The US Economy Is “Booming”, One Bank Finds As It Warns Of What Comes Next

Tyler Durden

Sun, 10/11/2020 – 18:30

According to the latest data from the Bank of America “machine-learning based US business cycle indicators through August

2020″, both the full-sample indicator, which uses data from November 1962 onwards, and the short-sample indicator, which starts in January 1985, remained in the strongest “boom” regime for the third consecutive month.

According to BofA global economist Aditya Bhave, the bank’s indicators reflect the stronger-than-expected US recovery:

Fiscal stimulus has supported consumer spending, particularly on goods. In turn, inventories have stabilized. Housing has benefited from 150bp of Fed cuts and pandemic-induced moves from cities to suburbs. Perhaps most importantly, the June/July surge in virus cases did not significantly derail the recovery.

As Bhave further explains, moderate targeted restrictions across the US instead of shotgun shutdowns, which even the WHO admits were a mistake to the great embarrassment and humiliation of “scientists” everywhere – or what the bank calls “learned immunity” – proved sufficient to bend the cases curve. And in part, people and policymakers have become tolerant of case counts that would have led to broad lockdowns in the spring. Incidentally, this is a point which Goldman Sachs made last week, when the bank found that the pandemic recession was actually not that bad.

That said, a day of reckoning is coming and as BofA admits, “once the quick gains from reopening have been exhausted, the recovery will inevitably slow”:

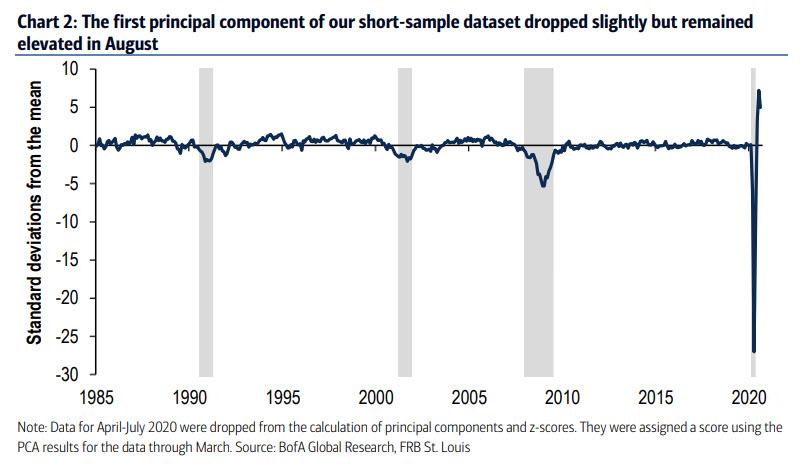

Growth was already slowing in August, with the first principal component (i.e., the common trend) of our short-sample dataset dropping slightly from its all-time high in July (Chart 2). But it remains elevated, and as a result the economy will have to dig itself out of a smaller hole when reopening has run its course.

Furthermore, as we cautioned two weeks ago and as BofA agrees, the bad news is that risks are accumulating to the downside.

Consumers are facing an income cliff as another round of fiscal stimulus now looks very unlikely before the elections. Personal income fell by 2.7% in August, and additional declines are likely as the Lost Wage Assistance Program’s supplemental unemployment insurance benefits have expired in some states and are due to expire soon in others. Spending actually increased in August, but the divergence from income is not sustainable.

Naturally, the other key concern is a major surge in the virus in the fall or winter that prompts much stricter, economically costly restrictions. In this regard the US’ “tolerance” for elevated case counts is a worry because a higher baseline level of cases increases the risks of a large outbreak. The outcome here would be political: if Trump wins on Nov 3, we expect Democratic governors to promptly shutdown their states in hopes of obliterating any hope for a recovery. Alternatively, under a Biden administration, expect the media to completely forget all about the covid pandemic within hours of Trump conceding, and to declare the coronavirus crisis over just days after the election.

In conclusion, BofA has raised our 3Q growth forecast to 33% Q/Q saar, which would leave GDP about 3.5% below its 4Q 2019 level: “so the good news is that the base case for the economy has improved significantly” while “the speed of the recovery is offsetting some of the pain from the depth of the downturn” even as a much more difficult phase in the cycle is about to be unleashed.