Massive Short-Squeeze Reverses Trump-Tweet Losses, Bond Vol Explodes

Tyler Durden

Wed, 10/07/2020 – 16:01

The last two weeks visualized…

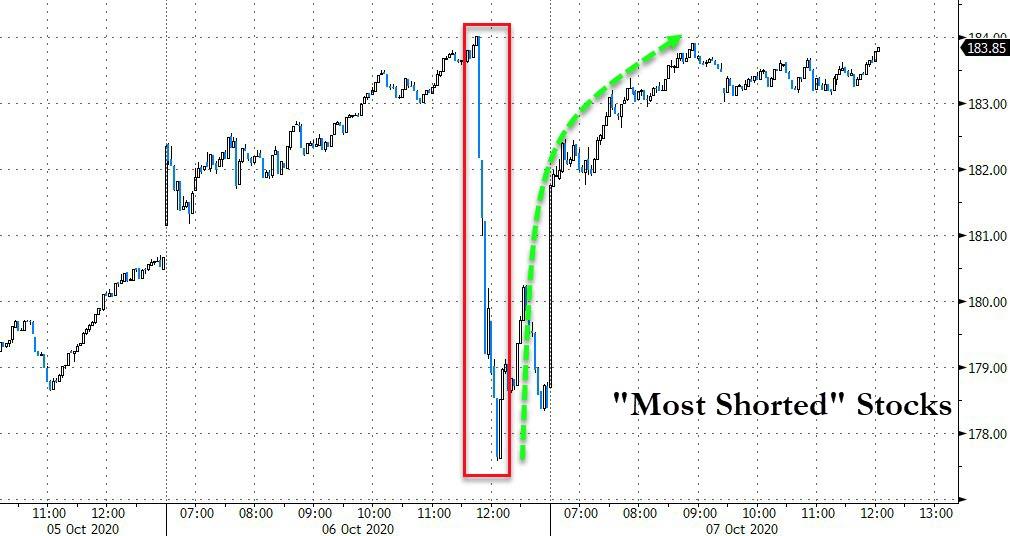

“Most Shorted” stocks soared today by the most in a month (8th squeeze in last 9 days), instantly erasing all of yesterday’s shock losses from Trump’s ‘no-deal’ tweets…

Source: Bloomberg

This is the biggest squeeze since June…

Source: Bloomberg

And that was enough to send stocks back above Trump tweet collapse levels yesterday…

We do note that while today was a big day for the stock markets overall, none of them managed to actually close above the Trump tweet levels from yesterday…

The Dow, S&P, and Nasdaq all bounced off their 50DMAs…

Cyclicals perfectly erased yesterday’s losses…

Source: Bloomberg

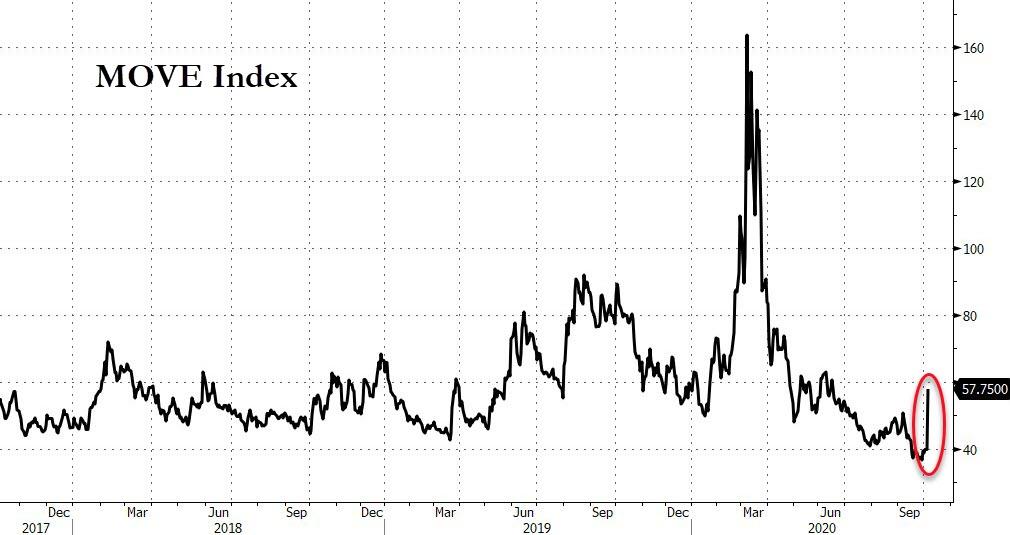

Yesterday’s sudden shock in bond yields sent expectations for bond market volatility soaring…

Source: Bloomberg

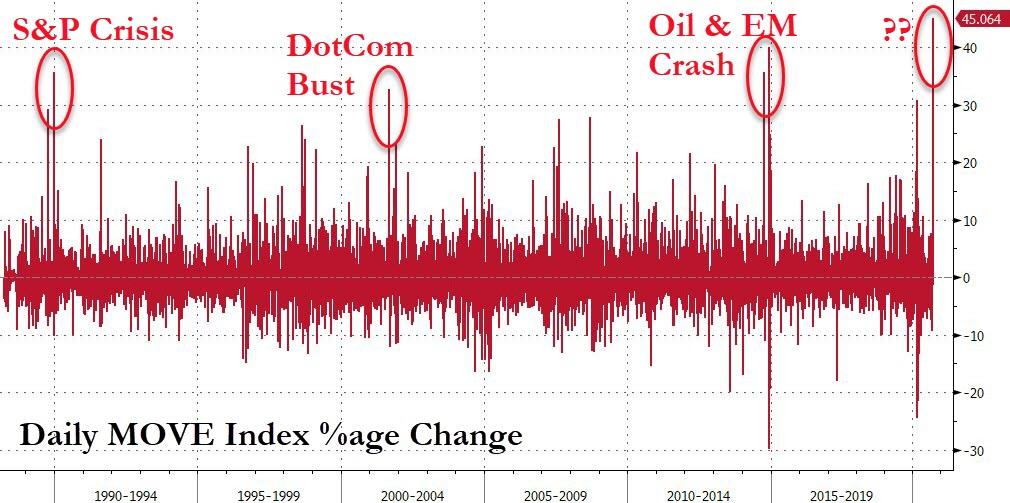

And, while we are not huge fans of %age shifts in vol charts (especially off record lows), the following chart gives some context for the shift in vol (h/t @TaviCosta)…

Source: Bloomberg

However, while ‘bond rout’ chatter was everywhere, some yield context is key…

Source: Bloomberg

The surge in yields today erased all of the yield drop yesterday…

Source: Bloomberg

10Y Yields pushed up to 79bps, notably only extending momentum modestly after FOMC Minutes…

Source: Bloomberg

The Dollar erased yesterday’s Trump-driven spike…

Source: Bloomberg

Another day, another record low in the Turkish Lira…

Source: Bloomberg

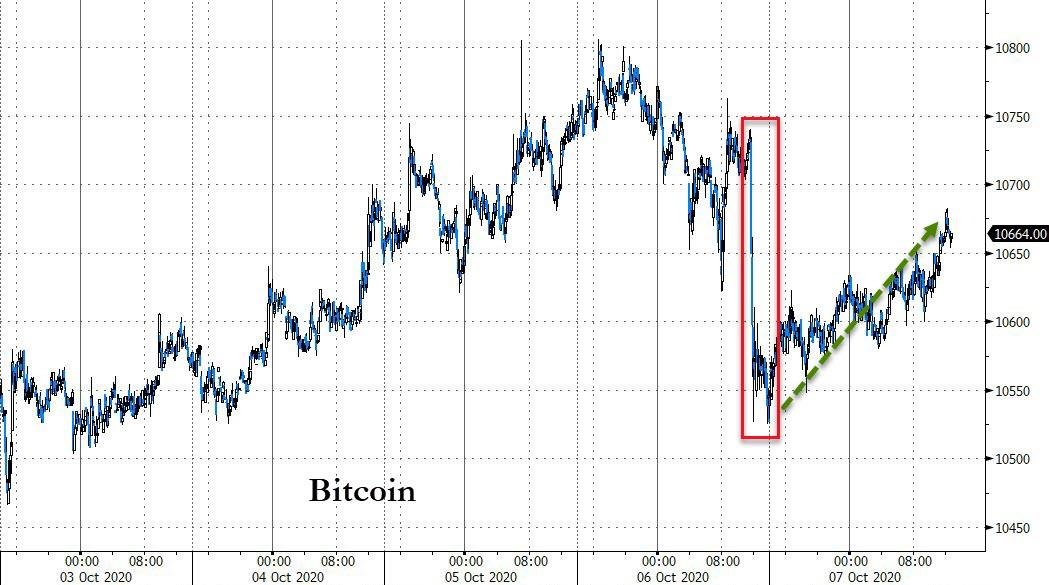

Bitcoin was unable to recover all of yesterday’s losses…

Source: Bloomberg

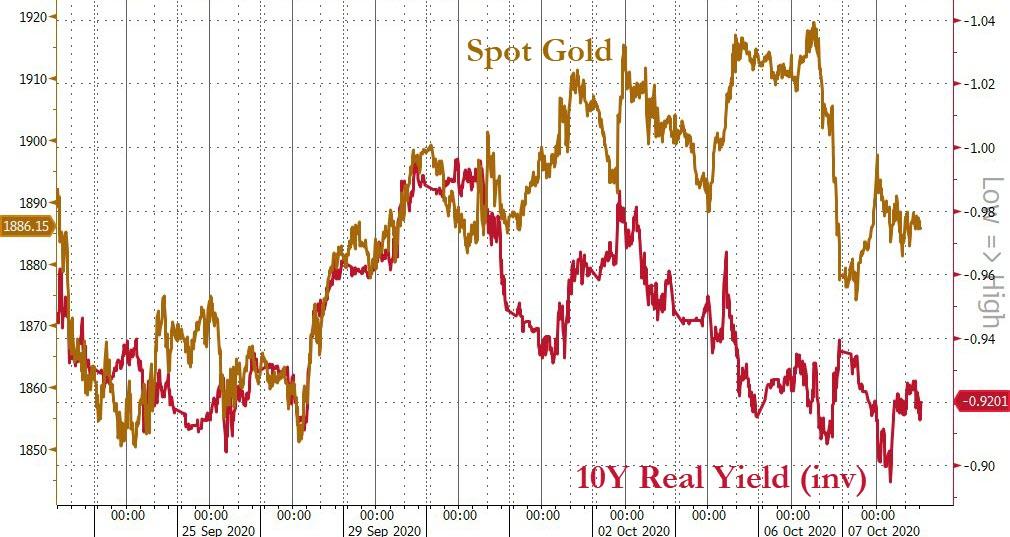

Gold jumped overnight after Trump’s Airline/PPP tweet, back above $1900, before fading back to unchanged

WTI bounced back up to $40 despite DOE data confirming a crude build as stocks dragged the energy complex higher…

Finally, while real yields are rising once again, we note that the correlation to gold has weakened notably…

Source: Bloomberg