Is The Next “October Surprise” An Unexpected Moment Of Clarity?

Tyler Durden

Sun, 10/11/2020 – 20:30

Last weekend, in its Sunday Start note, Morgan Stanley raised some eyebrows across Wall Street when it global strategist Andrew Sheets suggested that the 2020 market cycle was actually quite “normal”, with economic data leading risk assets, and that the recovery would continue in a “normal” way, with inflation expectations rising, yield curves steepening further, small caps continuing to outperform and defensive stocks have lagging (even as yields have remained range-bound). This is what Sheets concluded:

Twists and turns as the US election nears, the uncertainty regarding additional US fiscal stimulus, a rise in global COVID-19 cases and a still-unresolved Brexit saga all create significant uncertainty, and should keep markets volatile and range-bound over the next month. But amid that volatility, we maintain our central tendency – this cycle is more normal than appreciated, and should be treated as such until proven otherwise.’

Today, in yet another provocative piece this time from Morgan Stanley’s head of US Public Policy, Michael Zezas, the bank makes another contrarian argument, namely that for all the confusion and anticipated turbulence over the upcoming election, traders – whipsawed by months of pandemics, trade conflicts, legislation, and elections – may instead be rewarded with a “brief moment of policy clarity giving investors a reprieve from the chaos of 2020” and offer them “some unexpected, and underpriced clarity.”

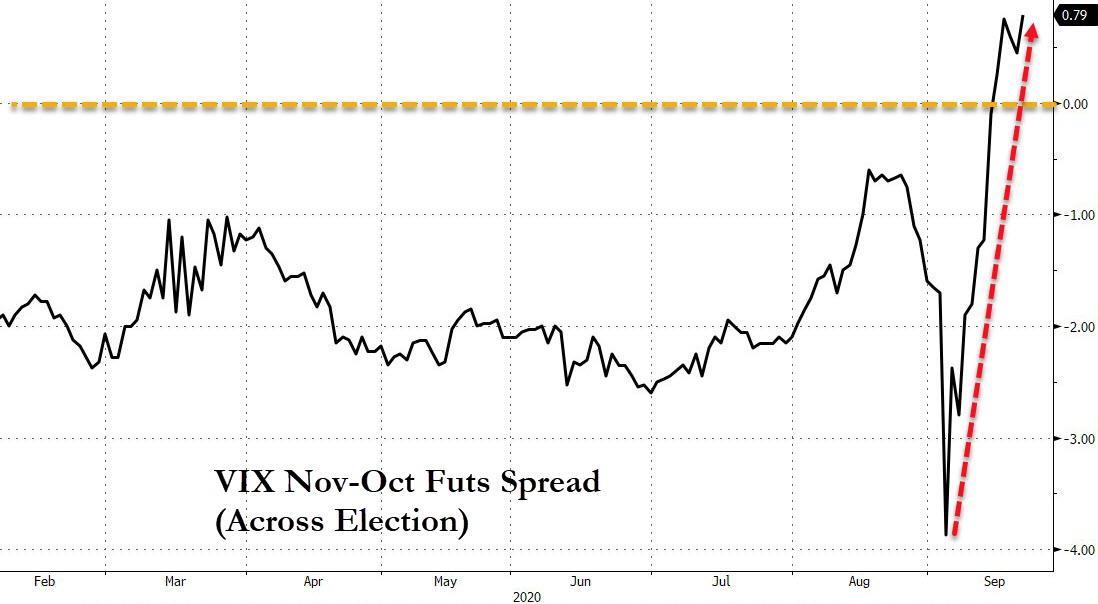

To be sure, Morgan Stanley is not the first to suggest that the market is overly obsessing over the potential vol surge around the election as a result of it getting drawn out into a contested election: two weeks ago, Nomura‘s x-asset strategist Charlie McElligott recommended selling the “kink” in the Nov-Oct VIX spread…

… saying the market had priced in more than a fair amount of election risk, and said that “some brave vol traders will try to take advantage as a perceived “generational” opportunity to sell this POST-NOV election “richness” (Dec / Jan)” which “could be a career “maker or breaker,” with the potential to see monster returns if the event were to pass and all that crash is puked back into the ether” although as he also hedges, conversely returns could “be turned to dust into a God-forbid realization of chaos, with civil disorder, dual claims to the throne etc.”

Well, the Morgan Stanley strategist is even more sanguine than McElligott as the bank only focuses on the bullish scenario, one where clarity over fiscal stimulus – either before or after the election – emerges in the coming days, while at the same time, Zezas also looks at the outcome of the actual Nov 3 election, and contrary to expectations of a long, drawn-out process which culminated with a SCOTUS decision, sees a quick resolution to the election with little “risk that it would take more than a few days beyond election day for investors to reliably know a result.”

He explains why in The Next ‘October Surprise’: A Moment of Clarity?

Investors crave precision in quantifying risk. Yet that level of precision is wanting when it comes to sizing up risk from events like pandemics, trade conflicts, legislation, and elections. Like it or not, we see investors being pressed into this style of analytical action as the new normal. Geopolitical trends towards multipolarity, fiscal expansion, and ‘slowbalization’ are not going away and will have lasting ramifications for market strategy.

But what if a brief moment of policy clarity is about to emerge, giving investors a reprieve from the chaos of 2020? Some emerging information could quickly turn into trends on two key US policy debates. This would give investors some unexpected, and underpriced, clarity.

- Fiscal stimulus: There appear likely paths to stimulus in the medium term, even if near-term paths dead-end: The market debate on the next US fiscal stimulus has been framed for months in terms of whether or not such action would come in the short term. Last week’s developments effectively answered ‘no’ to that question. Yet, it’s possible that a stimulus delay wouldn’t fully develop into the economic challenge it has the potential to be. Our economists now see evidence that US consumption can carry on for longer without fiscal support, given built-up excess household savings. This is good news as there are many viable political paths towards stimulus over the next three months. We see three out of the four most likely post-election party configurations delivering stimulus by early 2021. The biggest potential stimulus could come in a Democratic sweep, a result that may appear increasingly probable to investors, given a body of polling data that shows Joe Biden with a sizeable and stable lead in sufficient battleground states, and Democrats competitive in key Senate races. In this scenario, in addition to an upsized COVID-19 relief package, we believe that the ‘plausible policy path’ is further fiscal expansion as Democrats enjoy legislative consensus regarding their spending agenda but not regarding sufficient tax increases to fund it.

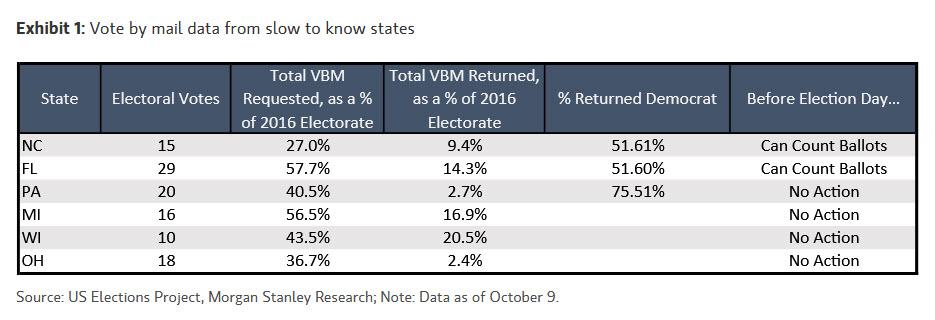

- Voters appear to be returning mail-in ballots quickly, limiting the risk that investors must wait beyond ‘election week’ to reliably know results: Voters did not lie in our surveys about their intent to increasingly vote by mail (VBM). State data show VBM requests shattering records. But voters also appear to be returning those ballots much quicker than anticipated. Consider the swing state of North Carolina (NC). VBM requests are already nearly five times their 2016 total. But over 30% of them have already been returned. Of those, over 50% are from registered Democrats. While these numbers don’t put to rest concerns about a delayed result (unreturned VBMs in NC remain nearly 20% of the 2016 vote), this would change if the trend continues. Consider that in NC, VBMs can be counted before election day. Hence, their rapid return could have two key effects: 1) Quickening the pace of the overall count; and 2) Reducing the risk that vote count progression sews uncertainty by initially showing large Republican leads that erode slowly on VBM counting. This would reduce the risk that it would take more than a few days beyond election day for investors to reliably know a result. Exhibit 1 shows a similar trend emerging in other swing states. Hence, the skew now appears away from not reliably knowing the result beyond a few days post-election, and we’re adjusting our scenario probabilities accordingly. Our base case remains ‘Election Week’ (70%), but we’re increasing the chances of ‘Silent Night’ (20%) and reducing for ‘Election Month’ (10%).

The conclusion:

In our view, key markets are not geared for such a moment of policy clarity should it emerge before year-end, presenting opportunities for some proactive and reactive tactics: We detail these dynamics in our most recent collaboration with Morgan Stanley’s cross-asset strategy team. One proactive idea that stands out for its asymmetrical response is being short duration in USD fixed income, the 30-year in particular. Despite its strong move last week, it should still be a bellwether for clearer expectations on deficit expansion and a continued V-shaped recovery in the US. A more reactive idea is in US equities, where a dip-buying opportunity could emerge. For example, if a Democratic sweep outcome in the election becomes known quickly, markets could initially reflect concerns about rising taxes before giving way to the benefits of fiscal expansion and, perhaps more importantly, an economy that remains in the recovery phase of the cycle.

There is just one problem with Morgan Stanley’s reco to short the 30Y: everyone and their grandmother is already in it, and in fact, one can argue that the entire Morgan Stanley line of thought is not contrarian at all, with markets now appearing to fully price in a reflation trade.

In fact, for those betting on outcomes, the best upside/downside risk-adjusted trade is to fade the reflation trade which in the past 3 weeks has allowed Russell stocks to strongly outperform their Nasdaq-based deflationary proxies. In further fact, for those cynics among us, one could almost argue that Morgan Stanley is merely hoping to take the other side of the trade that it is pitching to its clients. The next few days of trading should reveal the answer if the unprecedented 30Y short and heavy positioning into further curve steepening can continue, or will punish the momentum-chasing macrotourists.