“Growth Has Slowed”: Netflix Crashes After Huge Miss On EPS, New Subs As Covid Boom Ends

Tyler Durden

Tue, 10/20/2020 – 16:35

While recent earnings reports from streaming giant Netflix have been a mixed bag, missing badly just over a year ago when US subs declined and forecasting the first annual drop this decade, then smashing expectations four quarters ago, then beating expectations three quarters ago but disappointing in its guidance, then smashing expectations with a blowout first quarter three months ago in which it added a record 15.8 million subs thanks to covid, but once again offering a somewhat weak outlook for a post-covid world, then tumbling last quarter when the company reported earnings for its first full “post Corona” quarter and warned that “growth is slowing”, investors were on edge today to find out not whether the company would beat or miss expectations, but rather if Netflix, remains a pandemic-proof company and if the slowdown Reed Hastings warned about is for real and has pulled forward even more subscribers due to covid?

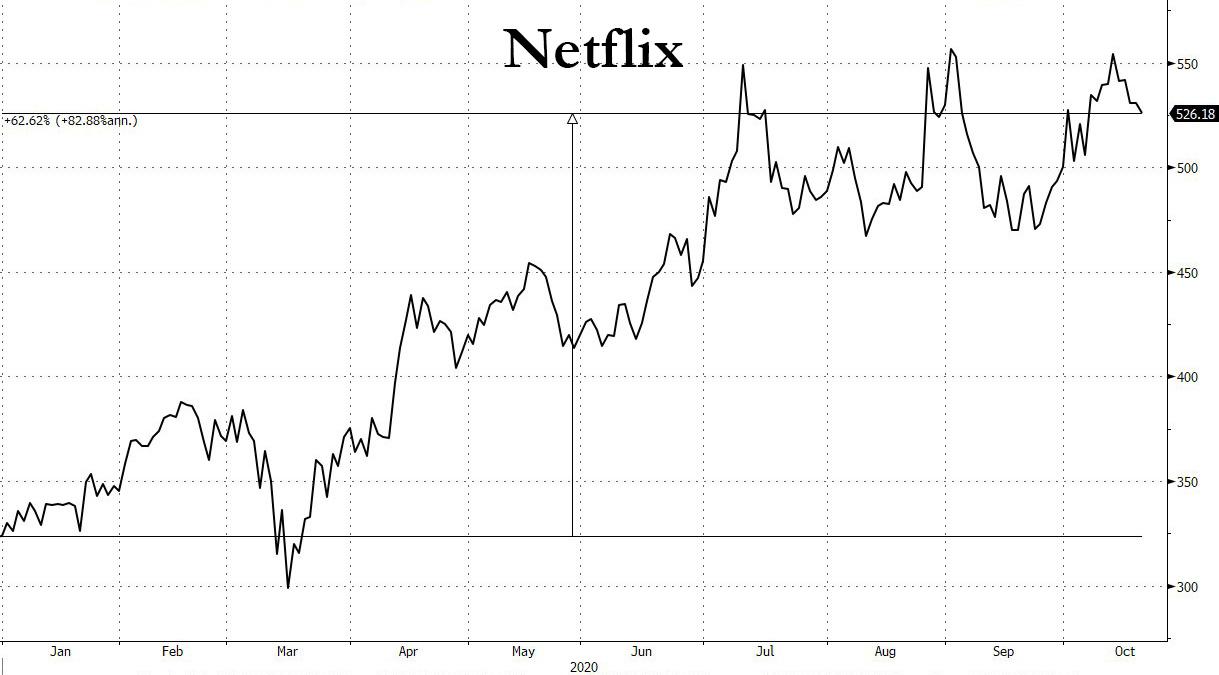

To be sure, the company has been riding a wave of optimism, its stock soaring over 60% this year – putting it in the top 15 for S&P 500 companies, similar to the gains seen by other shutdown beneficiaries Amazon.com and Ebay – and trading just shy of its all time high around $556, with investors pushing the shares to new highs and analysts seeing people download its app in record numbers. Still, after surging to a record high in early July, the stock has traded rangbeound, unable to break out to a new high. And while there’s no doubt that viewership has surged during the Covid-19 lockdowns in the U.S. and much of the world, there are complications: the virus has brought TV and film production to a halt, a situation that may only get more dire for Netflix as the months wear on. But the biggest question remains how many future subs has covid brought to the present?

As Bloomberg writes, options contracts on Netflix expiring this week are heavily skewed toward calls, which on the surface is a bullish indicator for the shares in the run-up to the earnings release (although that could be just SoftBank attempts to manipulate the stock). However, there have been similar setups heading into each of the past three quarterly reports, and the shares fell after the results. This time, calls outnumber puts by a rate of 1.8-to-1. If the most bullish positioning proves prescient, the stock could push back toward the all-time high touched three months ago.

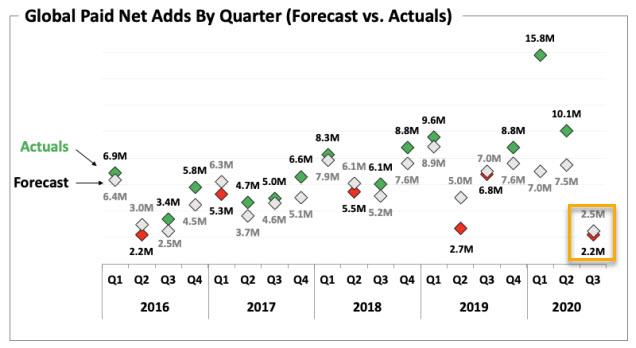

Indicatively, consensus expects 3.32 million new subs this quarter, higher than the company’s own guidance of 2.5 million, and a sharp slowdown from the 10.1 million new subs added in Q2. This is as streaming video remains on a hot streak since the pandemic struck. At the same time, the world’s largest paid streaming service is also facing more intense and cutthroat (or rather cut-price) competition than ever. Comcast’s Peacock platform has been rolling out for a few months, along with the short-form video service Quibi. And AT&T’s big bet on streaming, HBO Max is also up and running now while Disney+ has been a massive hit.

So was Q3 the quarter that would unleash another repricing higher for Netflix stock, or has the triple top telegraphed pain ahead? Sadly for the bulls, it’s looking very bad with NFLX stock plunging after it reported a huge miss in both EPS and new subs.

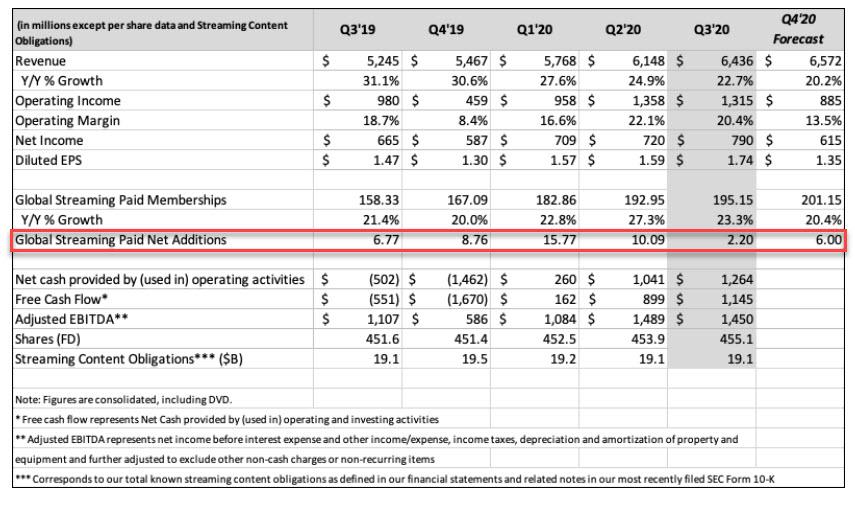

- Q3 Streaming Paid Net Change +2.2MM, Est. +3.3M, down from +10.09MM in Q2 2020 and down from +6.8MM a year ago

Shockingly, NFLX added just 180K net subs in the US, one of the worst quarters in recent history and almost certainly a function of the blowback over Cuties.

While the company’s financials are traditionally secondary, the company again beat on the top line but missed on earnings:

- Q3 Revenue $6.436B, Est. $6.38B

- Q3 EPS $1.74, Est. $2.37

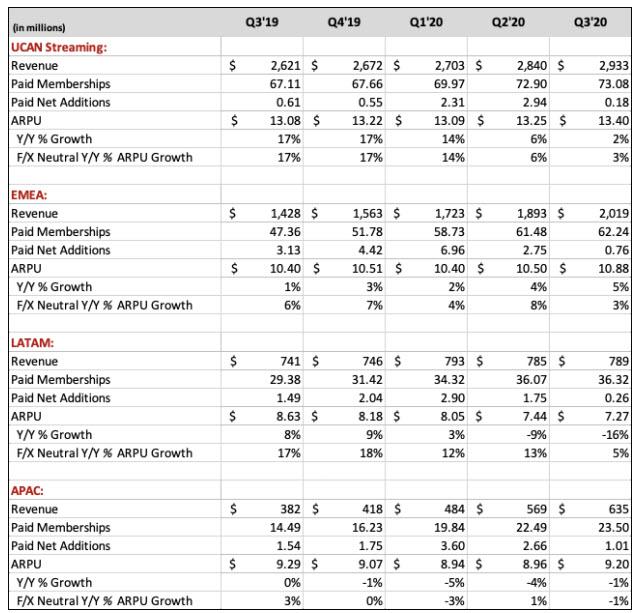

Netflix said the APAC region was the biggest contributor to subscriber growth this quarter, representing 46% of global customer additions, and revenue in that region rose 66% year-over-year: “We’re pleased with the progress we’re making in this region and, in particular, that we’ve achieved double digit penetration of broadband homes in both South Korea and Japan.”

Some Q3 more stats:

- streaming paid memberships 195.2 million, +23% y/y, estimate 196.3 million

- streaming content obligations $19.1 billion vs. $19.1 billion y/y

- UCAN streaming paid net change +180,000, -94% q/q, estimate +260,510

- EMEA streaming paid net change +760,000, -72% q/q, estimate +1.25 million

- LATAM streaming paid net change +260,000, -85% q/q, estimate +705,340

- APAC streaming paid net change +1.01 million, -62% q/q, estimate +1.10 million

- operating margin 20.4% vs. 22.1% q/q

- operating income $1.31 billion, -3.2% q/q, estimate $1.27 billion

- free cash flow $1.15 billion, +27% q/q, estimate $245.9 million

And visually:

The paltry 2.2 million in new subs means that the company was tied for its worst quarter in the past 5 years. One wonders just how much of this is the backlash over the Cuties scandal?

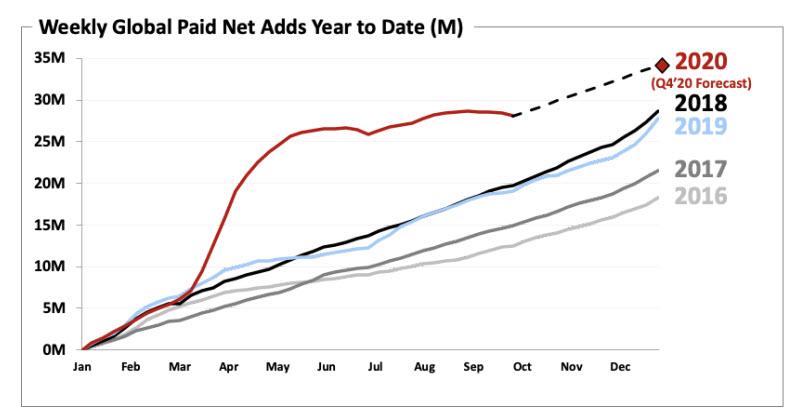

Confirming the worst case scenario, Reed Hasting started his later in the most dismal way possible: “As we expected, growth has slowed with 2.2m paid net adds in Q3 vs. 6.8m in Q3’19.” He continued: “We think this is primarily due to our record first half results and the pull-forward effect we described in our April and July letters. In the first nine months of 2020, we added 28.1m paid memberships, which exceeds the 27.8m that we added for all of 2019. In these challenging times, we’re dedicated to serving our

members.”

In short, the worst case scenario where covid pulled a lot of demand forward is materializing. And indeed, the outlook was ugly too:

- Netflix Sees Q4 Streaming Paid Net Change +6.00M, Est. +6.54MM

- Sees Q4 streaming paid memberships 201.2 million, estimate 202.8 million

- Sees Q4 operating margin 13.5%, down from 20.4%

The 6 million new subs would also be a disappointment compared to the 8.8MM subs it added a year ago. Still, the company expects a record year in terms of subscriber growth. “If we achieve our forecast, it will put us at a record 34m paid net adds for 2020, well above our prior annual high of 28.6m in 2018.”

Explaining why Q4 NFLX forecasts a below consensus 6.0MM paid net adds vs 8.8MM in Q4‘19, it writes that “our record first half paid net additions would result in slower growth in the back half of this year.” The company also adds that the state of the pandemic and its impact continues to make projections very uncertain, “but as the world hopefully recovers in 2021, we would expect that our growth will revert back to levels similar to pre-COVID. In turn, we expect paid net adds are likely to be down year over year in the first half of 2021 as compared to the big spike in paid net adds we experienced in the first half of 2020.” Predictably, in his letter Reed Hasting wrotes that he continues to view quarter-to-quarter fluctuations in paid net adds as not that meaningful in the context of the long run adoption of internet entertainment.

Here is the full forecast:

In terms of content, Netflix said its most popular title in the third quarter was the action thriller “The Old Guard,” starring Charlize Theron, watched by 78 million households it in the first four weeks after its release. Closely behind was another action flick, “Project Power,” starring Jamie Foxx, and mystery movie “Enola Holmes,” which were each watched by roughly 75 million subscribers.

The company said that it has restarted production on some of its biggest titles including season four of Stranger Things, Red Notice (starring Dwayne Johnson, Gal Gadot and Ryan Reynolds) and The Witcher season two, as conditions gradually return to normal.

“Since the almost-global shutdown of production back in mid-March, we have already completed principal photography on 50+ productions and, while the course and impact of C-19 remains unpredictable, we’re optimistic we will complete shooting on over 150 other productions by year-end.”

The company also had some words about its growing competition, saying that “linear television and other big categories of entertainment, like video games and user generated content from YouTube and TikTok are all vying for consumers’ attention and are strong drivers of screen time usage. We remain quite small relative to overall screen time.”

“This past quarter, we saw the debut of Comcast’s Peacock, which comes on the heels of the launch of HBO Max and Disney+. Disney’s recent management reorganization signals that it is embracing the shift to streaming entertainment. We’re thrilled to be competing with Disney and a growing number of other players to entertain people; both consumers and content creators will benefit from our mutual desire to bring the best stories to audiences all over the world.”

Translation: the market share fight will only get more vicious and lead to even more price cuts.

* * *

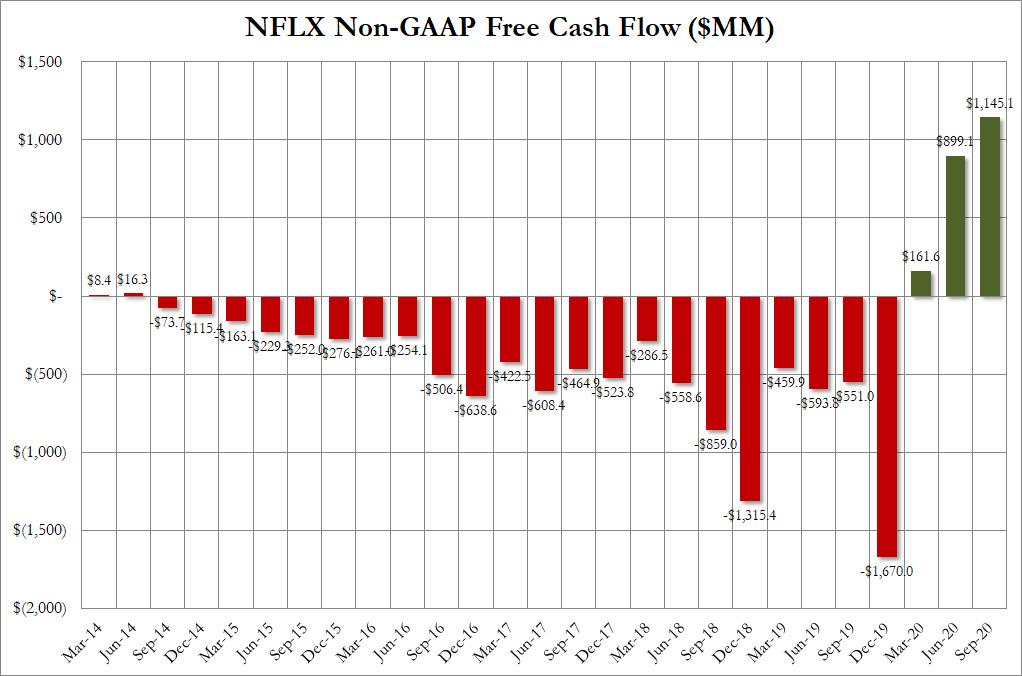

It wasn’t all bad news, however : Netflix reported third quarter cash flow of a record $1.145BN vs. -$502 million in the prior year period. Free cash flow positive for a third consecutive quarter at +$1.1b vs. -$551 million in Q3‘19, which however was largely due to the company shutting down production on content in the past two quarters. Year to date free cash flow was +$2.2 billion vs. -$1.6 billion in the first nine months of 2019.

Looking ahead NFLX said that “as productions increasingly restart, we expect Q4’20 FCF to be slightly negative and therefore, for the full year 2020, we forecast FCF to be approximately $2 billion, up from our prior expectation of break-even to positive. This change is due primarily to our higher operating margin expectation for 2020 and the timing of cash spending on content.”

Looking even further out, the company expects its FCF to “continue to improve as we increase our profitability and our transition to the production of Netflix originals (which requires more cash upfront vs. second run content) matures. For 2021, we currently expect free cash flow to be -$1 billion to break-even.”

That said, with $8.4 billion in cash plus a $750m undrawn credit facility, Netflix sees no need for external financing and has no plans to access the capital markets this year.

Alas, generating record cash is irrelevant for a company which now has confirmed it is “slowing”, and as a result the stock is crashing after hours, down over 6% as we type.