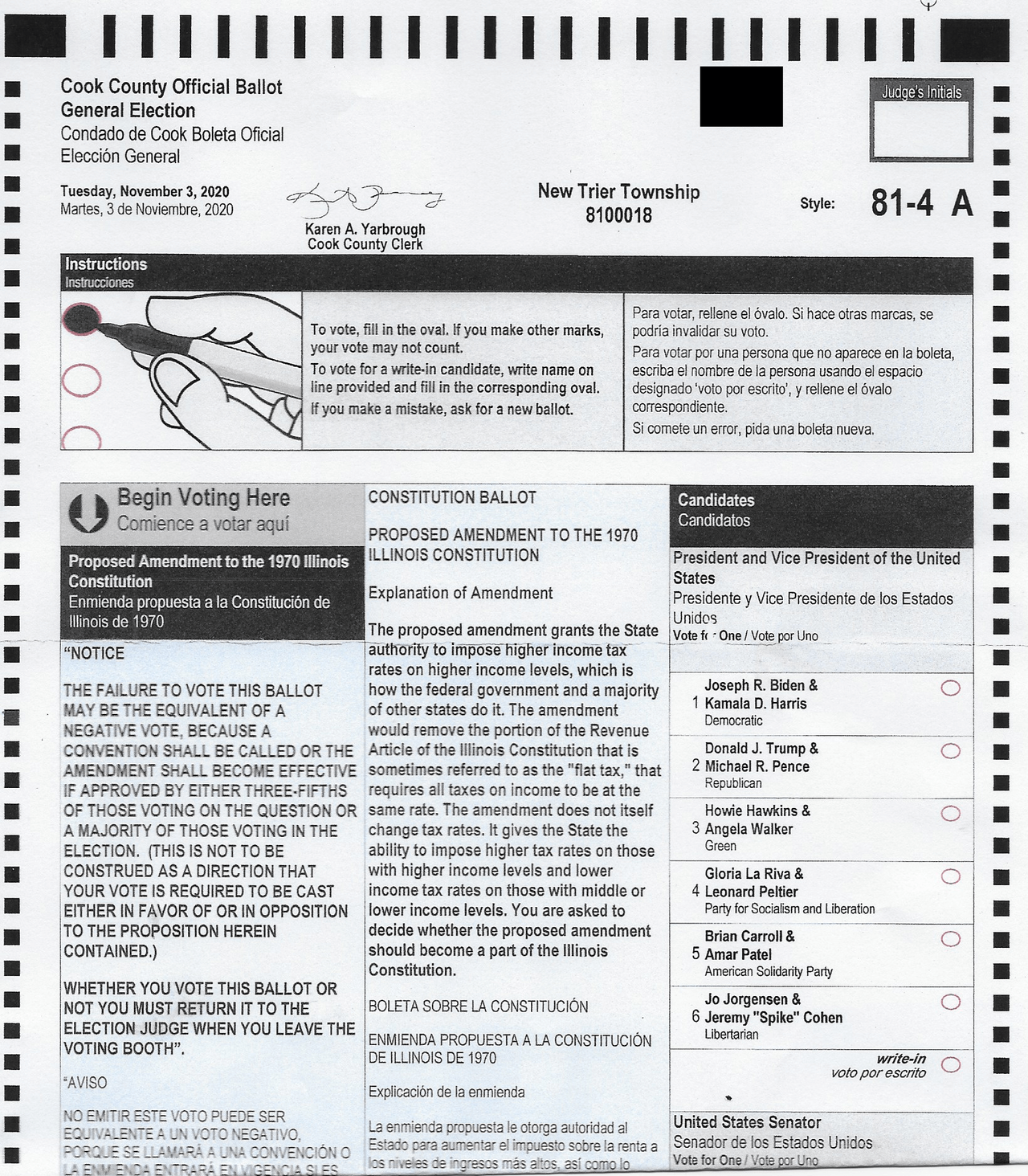

A ballot form is reproduced below that contains the Fair Tax language.

It’s a mail-in ballot sent to a Cook County voter, but the language for the Fair Tax vote will be identical in all counties across the state. That language is as follows:

The proposed amendment grants the State authority to impose higher income tax rates on higher income levels, which is how the federal government and a majority of other states do it. The amendment would remove the portion of the Revenue Article of the Illinois Constitutions that is sometimes referred to as the “flat tax,” that requires all taxes on income to be at the same rate. The amendment does not itself change tax rates. It gives the State ability to impose higher rates on those with higher income levels and lower income tax rates on those with middle or lower income levels. You are asked to decide whether the proposed amendment should become part of the Illinois Constitution.

Note that the amendment itself is not provided, thereby denying voters the option of reading it for themselves. Only a summary crafted by supporters is provided.

That summary is false and misleading for the following reasons:

• The opening line says or at least strongly implies that the amendment would authorize only “higher income tax rates on higher income levels.” That fist line is further enforced where the summary says the amendment “gives the State ability to impose higher rates on those with higher income levels and lower income tax rates on those with middle or lower income levels.”

That’s highly deceptive if not outright dishonest. Middle income earners could also be taxed at higher rates than lower earners, and that’s precisely among the arguments made by many of the amendment’s opponents. The amendment would authorize the state to impose whatever rates it wants on any income level. While the language in the summary may be literally correct at this time, it is incomplete, allowing many and perhaps most voters to read it to say it applies only to high earners.

• The summary includes material that is a marketing pitch for a Yes vote instead of dispassionate description where it says progressive rates are “how the federal government and a majority of other states do it.”

That’s a biased selection of one aspect of the amendment that its supporters routinely cite in its favor. Amendment opponents have their own list of negative aspects of progressive income taxes yet those do not appear in the summary.

Among those negative facets are the fact that states with progressive rates very commonly tax middle incomes at higher rates than Illinois does now. We, too, have documented 18 progressive tax states that tax middle income earners at the same marginal tax rate as high earners. That reality is contradicted by the summary’s false implication, as stated above, that only higher earners will see higher rates. And the summary ignores that 18 states have zero or flat taxes.

• The summary omits any mention of the amendment’s effect on corporate taxes – a major omission.

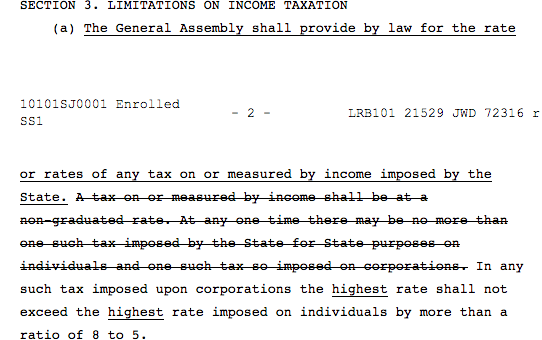

Corporate income tax rates cannot exceed personal rates by any more than a ratio of 8 to 5. The amendment, however, adds the word “highest” where shown here: “[T]he highest rate [on corporations] shall not exceed the highest rate imposed on individuals by more than a ratio of 8 to 5.” That means the cap for corporations would no longer be based on a generally prevailing rate but on the top rate the state chooses to tax its top earners.

The state has already passed the initial corporate rates that would go into effect on January 1 if the amendment passes. The total corporate income tax rate – including the Personal Property Replacement Tax – will go up 10% (from 9.5% to 10.49% when including the replacement tax). Illinois next year would be tied with New Jersey for the highest corporate rate in the nation.

• The summary omits the amendment’s deletion of the “one-tax” rule, opening the door to more – a major omission.

Under the constitution as now written, “no more than one” income tax can be imposed on individuals or corporations. The amendment, however, strikes that prohibition, as you can see in its full text below.

That means, for example, that the state would be free to impose a separate tax on retirement income with different rates. Or maybe the state would impose separate taxes on income from particular sources that politicians decide they disfavor. The ballot makes no mention of that whatsoever.

Finally, here’s what the Illinois Constitution says about ballots for constitutional amendments: “The vote on the proposed amendment or amendments shall be on a separate ballot. (Article XIV Section 2(b), emphasis added).

That couldn’t be clearer. Now look again at the ballot above. There is no separate ballot. The vote on the amendment is on the same form as the vote on other elections.

**************

Over the past several months Wirepoints has linked to every major opinion piece we have found, pro and con, on the Fair Tax. Some have been deceitful, but nothing should anger Illinois voters more than betrayal by their own representatives in Springfield who have presented them with a dishonest ballot.

And it is indeed your own legislators who are responsible. The joint resolution of the General Assembly that put the ballot before the voters also prescribed its form, including the language that summarizes the amendment. We reached out to both the Cook County Clerk and the Illinois Board of Elections to get their reaction to our objections to the ballot. Each pointed out that they had no hand in it, which is correct.

Legislators knew exactly what they were doing. They knew most voters will cast their vote with little understanding of the Fair Tax proposal beyond what they see on the ballot, and they will be deceived.

Votes Yes or No should be on the merits of an amendment proposal presented honestly and legally. Instead, voters will be presented with a ballot rigged to get Yes votes that’s not in the constitutionally mandated form. If the measure nevertheless passes, it should be annulled by courts.