Record Large 3Y Treasury Auction Tails As Yield Rises From All Time Low

Tyler Durden

Tue, 10/06/2020 – 13:19

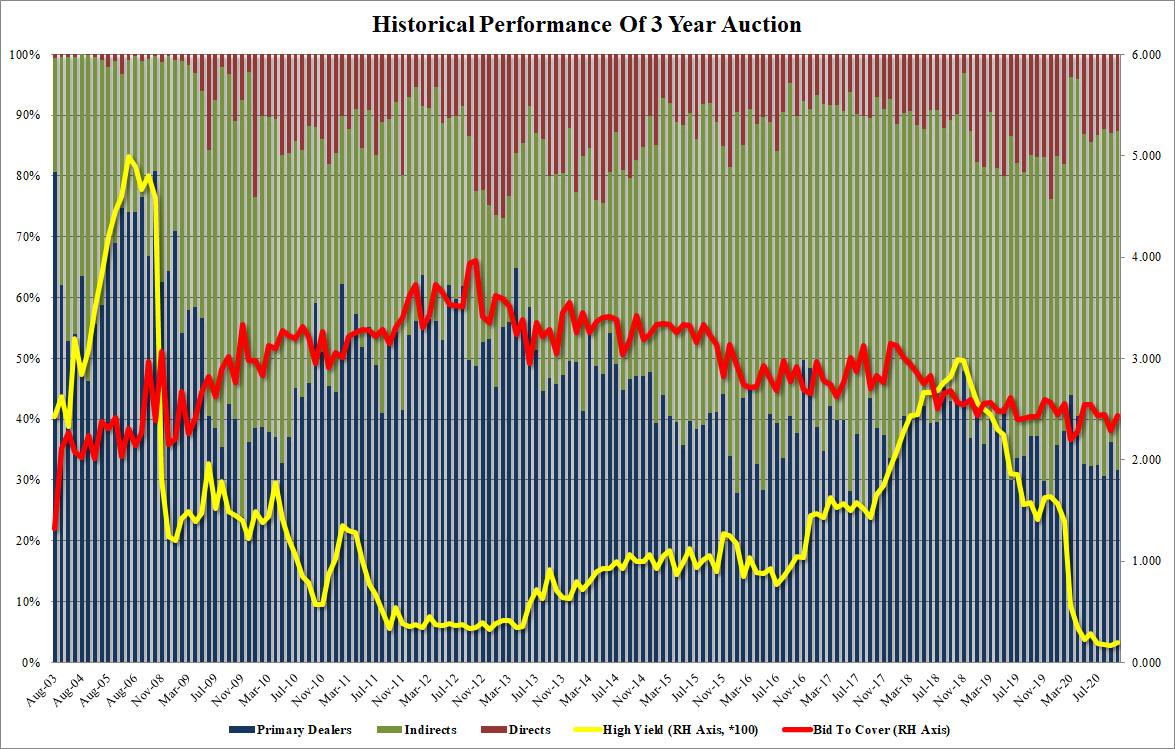

After three consecutive record-large 3Y Treasury auctions, which also priced at progressively (record) lower yields, moments ago the Treasury sold another record amount of 3Y paper, when it auctioned off $52BN, up $2BN from $50BN a month ago, but in a notable reversal from the recent trend, the yield on today’s auction was 0.193%, which not only tailed the 0.191% When Issued by 0.2bps, but was the first 3Y auction since June that did not price at a new all time low yield, printing 2.3bps higher than the 0.17% in September.

Despite the headline weakness which was largely a result of the recent steepening and selloff across the curve (but mostly in the long-end), the rest of the auction was actually stronger than last month’s, with the Bid to Cover rising from 2.28 in Sept to 2.44, above the 2.42 six-auction average. The internals were solid as well, with Indirects rising from 50.7% to 55.7%, the highest since July and above the 54.2 recent average. And with Directs taking down 12.6%, Dealers we left with 31.7% of the auction, down modestly from the 36.3% last month, and the second lowest Dealer takedown of all 2020.

Overall, a solid if not remarkable auction, although with yields already trading just barely above 0%, one fails to see just how yields can go any lower until the Fed goes NIRP.

And now we look to the upcoming reopenings of 10s and 30s over the next two days, when the action should be more memorable.