Platts: 4 Commodity Charts To Watch This Week

Tyler Durden

Mon, 10/05/2020 – 13:09

Via S&P Global Platts Insight blog,

This week’s Commodity Tracker kicks off with a look at easing stocks of refined oil products at the Middle East’s biggest storage hub of Fujairah, as well as the prospects for gas supply in Europe over winter amid bulging storages. The return of 2.7 GW of capacity to the German and Dutch power markets goes some way to easing fears of shortages with French nuclear capacity low, and European steel plants are eyeing up improved margins for 2021.

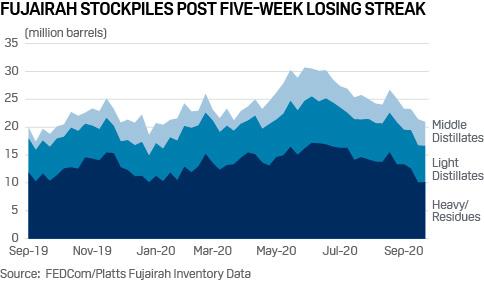

1. Fujairah oil stocks drop to eight-month low as market rebalances

What’s happening? Stockpiles of refined oil products at Fujairah, the Middle East’s biggest storage hub, have hit an eight-month low, with shipments of naphtha and gasoil picking up, supporting signs that the global oil market is balancing as OPEC+ output cuts offset pandemic-hit demand. Total stockpiles stood at 20.961 million barrels as of September 28, down 2.2% from a week earlier and the lowest since January 13, according to data from the Fujairah Oil Industry Zone released September 30. Stockpiles have now dropped for five consecutive weeks, the longest losing streak since the five weeks ended July 1, 2019. The record losing streak was six weeks in a row in 2017.

What’s next? Markets continue to watch global crude and product stock movements for clues to the pace of economic recovery from the pandemic, particularly as a spike in coronavirus infections to new highs globally fuels concerns over a second wave of lockdowns.

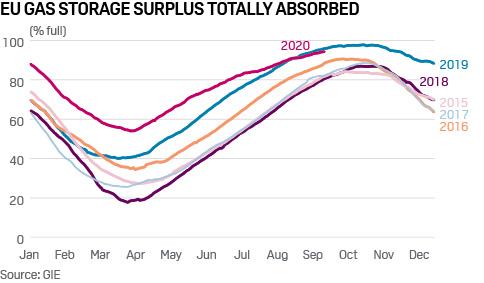

2. Europe well placed for gas supplies over winter…

What’s happening? With EU gas storages at around 95% full, Europe is again well placed to manage the upcoming winter from a security of supply perspective. Stocks have been built to almost capacity for the second consecutive year, the difference this time being that the risk of disruption to Russian imports via Ukraine is absent.

What’s next? With stocks almost full at the start of the new gas year, there is limited scope for further EU storage injections in the event of a warm October, and injection season in Ukraine – which has acted this summer as an “overflow” for European storage – also seems to have effectively finished. A ramp-up in gas supplies to Europe and warm weather could put pressure on the market.

3. …as gas plants emerge from mothballs

What’s happening? Two gas-fired power stations with a combined 2.7 GW of capacity returned to the German and Dutch power markets at the start of October after years in the wilderness. Back on the system are Uniper’s Irsching gas plant in Bavaria and RWE’s Claus C plant in the Netherlands. Cheap gas and a rising carbon price are behind the power station returns, after years when the assets were on the verge of permanent closure due to cheap coal-fired generation. The boot is on the other foot now CO2 prices are back over Eur25/mt.

What’s next? It remains to be seen whether gas’ ascendancy over coal will be maintained over the winter. From very low levels over the summer, European gas prices have stabilized around the Eur12/MWh mark, pulling gas plant margins down and close to parity with comparable coal plant margins. Meanwhile, the power station returns should ease fears of capacity shortages due to low French nuclear availability. There is enough fossil plant around to fill any thermal gap caused by a nuclear shortfall, but this would be at an economic and carbon cost.

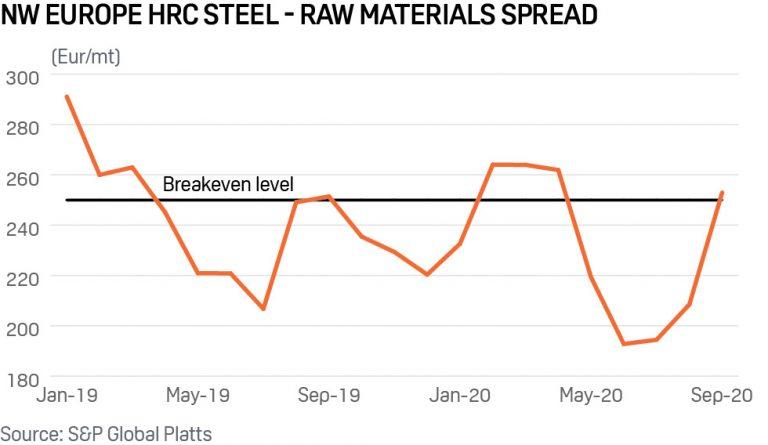

4. European steel plants eye improved margins in 2021

What’s happening? European hot-rolled coil steel to raw material price spreads turned sharply higher in September, as an increase in spot steel prices outpaced stronger coking coal and iron ore costs, according to S&P Global Platts estimates. The spreads show the steel industry moving back toward profitability after several quarters of weak margins.

What’s next? European steel plants are looking at lower forward iron ore prices, and for higher steel prices and demand to sustain improved margins into 2021. Potential weaker demand due to coronavirus-related disruptions is weighing on the sector. Moves to invest in new facilities to lower emissions hinge on underlying steel operating metrics attracting capital for Europe’s steel sector.