Tesla-Beating Carmarker Shows Xi’s Vision for 2025

Tyler Durden

Wed, 10/14/2020 – 21:03

By Bloomberg macro commentator Ye Xie

It was another wait-and-see session. The “blue wave” trades — higher stocks and yield-curve steepening — have faded this week.

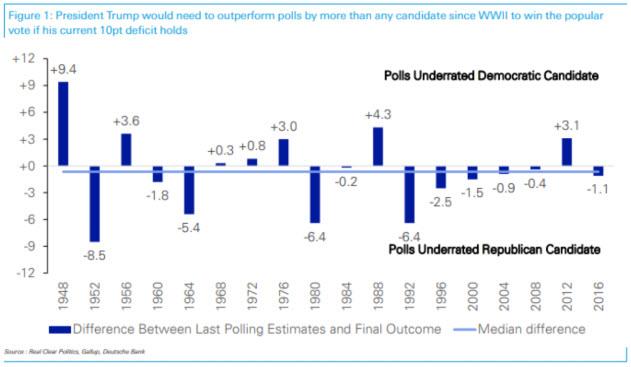

Mixed bank earnings, dwindling hopes for pre-election stimulus and skittishness about the virus and vaccine left investors with fewer reasons to bid up risky assets. Even with Joe Biden’s current lead, the skepticism toward polling data is understandable given memories of 2016. That said, if President Trump does overcome his deficit in recent polls, it would be the biggest underdog victory since World War II, according to Deutsche Bank’s Jim Reid.

Across the Pacific Ocean, President’s Xi’s highly anticipated speech in Shenzhen didn’t break any new ground. But his vision for a clean, efficient and innovative China in a five-year development plan was reflected in markets in the U.S. and Hong Kong Wednesday.

Consider these movements:

A. Electric carmakers, including NIO, Li Auto and BYD, surged. NIO jumped 23% after JPMorgan and Citigroup upgraded their ratings on the stock, extending its gain to 559% this year to outpace a 451% advance in Tesla. JPMorgan analyst Nick Lai expects the market share of new-energy vehicles in China to rise to 20% by 2025, from less than 5% in 2019.

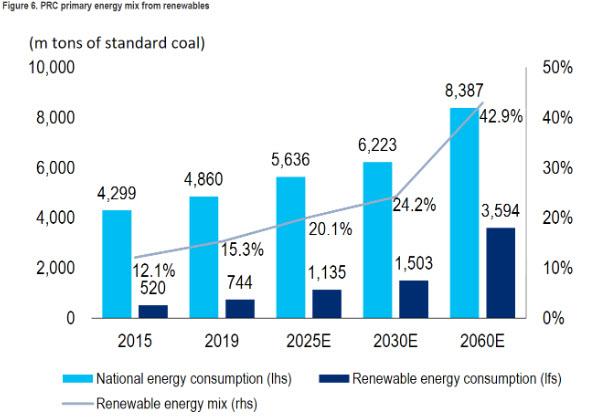

B. Solar energy company JinkoSolar rallied another 9% in the U.S., tripping its price this year, while China’s biggest wind-turbine maker, Xinjiang Goldwind Science & Technology, surged 22% in Hong Kong. The gains accelerated since Xi made an ambitious pledge this month to go “carbon neutral” by 2060. China tops the global league for emissions, at 28% of the total in 2019. The plan would call for renewables to account for 43% of China’s primary energy mix, from 15% now, according to Citigroup.

C. The yuan outperformed after a PBOC official played down the currency’s recent appreciation, saying the rally has been mild and reflects improvement in the Chinese economy. Sun Guofeng, monetary policy department head, also said China’s liquidity is reasonable and ample across the board, suggesting limited room for policy easing. Keeping a normalized monetary policy has been part of China’s strategy to attract foreign investors to support innovation and the development of its capital markets.

The old saying is that one has to listen to the Party to make money. There may be some truth to that.